BUSINESS SENTIMENT

ECONOMY TAKES A TOLL ON CONFIDENCE

Business sentiment dips amid fears over the national economy and high interest rates

A spate of ‘natural disasters’ grabbed the headlines towards the tail end of May and early June, as heavy rainfall led to flooding and landslides in much of southwestern Sri Lanka, resulting in major losses to life and property.

The authorities it would seem were overwhelmed by the scale of the tragedy – albeit that it could have been pre-empted and prepared for, given that a similar episode took place at around the same time last year. And as was the case in May 2016, the state entity tasked with disaster management stood as proof of a disaster in itself!

Notwithstanding the sorry state of affairs on the official front, citizens, relief organisations and the tri-forces came to the fore to assist those who were in desperate need.

It will take time to assess the real impact of this adverse weather-related catastrophe on the national economy, which was already reeling from drought-related vicissitudes. But for the time being at least, this could be one among many other reasons for the dampened corporate sentiment as reflected in the results of the latest Business Confidence Index (BCI) survey.

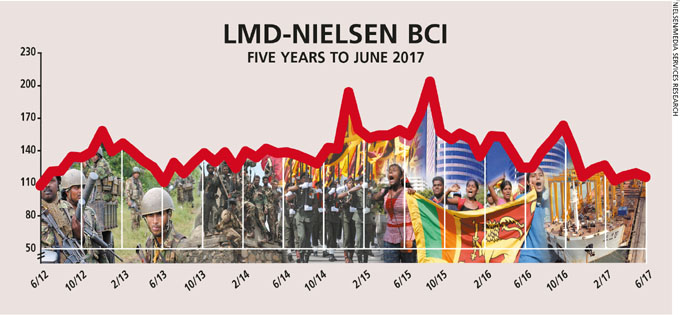

THE INDEX The BCI dropped to 115 in June compared to 119 in May. The index is also lower than its April score of 117 while both the 12-month and all-time averages in June (130) are 15 basis points higher. And a year ago, the confidence barometer registered 126 on the BCI scale.

Since January this year, business confidence has oscillated within a relatively narrow band of 15 points with all except one monthly movement recording six points or less – stagnation it seems is the overriding theme.

“This drop was expected with inflation showing no signs of slowing down, and the floods in May severely impacting day-to-day life and business in many parts of the island,” says Nielsen’s Managing Director Sharang Pant.

He points out that “the availing of GSP+ in May was welcome news but it might take time for the impact to be known in terms of growth in business orders or employment … Interest rates and the currency however, need to be managed as a priority to improve the ease of doing business and attract investment.”

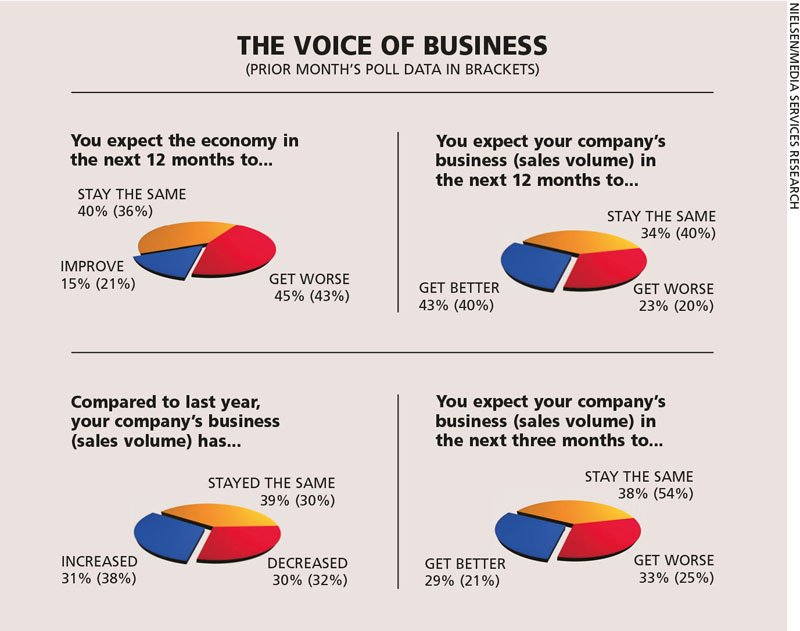

THE ECONOMY A majority (45%) of respondents continue to feel that the economy will struggle in the coming 12 months and these concerns have only grown as time has passed.

“With instability in the economy and poor decision-making by our government, it is hard to say where the economy as well as our business will stand in the coming months,” a corporate executive laments.

A more cautiously optimistic businessperson notes: “Many of our investment plans are on hold due to the low value of the rupee as well as the state of the economy at present. But we are hopeful that the economy will pick up in the future.”

BIZ PROSPECTS Possibly due to expectations of investments being driven by GSP+, 43 percent of respondents feel that business will improve over the next 12 months. At the same time, nearly three-in-10 of those surveyed feel that the present quarter would be good for business.

Both these numbers have increased compared to the previous month.

INVESTMENT The investment climate in the country is ‘good’ or better, according to nearly a fifth (versus 15% in May) of Nielsen’s survey sample.

However, a slim majority of 41 percent hold a negative view on prevailing investment conditions.

This corresponds with the views of one respondent who explains that “with interest rates steadily on the rise and a lack of confidence in the government, the investment climate does not seem to be too good – no one is willing to take the risk and invest.”

WORKFORCE In terms of plans for the workforce over the coming six months, nearly three-quarters (up from 66% in the previous month) of businesspeople who spoke to the pollsters say they will maintain current staff levels.

A further 19 percent of corporates say they plan to increase their staff numbers while seven percent reveal that they’re likely to consider retrenchment.

SENSITIVITIES The cost of credit, the rupee value and raw material prices feature among the main concerns of members of the business community. “Our company is in need of credit facilities to start new projects; however, these have been pushed back due to high interest rates,” a respondent reveals.

Another businessperson laments that “with the increasing cost of raw material imports as well as the depreciating rupee, our business has been negatively impacted.”

PROJECTIONS In the previous edition of LMD, we stated that the outlook for business confidence may seem brighter than it has been for some time, on the back of largely positive signs for corporate earnings as well as a somewhat bullish stock market and tapering inflation.

But while the index has by and large stood its ground in recent months, the latest survey results paint a less than pretty picture of what may be in store for Sri Lanka Inc.

With the majority of businesspeople pointing to a deterioration of the economy and investment climate, the outlook for the BCI is subdued. Not even the recent cabinet reshuffle it would seem has helped buoy business confidence.