STATE OF THE NATION

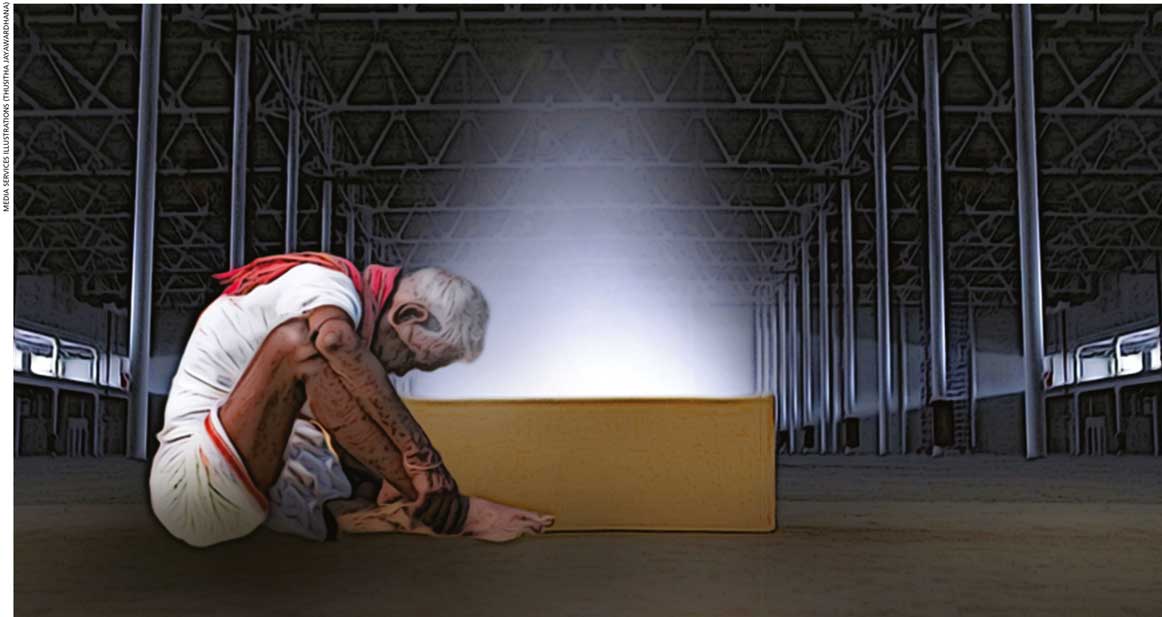

NEW HOPE IN THE DEPTH OF PANDORA’S BOX

Wijith DeChickera notes policy moves to fix a foundering economy, and trusts our governors and their electors will see a larger issue lurking

Sri Lanka stares into the bankruptcy abyss whilst battling economic and sociopolitical fires, and whether it’ll survive is a matter of conjecture. Let the monetary policy road map to guide us through this crisis be seen against that larger canvas.

Lowering interest rates to shore up a crumbling currency may seem intuitive. One hopes that trying to fix insolvency issues with liquidity solutions will not drown us.

Nothing short of a systemic overhaul may work. Despite the administration’s adamant stance, we’re long an IMF member and may have to roll up our fiscal sleeves for a restructuring jab, albeit under future governmental avatars.

Tax concessions may provide the much awaited economic stimulus our country desperately needs – if only the export sector is favoured to underpin lacklustre GDP growth in pandemic times.

Policy planners would do well to look closer at tax structures especially as state coffers benefit only 20 percent from direct taxation while a whopping 80 percent comes from indirect taxes.

This means our poor have to pay more in taxes to bolster the welfare of the rich who can afford to splurge but are let off the hook… courtesy tax holidays to the demonstrably ‘undeserving.’

Something may be radically wrong with our socioeconomic contract. Are we to commit harakiri by pandering to political friends, family members and their vested interests, and a fan club of fat cats who lap up the cream while the average citizen – to say nothing of the working poor or indigent masses – have to content themselves with the slops… now at skyrocketing prices?

Any fuel price hike that claims the Ceylon Petroleum Corporation (CPC) sustains billions in losses runs the danger of ignoring two truths: it’s throwing good money after bad to bail out this dismal dinosaur; and then there’s the poverty of state institutions that don’t pay their fuel bills.

A rise as small as Rs. 5 for a loaf of bread – or a 10 rupee hike for a cuppa or kottu – runs the risk of becoming a life-and-death issue… long before election time could see cuts and payment deferrals (which someone, somewhere, someday will have to pay).

Short-sighted policy decisions to slash the importation of chemical fertiliser to save US$ 300 million in forex could come at the cost of a 40 percent drop in tea export volumes for an industry that once commanded 1.3 billion dollars annually.

A cash-strapped government meanwhile, proposes to import luxury vehicles for Rs. 3.7 billion to drive its political agenda, set up 500 gyms for an outlay of 625 million rupees and 200 jogging tracks at a cost of Rs. 2 billion.

What price a healthy but hungry and hamstrung nation?

The can of worms recent global exposures smeared across the dismayed face of public consciousness (and frustration with shadowy doings of ‘economic assassins’ in high, secret places) suggests there’s not even hope at the bottom of our Pandora’s box!

Not as long as the polity remains apathetic to the true cost of corruption. But successive governments have willed it that voters languish ignorantly at how crooked governors and crony politics have cut the rug from under the feet of a no longer young or newly independent nation, which had such tremendous potential in that now distant dawn of newfound liberty…

The danger with such powerful anti-political sentiments is that a groundswell of dissatisfaction could well up into so much democratic dissent that Sri Lanka could end up compromising its longstanding civic traditions.

Dissidents – as evinced by madding crowds at protest barricades before interprovincial ‘travel restrictions’ stymied more widespread agitation – will push a turbulent country back into the throes of civil unrest… and perhaps even a new incarnation of social terrorism.

Or increasingly paternalistic governance (patriarchal, authoritarian and inclined to implement a top-down approach, in everything from public health and safety to price controls or lack thereof) will drive our resplendent isle out of favour in our predominantly Western export markets – where guarantees of much needed exceptions to tariffs and preferential trade deals lie.

Naturally, there’s innate suspicion of foreign interventionism and all the other ghosts of failed national reconciliation measures, which come out of the closet like skeletons at the cyclical and seasonal UN feast.

But despite the hypocrisy, double dealings, cynical politics and vested interests of players at the UN high table, there’s no denying the debt we owe ourselves – even if we renege on our international obligations.

Surely, no one wants the spectre of past trials and terrors to traumatise an unborn generation of Sri Lankans, held hostage by undying remorse and unresolved regrets. So it behoves us to ignore local, global and diasporic axes to grind, and expedite a national, inclusive and transparent mechanism to heal the wounds of war, and let the dead bury their dead…

Whether for love of GSP+ or lack of GDP prospects, let’s set our law and order house at least in order. It’s the least we can do to keep our economy intact and elected representatives accountable.

Let the electorate say so – loud and clear – well ahead of any cost cutting, face-saving election.