COVER STORY

SRI LANKA MUST BE DISASTER READY

A big part of this is digital enablement – and we’re investing heavily in our digital infrastructure as a result

Thimal Perera

Following his appointment as DFCC Banks’ Chief Executive Officer on 1 January, Thimal Perera moved into the hot seat of a leading financial services institution at a crucial time. After all, Sri Lanka has been grappling with a severe economic and monetary crisis since early this year.

A pillar of the bank’s leadership team since 2017 (he has been its Deputy Chief Executive Officer and a board member since 2019), DFCC Bank is now in Perera’s capable hands. He is driving the bank’s sustainable banking solutions by leveraging his extensive experience and skill set to push the boundaries of service excellence.

A pillar of the bank’s leadership team since 2017 (he has been its Deputy Chief Executive Officer and a board member since 2019), DFCC Bank is now in Perera’s capable hands. He is driving the bank’s sustainable banking solutions by leveraging his extensive experience and skill set to push the boundaries of service excellence.

His expertise combined with experience in global and local financial markets will be integral to DFCC Bank’s efforts to become a customer centric and digitally enabled bank.

Perera brings a unique perspective to the table as a tech savvy entrepreneur himself, coupled with over two decades of experience both locally and internationally – i.e. with the HSBC Group, the Commercial Bank of Qatar, Barclays Bank in the UAE and Hatton National Bank (HNB).

He has also served as a board member of HNB Assurance, HNB General Insurance and HNB Finance; is the chairman of Synapsys, DFCC Consulting and Acuity Partners; and is a director of Lanka Clear, Lanka Ventures and LVL Energy Fund.

In this exclusive interview with Yamini Sequeira, Thimal Perera assesses the state of play at a crunch time for Sri Lanka’s economy as it battles an unprecedented foreign exchange crisis in addition to various other socioeconomic woes.

He also shares his views on what Sri Lanka’s road map for the future should look like, if it’s to emerge unscathed from the quagmire it finds itself in.

– Yamini Sequeira

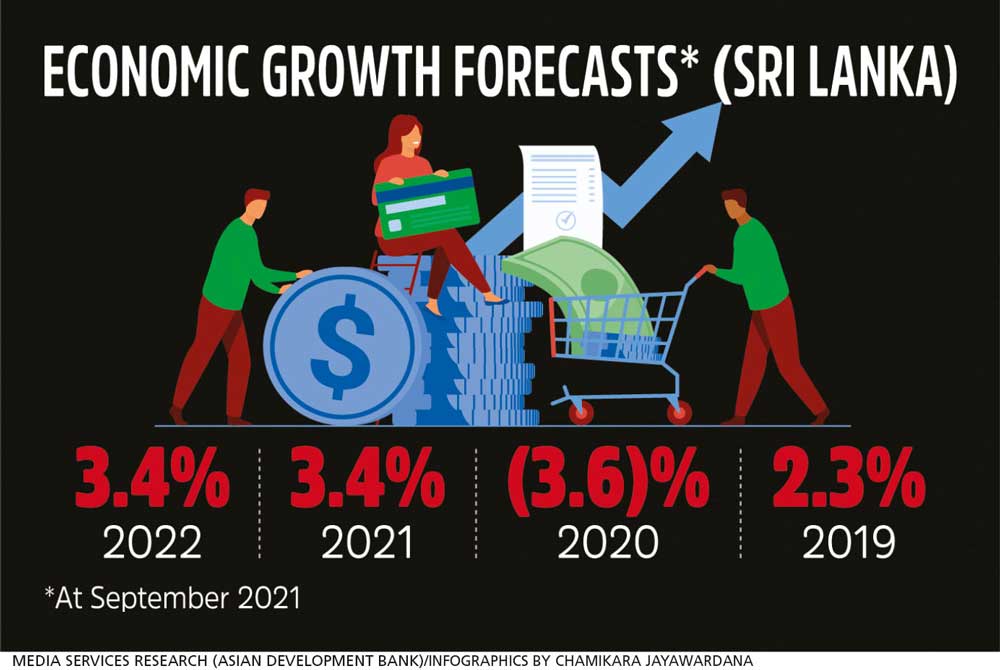

Q: The Asian Development Bank (ADB) expects Sri Lanka’s GDP to grow by 3.4 percent this year whereas projections by our authorities are higher – for example, despite the contraction of 1.5 percent in the last quarter of 2021, the Governor of the Central Bank of Sri Lanka expects a 6.5 percent uptick in economic activity in the first quarter of this year. Where do you stand in this regard and what are the associated sensitivities?

A: The expectation was for economic activity to be relatively robust this year although what we have seen so far has not been so due to the energy crisis. The World Bank estimates may be conservative but our belief is that optimism is warranted.

A: The expectation was for economic activity to be relatively robust this year although what we have seen so far has not been so due to the energy crisis. The World Bank estimates may be conservative but our belief is that optimism is warranted.

As our export markets recover and tourism picks up, the potential for growth to achieve more optimistic targets is possible, provided we address some of the more fundamental issues impacting industries and businesses.

Unfortunately, Sri Lanka’s economic growth in 2022 is heavily dependent on external challenges and also hinges on our ability to tackle internal problems such as the foreign exchange crisis.

Therefore, without dwelling too much on which forecast is more accurate, we’re able to state that sudden changes to the external environment notwithstanding, it is fair to expect a reasonable economic recovery this year.

Q: The Central Bank has hiked its policy rates this year in order to contain the nation’s balance of payments crisis and runaway inflation. Where do you think interest rates are heading and what is the monetary policy outlook likely to be for the rest of this year?

A: Sri Lanka is most certainly in a tightening cycle – as it should be.

On 8 April, the Monetary Board of the Central Bank of Sri Lanka decided to reinforce the stance it adopted in March by increasing the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) by 700 basis points each, to 13.5 percent and 14.5 percent respectively

With the expansion of the money supply showing its effects in terms of high inflation, the increase in interest rates is a responsible course of action. Therefore, it is reasonable to expect further rate rises in the immediate future and over the medium term.

While the tightening of monetary policy in January and March was the right course of action, it is important to find the correct balance so as not to stifle industry and economic activities while also being conscious of the ability of businesses to meet their debt service obligations.

Q: The monetary authorities have said they expect an increase in interest rates – particularly in deposit rates – to encourage savings “while discouraging excessive consumption, which also fuels imports”. How practical are these expectations, from a banker’s point of view as well as that of the business sector?

A: A delicate balance needs to be maintained between increased rates and accessibility of credit. A certain degree of disincentives towards consumption can be beneficial in the short term.

However, one should not forget that consumption, whether this be of imports or local produce, is one of the primary drivers of economic growth and thus must not be stifled to a point of becoming counterproductive.

In the same vein, access to credit is important for businesses to grow sustainably. Therefore, increasing the cost of credit beyond a reasonable threshold, coupled with discouraging consumption, would lead to reduced economic growth.

It is important therefore, to take a balanced approach that will be in the best interests of the larger economy, rather than focussing solely on reducing imports by discouraging consumption.

An approach that encourages exports and incentivises local production, through a policy of industrialisation and consumption, will have a much more sustained and favourable outcome than merely disincentivising consumption through continuously increasing interest rates.

Supply side disruptions, increasing global commodity prices, associated domestic administrative price adjustments and food supply disruptions have been the key drivers of rising inflationary pressures domestically.

Q: How do you view Sri Lanka’s monetary policy in the last two or so years and the likelihood of it normalising in the foreseeable future? And what are the implications of this for the banking sector – including the development banks?

A: A continued dovish policy stance is not advisable. At the same time, a strongly hawkish stance isn’t recommended either.

A balanced approach would be most beneficial for Sri Lanka and the banking sector as a whole, at this time. However, given the immediate need to rein in inflation, the recent hawkish policies that have been adopted seem to be the way forward for the near to medium term.

A balanced approach would be most beneficial for Sri Lanka and the banking sector as a whole, at this time. However, given the immediate need to rein in inflation, the recent hawkish policies that have been adopted seem to be the way forward for the near to medium term.

A relatively high interest rate environment will benefit banks in terms of increased savings deposits and increased interest income from lending activities.

An excessively high interest rate environment will put pressure on the banking system as it will become increasingly difficult for businesses to continue servicing their debt while also reducing the demand for credit, which will put further pressure on banks and the economy as a whole, due to the higher default risk, stagnation of the economy and higher levels of unemployment.

Having said that, regardless of the approach adopted by Sri Lanka, the crucial need of the hour is policy certainty. A policy stance that is constantly in flux does little to inspire business, investor and consumer confidence – and this must be avoided.

Q: What is your take on the furore over Sri Lanka’s rating downgrade not long ago and the reactions to it by various authorities?

A: Irrespective of the rating downgrades, Sri Lanka’s banking and finance sector is robust, stable, well-capitalised and primed to absorb the economic headwinds.

The downgrades make it more difficult and expensive to raise external debt – although DFCC Bank was able to raise US$ 150 million from the United States Development Finance Corporation (DFC) at concessionary rates, which has helped us support and finance SMEs and Women Lead Businesses across the country, by offering low interest rates and favourable terms.

Speaking specifically on the downgrades, to me it seems that both sides are justified in their thinking and approach. While the country feels hard done by, the rating agencies also have their justifications for the actions taken.

Q: Sri Lanka’s SME sector is recognised as the backbone of the economy – it accounts for more than 50 percent of our GDP, employs 45 percent of the workforce and represents three-quarters of the nation’s businesses. In addition to the moratoriums granted by the government with the help of the banking sector in the wake of the pandemic, what further assistance can and should they be offered?

A: The Asian Development Bank (ADB) notes that despite the moratoriums, most SMEs are afraid to accumulate a high interest debt burden and roll over risk of working capital without sufficient revenue.

A: The Asian Development Bank (ADB) notes that despite the moratoriums, most SMEs are afraid to accumulate a high interest debt burden and roll over risk of working capital without sufficient revenue.

Given the SMEs’ large presence in various sectors and ability to create employment opportunities in Sri Lanka, the government should continue to prioritise support for SMEs to mitigate the impact from economic shocks by ensuring their business continuity in the short term.

In my view, we need initiatives to support industries that can play a major role in the global supply chain. We need to find our niches in the BPO-KPO industry, information technology, agricultural segments such as organic and vegan produce, and so on. There should be incentives for investment and participation in such industries.

As a banker, I would also like to see credit guarantee schemes in place, especially to help startups. This would encourage investment in new industries and businesses, and also provide comfort to banks to support and nurture such startups.

Banks must seek to work together with clients as partners to ensure that their accounts remain performing. Furthermore, by working together with clients, we can use our own risk management resources to help guide and warn customers early to help them avoid financial hardships, which would ultimately prove to be mutually beneficial to both the lender and borrower.

Furthermore, a case-by-case approach – as opposed to a more generalised approach – will help ensure that neither banks nor customers are unduly in distress.

Q: In your view, will decentralised banking become a part of Sri Lanka’s financial services industry going forward? And if so, how must the industry and stakeholders prepare for this?

A: It is too early to make a definitive claim about this. However, decentralised finance – or DeFi, as it is more commonly known – has gained significant traction globally; and it is reasonable to expect the trend to catch on here too.

However, we need to see this technology and framework prove itself in more developed markets before a small market such as Sri Lanka can openly embrace such technologies.

However, we need to see this technology and framework prove itself in more developed markets before a small market such as Sri Lanka can openly embrace such technologies.

While there are many perceived benefits of DeFi, one of the most crucial weaknesses is the lack of regulatory protection and high susceptibility to scams. These must be addressed in some shape or form for DeFi to truly challenge and disrupt global banking platforms.

While DeFi itself may be sometime away before we see it in Sri Lanka, some of its underlying platforms such as blockchain technology are already here and we will continue to see greater applications going forward.

As an industry however, we must be ready for this change. If anything, the last two decades have taught the financial services industry that it needs to constantly innovate. So as industry stakeholders, we need to be ready to adapt and be open to collaboration as that is where the future is headed.

Q: What lessons should Sri Lankan corporates learn from their global and regional counterparts in regard to mitigating the dire consequences of multiple crises brought on by the pandemic?

A: We must always be ‘disaster ready.’ A big part of this is digital enablement and we’re investing heavily in our digital infrastructure as a result.

On a broader, more national scale, we need to update our legislation and regulatory framework to allow for digital enablement.

Only recently, we have made some progress with regard to 100 percent online customer onboarding, for example. In terms of trade and other commercial banking activities, it’s also necessary for us to look at electronic documents and legal transfer of possession, and the legitimisation of electronic signatures alongside wet ink signatures. To summarise, we need to be able to imagine the impossible and prepare for such eventualities.

Q: And finally, what does your crystal ball say about Sri Lanka’s prospects in the next 12 months or so?

A: Simply put, I believe the next 12 months will be challenging.

However, we’re seeing some green shoots around us. We have already seen tourist arrivals exceed expectations in the early months of this year. If this trend is sustained, we could see a significant improvement in the outlook by the middle of the year for the tourism and travel sector.

Furthermore, productive economic activity and export businesses must be given every possible support by the government, the banks and society at large.

Furthermore, productive economic activity and export businesses must be given every possible support by the government, the banks and society at large.

It is only by expanding the real productive economy that Sri Lanka can hope to avert any further crises and return to its healthy growth trajectory. Increased exports, tourism and remittances by foreign workers can help reduce the trade deficit and begin the journey towards full economic recovery.

The rapid vaccination drive is also expected to have a long-term progressive effect on economic growth this year. Sourcing of adequate funding to meet our short-term foreign debt obligations would remain a priority. Working in unison, these factors could contribute towards a positive cascading effect on the entire economy as a whole.

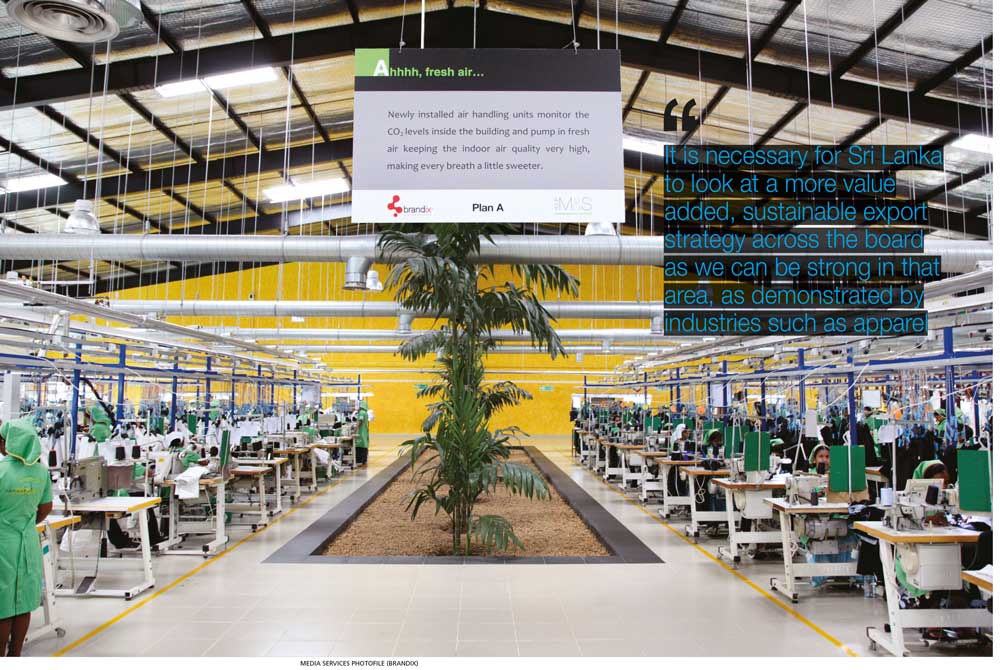

It is necessary for Sri Lanka to look at a more value added, sustainable export strategy across the board as we can be strong in that area, as demonstrated by industries such as apparel. Alongside this, we will need to incentivise to the maximum every form of productive economic activity while massively incentivising local production to reduce our import expenses.

A more liberal foreign exchange policy too, while challenging early on, will result in a much more favourable trade and fiscal position over the long term. These measures are likely to make Sri Lanka even more attractive to foreign direct investment.

Most importantly, a consistent policy and regulatory framework which all political parties can commit to for the long term will be crucial, if we are to come out of this crisis and rebuild our economy.

It is time for action.

The pandemic is behind us, and each of us has a role to play in the revival and recovery of the economy. However, we need to act fast – and now. Let us put political differences aside and act as one.

It is time to look beyond short-term gains and profits, and consider the national interest and ask what we can do in order to face challenges… and act accordingly. We will need to dig deep but I’m sure that before long, we’ll begin to see the results of our resolve.

Leave a comment