THE LITMUS TEST | 2021/22

PATHWAYS TO SUCCESS

The nation’s corporate leaders find pathways to considerable success and progress – despite the economic shenanigans

International travel may have been off the cards for the general population but the nation as a whole took a roller-coaster ride to counter the travel restrictions the COVID-19 pandemic imposed on Sri Lanka… and beyond.

Contributors to the ‘ride’ included not only the fallout from the ‘virus years’ but political upheaval, a forex crisis and valiant efforts to shore up a badly eroded economy.

The LMD-NielsenIQ Business Confidence Index (BCI) mirrored the economic ups and downs despite starting financial year 2021/22 with a strong showing of 138 basis points in April 2021, only to plunge by 49 points to 89 in May that year.

Business confidence rallied somewhat in September (104) and climbed steadily to end the financial year with promising score of 132 in March 2022.

This edition of the LMD 100 presents a review of the performance of the island’s leading listed entities in a year the likes of which we hope not to see for a long time to come – though they were neither the best of times nor the worst.

LEADERBOARD Expolanka Holdings (Expolanka), a premier transportation and logistics conglomerate, leads the LMD 100 for financial year 2021/22, rising from second place in the previous period’s rankings to take the winner’s podium.

Entities from a diversity of sectors – including capital goods; diversified financials; banking; telecom services; food, beverage and tobacco; food and staples retailing; insurance; energy; banks; and transportation – are represented on the coveted Leaderboard.

Hayleys, the capital goods export-oriented conglomerate, which led the board in 2020/21, swapped places with Expolanka Holdings to take second place. And LOLC Holdings (LOLC), an entity from the diversified financials sector, retained its hold on third place with a strong showing once more.

John Keells Holdings (JKH) comes in fourth in the pecking order. The capital goods conglomerate climbed two notches from its sixth place ranking in 2020/21. Carson Cumberbatch (Carsons), the food, beverage and tobacco giant, too rose by an impressive three places to come in at No. 5 in the LMD 100 rankings.

Carsons is followed in sixth position by fellow food, beverage and tobacco conglomerate Bukit Darah, which also improved its ranking (by three places) from financial year 2020/21.

Coming in at No. 7 is Commercial Bank of Ceylon (ComBank). The leading private sector commercial bank dropped three notches in the rankings from the previous financial year.

Dialog Axiata comes in at eight (No. 7 in 2020/21). Both CT Holdings (ninth position) and Cargills (Ceylon) (No. 10) improved on their 2020/21 rankings by a single notch to make it into this period’s top 10 listed companies.

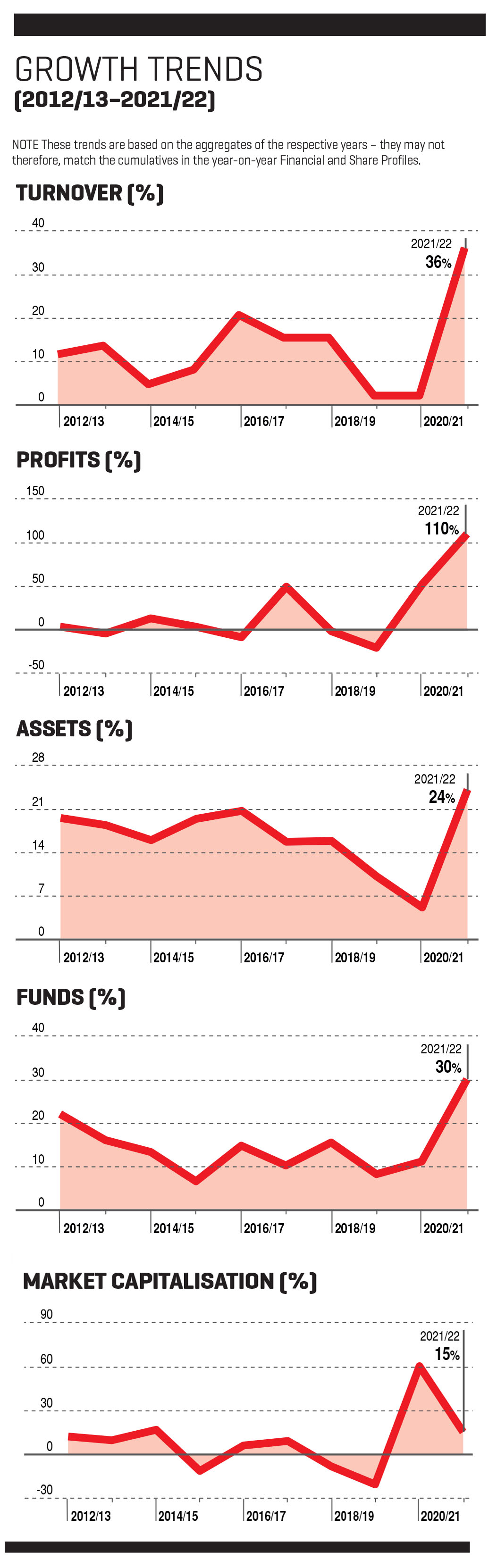

REVENUE STREAMS The cumulative revenue of Sri Lanka’s 100 largest listed companies stood at slightly over Rs. 5,376 billion in 2021/22. This amounts to an annual growth of 36 percent in a period in which the official rate of inflation for 2021 was recorded as seven percent.

For the sake of comparison, in the previous financial year, the aggregate turnover of LMD 100 companies surpassed Rs. 3,945 billion while inflation stood at 6.2 percent in 2020.

Over 60 (52 in 2020/21) LMD 100 corporates registered an annual turnover of more than 20 billion rupees in financial year 2021/22.

The 14 highest ranked corporates (Expolanka, Hayleys, LOLC, JKH, Carsons, Bukit Darah, ComBank, Dialog, CT Holdings, Cargills (Ceylon), Hatton National Bank (HNB), Sampath Bank, Melstacorp and Sri Lanka Telecom) breached the Rs. 100 billion mark.

With a revenue growth of a staggering 217 percent, Expolanka leads the turnover rankings with an annual income of nearly Rs. 695 billion. It is also only one of five entities to report a top line improvement in excess of 100 percent for the period under review.

BOTTOM LINES At just over Rs. 696 billion, the 2021/22 aggregate post-tax profits of the LMD 100 increased by a commendable 110 percent compared to the previous financial year.

The profit after tax (PAT) of 20 quoted companies – including LOLC, which leads the pack with a PAT of over 77 billion rupees, Expolanka (Rs. 72 billion and counting), Browns Investments (in excess of Rs. 31 billion) and Brown and Company (over 29 billion rupees) – crossed the Rs. 10 billion mark in the period under review.

Only five (compared to 13 in the previous period) of LMD 100 entities closed the financial year 2021/22 in the red – viz. Laugfs Gas, John Keells Hotels, Tokyo Cement, Colombo Fort Land & Building and Lankem Ceylon.

Twenty-nine of the listed entities making the rankings in the review period recorded a profit after tax hike in excess of 100 percent, led by Brown and Company (989%), Browns Investments (760%), Melstacorp (607%) and HNB Finance (517%).

TAXATION In financial year 2021/22, an LMD 100 corporate paid out over 1.6 billion rupees on average in taxes.

Expolanka forked out nearly Rs. 13 billion in taxes (a 651% increase from the previous period). Other major contributors to the nation’s coffers were Ceylon Tobacco Company a.k.a. CTC (Rs. 10.5 billion), Melstacorp (over nine billion rupees), ComBank (more than Rs. 8.6 billion), and Bukit Darah and Carsons (both contributed in excess of 7 billion rupees each).

Hayleys and Vallibel One paid out over seven billion rupees each in taxes for the period while JKH’s tax charges were just shy of Rs. 7 billion.

ASSET VALUES Three of the nation’s leading banks – viz. ComBank, HNB and Sampath Bank, and the diversified financials corporate LOLC declared assets in excess of Rs. 1.2 trillion. ComBank once again demonstrated the strength of its balance sheet with nearly two trillion rupees in assets at 31 December 2021.

For the second consecutive financial period, Expolanka forged the highest percentage gain in asset values among the top 100 – its total assets of nearly 300 billion rupees reflected a 335 percent appreciation from the end of the preceding year. Its closest rival for asset growth is Hayleys Fabric with a 212 percent appreciation reflected in a value of over Rs. 36 billion.

Browns Investments, Brown and Company and Hela Apparel Holdings also recorded asset growth of over 100 percent.

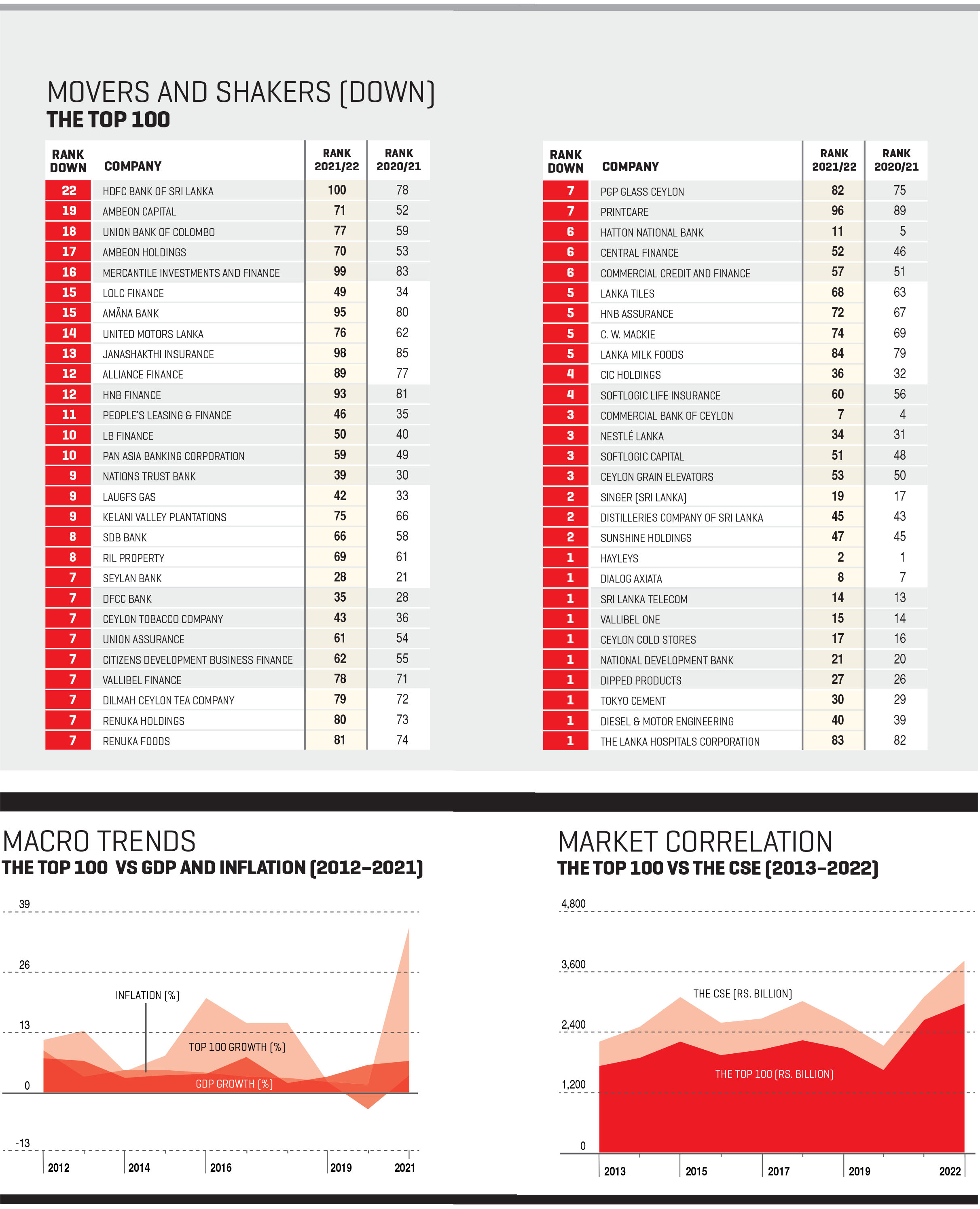

MOVERS AND SHAKERS Aitken Spence Hotel Holdings climbed a remarkable 37 places – from 91 in 2020/21 to 54 in 2021/22 – of the LMD 100 list to lead the movers and shakers in this period.

Browns Investments improved on its 2020/21 ranking and rose from 76th to 55th place while Hayleys Fabric gained 12 positions from 60 to 48 in the 2021/22 edition of the LMD 100.

In the meantime, as many as 29 of the island’s listed corporate entities improved on their 2020/21 LMD 100 ranking.

SECTOR RANKINGS In the period under review too, capital goods takes the lead with a cumulative turnover of over Rs. 1,232 billion, which represents more than 22 percent of the LMD 100’s combined revenue and about 24 percent of shareholder’s funds for 2021/22.

The capital goods sector accounts for approximately 23 percent of the LMD 100’s cumulative profit after tax in the said period.

Once again, the food, beverage and tobacco sector follows as the second largest player in the LMD 100 with an aggregate income in excess of Rs. 886 billion and a share of a little over 16 percent of the cumulative revenue in the 12 month period.

INVESTOR YARDSTICKS Expolanka leads with a market capitalisation of over Rs. 406 billion at 31 March 2022; it is followed by LOLC, which registered a market cap of nearly 284 billion rupees at the end of the LMD 100’s 2021/22 financial year.

Fourteen of the 100 leading listed corporates maintained an equity value in excess of 50 billion rupees at the end of 2021/22.

THE FUTURE In November 2022, the Ceylon Chamber of Commerce made a “clarion call” for the independence of the Central Bank of Sri Lanka to be restored – this call was made ahead of the Sri Lanka Economic Summit 2022 to be held in December, themed Resetting from Turmoil to Opportunity.

THE FUTURE In November 2022, the Ceylon Chamber of Commerce made a “clarion call” for the independence of the Central Bank of Sri Lanka to be restored – this call was made ahead of the Sri Lanka Economic Summit 2022 to be held in December, themed Resetting from Turmoil to Opportunity.

The chamber said: “Institutions like the Central Bank of Sri Lanka should be allowed to function independently in performing its mandate as in most other countries, particularly at this stage when the country is grappling with a major economic crisis… to enable an independent Central Bank, prioritise price stability and limit the monetisation of the fiscal deficit.”

It also reiterated “the need for a strong and independent Central Bank, which is paramount in driving Sri Lanka’s economic revival. Over the decades, Sri Lanka has been hampered by weak institutions and poor governance, which has deteriorated the efficiency of the public sector and led to sub-optimal policymaking on the economic front.”

In October 2022, in a non-rating action commentary titled Mixed Impact on Rated Sri Lankan Corporates from Macroeconomic Challenges, Fitch Ratings cautioned: “Rated Sri Lankan corporates in consumer goods retail, power generation and homebuilding will be among the most affected if the economic crisis deepens or is sustained for a prolonged period.”

Fitch Ratings went on to say that “significant cost inflation affecting demand and profitability, import restrictions disrupting operations, and high interest rates are key risks faced by domestic corporates in the next 12-18 months.”

The rating agency elaborated by stating that “based on Fitch’s base case forecast assumptions, we project that most other corporates will be able to weather the current economic downturn, supported by their presence in defensive industries, weakened competition, strong balance sheets and adequate liquidity.”

“Most rated corporates posted strong revenue growth and expanding margins in their June 2022 quarterly results due to inflation-led price hikes and sale of lower-cost inventory purchased prior to the sharp devaluation in the local currency in March 2022,” the agency said.

It added: “However, the cost of new inventory has risen sharply since then while high inflation and falling affordability will make it challenging to raise selling prices further. There is also a significant increase in operating costs, which will be reflected more acutely in the next few quarters, and it is likely to pressure cash flow.”

Fitch listed future challenges to include the extension of an ongoing import ban beyond the next six months, a further rise in interest rates, prolonged high inflation leading to difficulties in raising selling prices, and delays in receipts from government counterparties, and commented that these could lead to a rapid deterioration in some companies’ liquidity positions.

As for an international perspective, the IMF’s World Economic Outlook (WEO) published in October 2022 (titled Countering the Cost-of-living Crisis) highlights in its overview both inflation and uncertainty. It points out that global economic activity is experiencing a broad-based and sharper than anticipated slowdown with inflation higher than seen in several decades.

It cites the cost of living crisis, tightening financial conditions in most regions, Russia’s invasion of Ukraine and the lingering fallout from the COVID-19 pandemic as weighing heavily on the outlook.

The report surmises that global growth could slow from six percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023, which is the weakest growth profile since 2001 – except for the global financial crisis and the acute phase of the COVID-19 pandemic.

The report says: “Monetary policy should stay the course to restore price stability, and fiscal policy should aim to alleviate the cost of living pressures while maintaining a sufficiently tight stance aligned with monetary policy.”

“Structural reforms can further support the fight against inflation by improving productivity and easing supply constraints, while multilateral cooperation is necessary for fast-tracking the green energy transition and preventing fragmentation,” the IMF report notes.