COVER STORY

EXCLUSIVE

MARKET-MAKING PHILOSOPHY

Ray Abeywardena says it is time Sri Lanka makes good on its promise to be a regional

investment hub

The recently appointed Chairman of the Colombo Stock Exchange (CSE) Ray Abeywardena is no stranger to the nation’s investment landscape. A veteran stockbroker, Abeywardena is the Managing Director of Acuity Partners and comes with extensive experience in the capital market here in Sri Lanka as a stockbroker and an investment banker.

The recently appointed Chairman of the Colombo Stock Exchange (CSE) Ray Abeywardena is no stranger to the nation’s investment landscape. A veteran stockbroker, Abeywardena is the Managing Director of Acuity Partners and comes with extensive experience in the capital market here in Sri Lanka as a stockbroker and an investment banker.

In 2001, he was instrumental in the creation of DFCC Stockbrokers, having served as its Managing Director and CEO. Abeywardena then joined Acuity Partners in 2009 as its CEO and has served as the firm’s Managing Director since 2012.

In this exclusive interview – the first for a magazine since his appointment to the CSE’s chair – he fields questions from a panel comprising LMD columnist and economist Shiran Fernando, former Director General of the Securities and Exchange Commission of Sri Lanka (SEC) Arittha Wikramanayake, LMD’s Special Correspondent Savithri Rodrigo, and LMD’s editorial team.

Abeywardena outlines the key imperatives to propel the market from being a one-trick pony of sorts to a financial powerhouse that makes a greater contribution to the expansion of the national economy.

The career stockbroker with 31 years’ industry experience under his belt says he draws inspiration from the likes of Nelson Mandela, Lee Kuan Yew and Muhammad Ali, of whom he has read extensively and whose single-minded determination to succeed has motivated Abeywardena to adopt a bold vision for the Colombo bourse.

And he calls on the support of all stakeholders to set aside their differences and work in unison to turn his vision into reality.

– LMD

PANELLIST

Shiran Fernando

Q: Are the stock market’s movements more a reflection of economic sentiment than the economy as a whole?

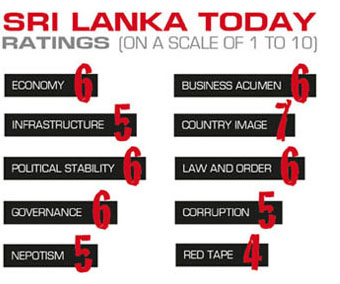

A: What we have witnessed in recent times is primarily as a result of funds flowing into Asian markets. It has been that way since the last quarter of 2016 and it is only now that some of it is trickling into Sri Lanka. But a multitude of things need to be done for there to be sustained foreign inflows to our market – for example, our economic numbers need to improve, and there must be political stability and confidence in the market.

Earnings continue to be good and that’s a positive. Companies continue to do well and are generating healthy profits with year-on-year increases.

Of course, the rupee has to stabilise. It’s very difficult for a foreign investor to enter the market when the rupee is not stable. And certainly, there must be vibrancy in global markets too. We also need to increase liquidity.

Q: We have seen a couple of IPOs in the recent past. What will incentivise those who are thinking of going down this path to do so?

Q: We have seen a couple of IPOs in the recent past. What will incentivise those who are thinking of going down this path to do so?

A: Valuations. It’s a chicken and egg situation. When the market picks up, the ratios rise and this attracts companies to list. On the other hand, investors look at cheaper stocks to invest in.

There are two aspects when we consider listings: one is the state-owned enterprises (SOEs) that we’re earnestly looking forward to having listed; the other is privately owned businesses.

We are constantly talking to potential private companies about listing and also intend to conduct a forum shortly to attract private family-owned businesses to list on the stock market. There are soft elements to consider such as the fact that it’s good to be listed to raise funds and so on. But some of these are companies that may not need to list to raise funds as they are flush with funds. So what else would entice them to enter the market? Attractive valuations.

Another good reason to consider going public is when a family-owned business doesn’t have a next generation to run it – this will be a good reason for such companies to enter the market. We must look at valuations and make it attractive for entities to list. Once we do that and have companies approaching the market to list, we become more attractive to foreign investors.

Ours is a very small bourse with a market capitalisation of only 23 percent of GDP while others such as Malaysia, Thailand and India boast in excess of 70 percent. So you can see how large those markets are. The average market turnover in Vietnam – which is essentially a communist state – is approximately US$ 88 million a day. Meanwhile, we’re struggling to achieve a turnover of 10 million dollars a day. The mismatch is very evident.

Since my appointment, one of my first initiatives was to call for a study of stock markets that have been similar to ours but have broken through. This can help us work out what else they did that we haven’t done so far.

Since my appointment, one of my first initiatives was to call for a study of stock markets that have been similar to ours but have broken through. This can help us work out what else they did that we haven’t done so far.

The fundamental yardstick that people speak about is economic growth. Sri Lanka’s economy is expected to expand by 4.7 percent while the rest of the region is set to grow at over seven percent with countries like Vietnam growing very rapidly. And India is growing at over seven percent. So there is a mismatch here as well.

We need to achieve over six percent growth. Then investors will come in, and we won’t need to go out and market with a hard sell; investors themselves will be attracted to our market.

Q: Beyond policy consistency and a sound macroeconomic environment, what more should be done to improve Sri Lanka’s investment climate?

A: One key factor is economic growth while the other is that we need political stability. We have a coalition government, the parties of which must all sing the same tune. These are the external factors. Internally, we must convey the message that our market is stable and strong.

We implemented platforms such as automated trading and scripless trading long before other markets – even before India. So we got the infrastructure aspect right a long time ago. But the rest of the market didn’t grow. Therefore, a holistic effort is required to elevate the local stock market to compete at a global level.

PANELLIST

Arittha Wikramanayake

Q: What are your plans for infrastructure development, considering that little if anything has been done to improve the infrastructural or regulatory framework of the stock market?

A: We are looking to introduce delivery versus payment (DVP), which is very important to boost investor confidence. Our settlement cycle is such that when you buy a stock on transaction date the stock moves out of the portfolio – so there’s exposure for three days until the buyer settles the seller through the broker.

When we introduce DVP, the stock doesn’t leave the account until payment – the term itself is self-explanatory. That’s the first step. Then we’re looking at introducing a central counter party (CCP) that will permit us to trade in derivatives and other products.

For the last 30-odd years that this market has been in existence, it’s been an equity market; we don’t have short-selling nor derivatives. We tried to introduce a debt market but that too didn’t work. We need to take some bold decisions and implement these initiatives.

Q: What do you expect the main challenges to be during your term as Chairman of the CSE?

Q: What do you expect the main challenges to be during your term as Chairman of the CSE?

A: The key factor is that I need the requisite support to make this a vibrant and attractive market. I’m passionate about trying to do something especially as someone from the industry and the first career stockbroker to be appointed to this post. And I feel that I owe it to the industry, and present and future generations, to create a vibrant market that reflects a strong economy.

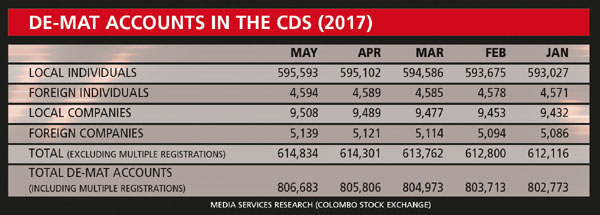

We need to gain more listings that include the SOEs mentioned in the budget last year. And we must create more liquidity. Look at Pakistan, which has moved up from being a frontier market to an emerging market. Sri Lanka’s war ended in 2009 but we have not moved forward yet in this regard.

Q: And what do you intend to do to address market concerns about the ability of the CSE and SEC to respond to issues decisively? For example, there could be concern that there have been continually changing regulations and policies for listed entities, and that this indecisiveness has led to companies not wanting to list while those that are listed want to delist.

A: Indecisiveness is a key factor. We need people who can take bold decisions and get things done.

The SEC handles the regulatory part of it; and it’s managing this very well. We began having meetings on a regular basis with the SEC secretariat, which will coordinate the regulatory framework. And we look forward to its support as well because I need the government, the SEC, fund managers, unit trusts and stockbrokers to support me in this endeavour. I’ll make it a success but I need the fullest support of all these stakeholders.

There is no shortage of qualified individuals in the market – we only need to have the infrastructure in place in terms of technology platforms to introduce new products.

PANELLIST

Savithri Rodrigo

Q: How is the bourse faring in the context of regional and global trends?

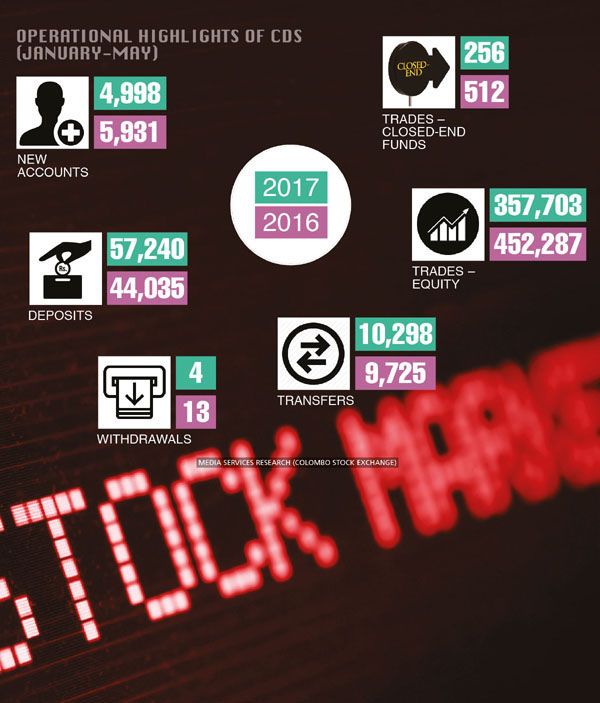

A: That’s a good question because although the index was down for most of the first quarter of this year, the CSE was attracting inflows albeit on a lower scale compared to some other emerging markets. The positive feature we see now is that continuous inflows have had a sharp and positive impact on the index.

Q: And where do you see the local bourse heading in the medium term and what more must be done to revive it going forward?

A: The stock market is heading towards the much-needed stability that was severely lacking in the last couple of years.

We must increase market liquidity, restore investor confidence and stabilise the macro-economy. I can’t overemphasise the importance of these three aspects because they must be in place if we’re to see the bourse achieve aggressive growth.

Q: Could you cite three initiatives that the CSE can take to boost the market?

A: We can introduce new instruments, lobby the government for SOEs to be listed and continue with our marketing initiatives.

The first should have been done at least a decade ago; we essentially remain an equity-only market. It’s imperative that short-selling and other money market instruments are introduced. By persuading at least a few SOEs to list, we’ll be able to address the lack of liquidity to some extent. Road shows, continuous market awareness and educational programmes must also gain further momentum.

Q: What is your take on the perception that there are artificial market movements from time to time?

A: This could occur if there’s a lack of liquidity in a stock, which is why increasing liquidity and introducing new instruments such as short-selling is imperative to mitigate the risk of artificial prices creeping into the system.

Q: How much reliance is placed by retail investors on stockbrokers’ recommendations?

Q: How much reliance is placed by retail investors on stockbrokers’ recommendations?

A: This is difficult to quantify as some retail clients act on sentiment while the more discerning investor will study quantitative information. Certain investors are market-savvy and rely on research data to make their investment decisions although there are others who trade purely on sentiment.

Q: And to what extent do stockbrokers assess corporate ethics and governance in recommending stocks to their clients?

A: The more discerning stockbrokers will take cognisance of corporate governance and ethics when recommending a stock to an investor.

Q: From an investor’s point of view, what factors come into play when selecting a stockbroker?

A: Experience, the stability of the broking firm in which they’re employed, their reputation in terms of integrity and commendations from other investors would be the primary factors.

Q: How much influence do stockbrokers have over the regulatory framework?

A: None – they must work within the given regulatory framework.

PANELLISTS

LMD’s editorial team

Q: The lack of liquidity and scale among Sri Lankan stocks is regularly cited by foreign investors as being a deterrent to equity investment in the island. What fresh ideas are available to address this issue?

A: The key is to have SOEs on board. We are also shifting towards encouraging privately owned entities to list. The other aspect that the SEC brought about was to try to ensure a minimum free float. But that became somewhat of an issue because foreign-owned businesses were over 80 percent non-public owned. And then we need to bring in other products as well to create a vibrant market.

Q: Local retail investors have been reluctant to return to equity markets following the boom and subsequent crash in 2011/12. What new measures can be taken to encourage retail investors to return in a big way?

Q: Local retail investors have been reluctant to return to equity markets following the boom and subsequent crash in 2011/12. What new measures can be taken to encourage retail investors to return in a big way?

A: If you look at it from a purely domestic perspective, interest rates are high. The market enjoyed a good run in 2014 when interest rates fell to the mid-single digits but they have risen again in the last few years.

When interest rates rise, discerning investors would sell out of the market and place their funds in a stress and hassle-free investment for the next couple of years. When interest rates reduce, they enter the stock market once again.

And look at other developed markets even in Asia where interest rates are very low and investors are compelled to enter the market to achieve higher returns. So we have this challenge between high interest rates and the market’s fortunes as well. That’s one aspect of it.

The other is that we need to continue to educate retail investors. We have planned a programme for even the discerning investors to enhance their knowledge and we’re targeting retail investors through a series of events. Moreover, we will continue to create awareness about the market at the grassroots level in the villages and outer provinces.

People need to have a greater awareness that trading on the stock market is not the same as gambling. To the gamblers I’d say don’t come to this market – they not only harm themselves financially but damage the market as well.

This is an investment vehicle investors should enter with a mid to long-term view, which will help the bourse grow.

This is an investment vehicle investors should enter with a mid to long-term view, which will help the bourse grow.

Unit trusts must also play a greater role to act as a conduit for the small investor who uses them as a vehicle to enter the market. This has occurred in India where most citizens have invested in unit trusts. Unit trusts began in Sri Lanka in 1992 but there’s been hardly any growth or penetration.

Schools can also be encouraged to educate students about investing in the stock market by including it in the curriculum. We must target young workers who are more market-savvy.

Q: It is widely believed that many stockbroking firms are finding it difficult to survive given the large number of players in the industry compared to market turnover levels. Are there formal plans for consolidation or is this expected to take place organically in the light of the new capital requirements?

A: My personal view is that consolidation is fantastic and must take place; it will make the stockbroking industry that much stronger. But unlike banks where you merge assets and loan portfolios, this is a very relationship-oriented business. The assets are the people. So why go out and spend to buy a liability when you can take on the staff only?

There has to be some kind of incentive – for example, a lower tax – that will entice larger stockbrokers to merge with smaller firms.

Almost all entities are compliant with the new capital requirements. We have introduced the capital adequacy ratio (CAR), which is a very good thing.

Q: What steps can be taken to expedite Sri Lanka being included in a major global emerging markets index?

A: Ours is currently a frontier market. The next step is to be among the emerging markets that will attract some other larger funds, which is what has occurred in Pakistan. We were once part of the MSCI and need to return to it. For that to happen, a key factor would be liquidity.

Q: What is the outlook for emerging/frontier market equity in the context of the normalisation of global interest rates?

A: Positive. From a global perspective, there was an expectancy that with a further rate hike in the US, more funds would flow out from Asia back to the US. But we see that Asian markets are strong and stable. And Wall Street has also been doing well because it expects growth in the domestic economy.

Leave a comment