CORPORATE INSIGHTS | 2021/22

A TEST OF ENDURANCE

Sri Lanka’s leading corporates demonstrate grit and gumption

– despite trying times and economic headwinds that abound

It is anticipated that global economic activity will slow as inflation heads north, and many regions experience crises with the rising cost of living and tightening monetary measures – all of this exacerbated by Russia’s invasion of Ukraine and the lingering fallout from the COVID-19 pandemic.

Meanwhile, the Central Bank of Sri Lanka publication titled ‘Recent Economic Developments: Highlights of 2022 and Prospects for 2023’ maintains that “the Sri Lankan economy, which faced extreme headwinds and heightened uncertainties during the first half of 2022, has shown signs of stability in the second half of the year thus far, helped by the myriad of multifaceted policy interventions undertaken to steer the economy to transition towards a path of stable and sustainable growth over the medium term.”

The report notes that the economy’s contraction was exacerbated by the unprecedented economic crisis felt across several sectors owing to fuel shortages, power outages, widespread scarcity of key imported raw materials and other essentials, and other factors including the soaring cost of production.

A steady rise in inflation since the beginning of 2022 and the sharp depreciation of the Sri Lankan rupee against the US Dollar have impacted household purchasing power. Moreover, the nation’s fiscal policy and low tax regime introduced in late 2019 fuelled inflation by necessitating monetary financing to bridge the expanding budget deficit.

The lack of access to international capital markets following rating downgrades also contributed to the downturn, it notes: “The monetary tightening efforts, which commenced in August 2021, accelerated thus far in 2022 to avoid possible de-anchoring of inflationary expectations and arrest lingering demand driven pressures.”

The lack of access to international capital markets following rating downgrades also contributed to the downturn, it notes: “The monetary tightening efforts, which commenced in August 2021, accelerated thus far in 2022 to avoid possible de-anchoring of inflationary expectations and arrest lingering demand driven pressures.”

Inflation increased during the financial year, reflecting the pressure on prices. Food inflation was the main driver, partly due to the depreciation of the rupee. Non-food inflation followed a similar pattern, following the hike in fuel prices.

By mid-2021, there was optimism that Sri Lanka could transform the challenges presented by the COVID-19 pandemic into opportunities to build back better… but the nation laboured under natural and man-made disasters such as floods and the fire on the X-Press Pearl in its waters.

The nation also remained burdened with obtaining and administering vaccines as the Delta variant of the COVID-19 virus brought fresh threats to lives and livelihoods from what was called the ‘third wave of the pandemic.’

Indeed, the additional mobility restrictions continued to affect tourism and as a consequence, ancillary goods and service providers found survival to be an uphill task.

Concerns with regard to the fuel price hikes – which had a cascading effect on the cost of goods and services – and macroeconomic challenges (such as the nation’s foreign exchange reserves, meeting debt obligations and bridging the ballooning trade deficit) had begun to loom large on the horizon.

Concerns with regard to the fuel price hikes – which had a cascading effect on the cost of goods and services – and macroeconomic challenges (such as the nation’s foreign exchange reserves, meeting debt obligations and bridging the ballooning trade deficit) had begun to loom large on the horizon.

And pandemic induced lockdowns continued to plague the nation in 2021 and into the year that followed.

These roadblocks invariably impacted the recovery of non-debt generating inflows; and coupled with Sri Lanka’s limited external financing options and diminishing forex reserves, they created a formidable economic environment for businesses to operate in.

‘Quarantine curfews’ brought many small and medium-size businesses to their knees across many sectors, and the business environment persistently operated under dire conditions in the wake of import restrictions, forex restrictions, the depreciating rupee and travel restrictions.

By the time the economic forum organised by the Ceylon Chamber of Commerce was held at the end of 2021, informed voices and economists were exhorting the government to pursue a debt restructure by drawing up a credible programme – and approaching the IMF, rather than waiting until matters came to such a head to have to approach the UN lending agency as a last resort.

But despite all these negatives, a sense of hope persisted.

Businesses demonstrated their resilience and will to thrive, by adapting to new norms and ways of working around the unprecedented crises.

Accordingly, the financial year under review ended on a high note with business confidence rallying and several LMD 100 corporates achieving exceptional if not highly commendable revenue growth despite operating in one of the most challenging times in recent history.

Here, we highlight the performance of the top 10 listed companies, which comprise the coveted Leaderboard of the LMD 100 for financial year 2021/22.

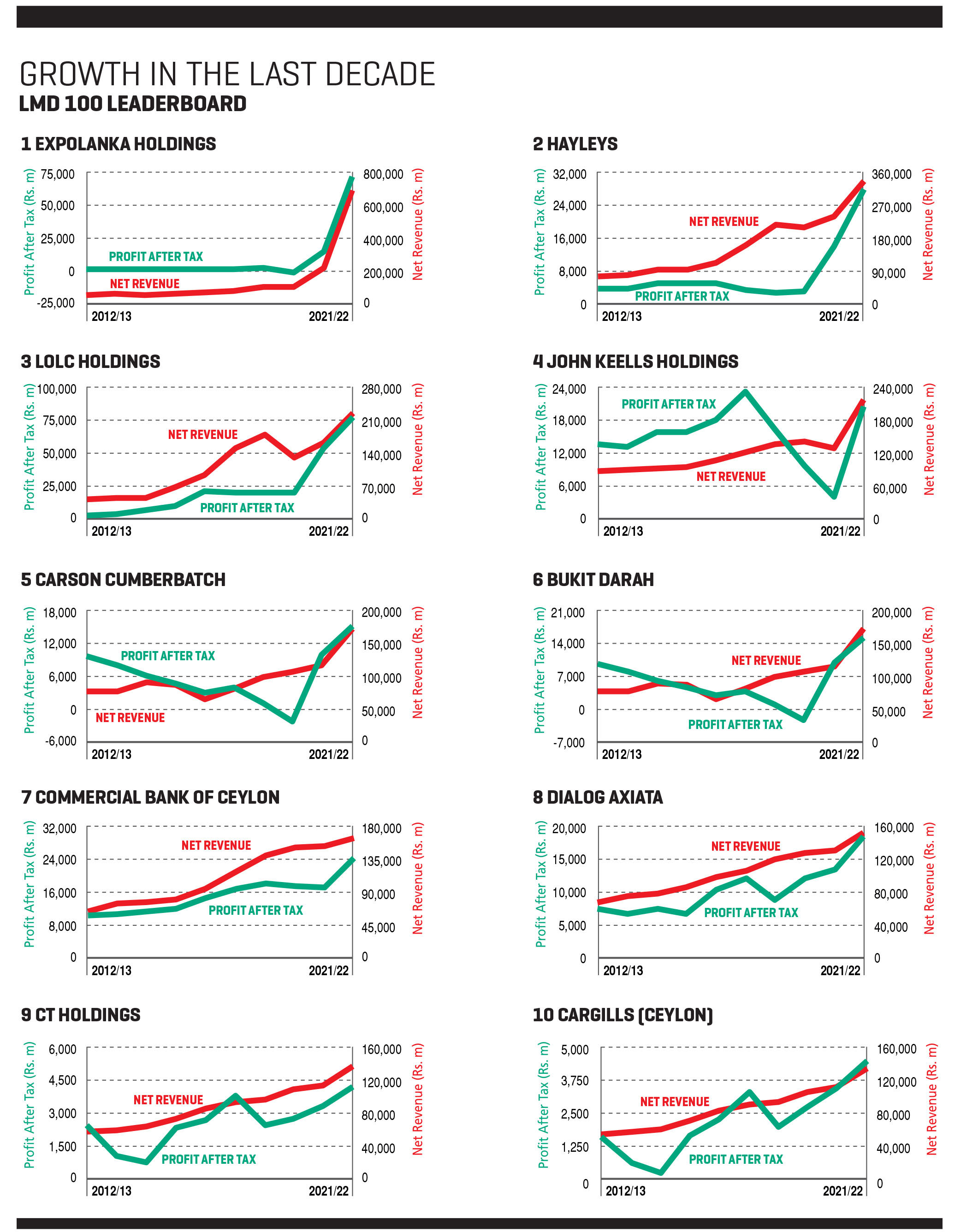

An unparalleled 217 percent growth in turnover – to nearly Rs. 695 billion – ensured that Expolanka Holdings would take its place as the undisputed champion of the Leaderboard. The transport and logistics conglomerate rose to first place on the corporate podium from its position as first runner-up in the 2020/21 edition of the LMD 100.

The conglomerate says in its integrated annual report for 2021/22 that it will continue to scale up and invest in growth – and strive to position itself and gain market share as one of the digitally driven top tier logistics companies in the world.

It recognises that there’s potential for further market expansion by way of its footprint in the North American trade lane and opportunities in Europe and intra-Asia, which the corporate intends to consolidate.

Expolanka is also proactively looking at capitalising on emerging international market opportunities in Bangladesh, and has already initiated a pragmatic restructuring programme in terms of rationalising the product portfolio, mitigating high risk profiles and streamlining factory processes, in order to scale up and generate adequate returns on investments in its export operations.

As its business interests span several key industries, and being among Sri Lanka’s largest logistics companies, Expolanka plays a pivotal role in facilitating export sector growth. The company operates as a net foreign exchange earner that generates a large share of its revenues from international markets.

As its business interests span several key industries, and being among Sri Lanka’s largest logistics companies, Expolanka plays a pivotal role in facilitating export sector growth. The company operates as a net foreign exchange earner that generates a large share of its revenues from international markets.

Though its flagship logistics vertical remains Expolanka’s forte, international operations accounted for 95 percent of the group’s revenue in the period under review. Executive Director and Group CEO Hanif Yusoof says the conglomerate is among the select few Sri Lankan entities with a global footprint in 34 countries.

“Our consistent, comprehensive, agile and congruent strategy has been the hallmark of our success, supported by our ‘dare-to-do’ spirit, grit, determination and unyielding focus in executing our strategic initiatives,” he elaborates.

Commenting on the operating environment, Expolanka’s Executive Chairman Hitoshi Kanahori states: “Challenges bring out the best in people and this is reflected in the exceptional performance that was delivered… During the concluded financial year, the company overcame – with a great degree of success – several factors, which had impacted the business.”

Hayleys takes second place in the rankings of the LMD 100 with a consolidated revenue of just over Rs. 338 billion for the year ended 31 March 2022. Additionally, the capital goods conglomerate’s profit after tax (PAT) expanded by 100 percent from the prior year to 28 billion rupees in 2021/22.

Hayleys takes second place in the rankings of the LMD 100 with a consolidated revenue of just over Rs. 338 billion for the year ended 31 March 2022. Additionally, the capital goods conglomerate’s profit after tax (PAT) expanded by 100 percent from the prior year to 28 billion rupees in 2021/22.

The highly diversified conglomerate derives 52 percent of its revenue from export and other foreign exchange earnings while the remainder comes from the domestic market in which it is a key player. The group’s performance in US Dollars is also impressive with a turnover growth of 25 percent to US$ 1.6 billion reflecting strong activity levels.

In the group’s 2021/22 annual report, Chairman and Chief Executive Mohan Pandithage notes: “Value to shareholders increased considerably during the year with earnings per share moving up from Rs. 10.18 to 24.34 rupees and an increase of 125 percent. We also distributed an interim dividend of Rs. 4 a share in March 2022.”

LOLC Holdings (LOLC) holds third place with top line of Rs. 224 billion in the latest LMD 100 rankings. The conglomerate’s post-tax profit (in excess of 77 billion rupees) reflects an increase of 46 percentage points compared to the prior year – the highest, as it was in 2020/21, in this year’s edition of listed company rankings.

It follows that LOLC retains the mantle of being the most profitable diversified conglomerate in Sri Lanka for the fourth consecutive year.

Deputy Chairman Ishara Nanayakkara asserts in the group’s 2021/22 annual report that “we are now a true multinational in every sense as the group derived a major portion of its revenues from its global operations and increasingly, from diverse sources.”

“We have expanded our footprint from 14 countries last year to a global presence in 20 countries to date. This achievement is all the more remarkable in the current context of economic and political upheaval, both local and global,” he added.

Having recorded marginally in excess of Rs. 218 billion (up 71% compared to 2020/21) in income for the year ended 31 March 2022, John Keells Holdings (JKH) secures fourth place in the latest LMD 100. JKH advances two notches on the Leaderboard from its ranking in the prior year.

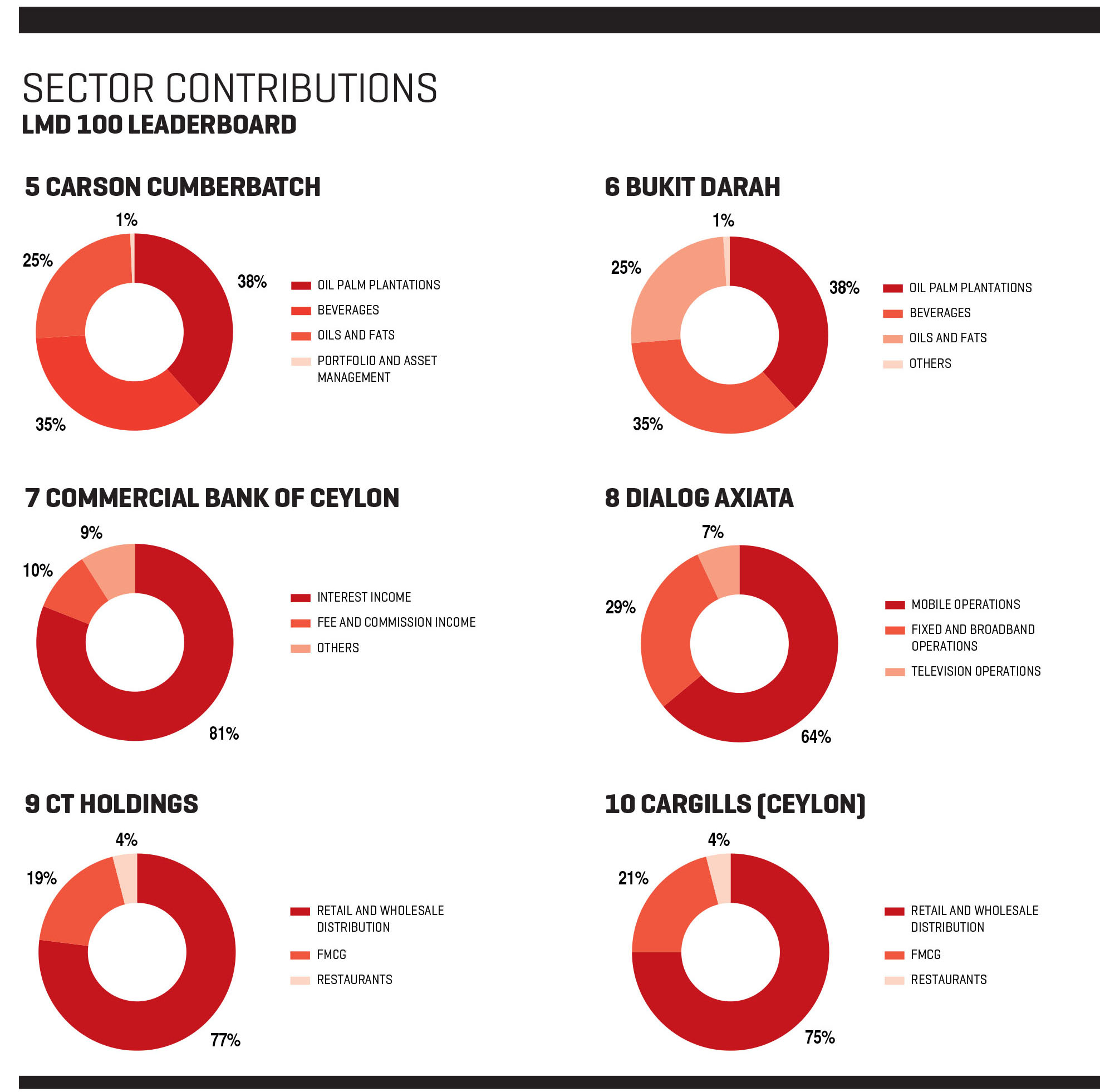

Advancing three places to No. 5 in the 2021/22 LMD 100 is Carson Cumberbatch. The diversified group posted a PAT of nearly Rs. 15 billion for the financial year under review, compared to a profit after tax of slightly under 10 billion rupees in 2020/21. Moreover, its revenue for the period grew by 49 percent to almost Rs. 171 billion.

Coming in at No. 6 is Bukit Darah – also with a recorded revenue for 2021/22 of just under Rs. 15 billion and revenue growth of nearly 50 percent. The diversified entity – which has interests in beverages, oil palm plantations, and oils and fats – climbed three places up from ninth position on the 2020/21 LMD 100 Leaderboard.

The sole bank to make an entry into the top 10 is Commercial Bank of Ceylon (ComBank). The bank slips three notches to seventh place in the current rankings, recording a PAT of Rs. 24.3 billion and revenue of almost 164 billion rupees for its financial year ended 31 December 2021.

Dialog Axiata, the only telecommunications services provider in the top 10, drops one place in the LMD 100 for financial year 2021/22 to eighth place with a revenue growth of 18 percent (to nearly Rs. 142 billion) and a bottom line surpassing 17 billion rupees.

In ninth place and improving by one position in the LMD 100 rankings is CT Holdings. The food and staples retailing group recorded a PAT of over Rs. 4.1 billion (a growth of 26%) and revenue in excess of 136 billion (a 21% increase) in the period under review.

Rounding off the top 10 of the LMD 100 for 2021/22 is Cargills (Ceylon), rising in the listed entities’ rankings from 11th position in the previous financial year. Cargills (Ceylon) recorded revenue upside of 21 percent to register a turnover of Rs. 136.7 billion and a bottom line of 4.5 billion rupees.