BANKING SECTOR

THE GREAT DEBT RESTRUCTURE

Compiled by Yamini Sequeira

ASSET QUALITY UNDER REVIEW

Sanath Manatunge preempts the implications of local debt restructuring plans

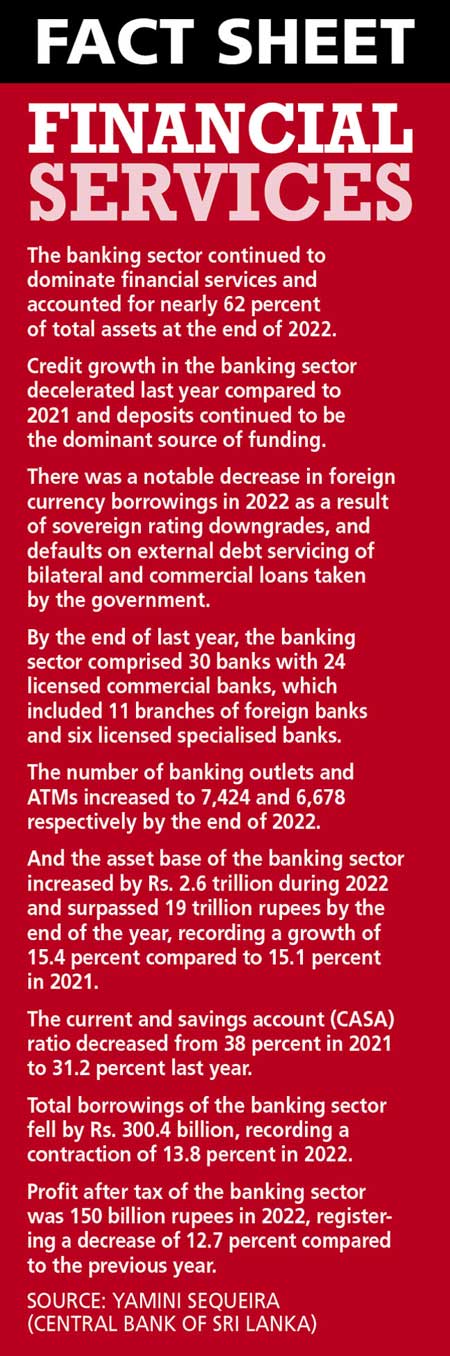

The banking sector faced unprecedented challenges in 2022. Against the backdrop of shrinking purchasing power, hyperinflation and high interest rates, the priority was to maintain a strong loan book performance.

CHALLENGES Sanath Manatunge explains that “in this volatile climate, addressing asset quality issues could be a critical problem, and should ideally be done by balancing the interests of both customers and banks. Looming debt restructuring, and its expected impact on the capital and liquidity of banks, are key concerns.”

“Furthermore, the increase in tax rates has impacted [financial services] industry profitability. Exploring new markets could also be difficult for financial services institutions – especially given the rating downgrades suffered during the crisis,” he adds.

The banking sector has always been resilient despite various crises; but the last two years have been particularly tough.

Manatunge recounts: “Sri Lanka lost access to international financial markets following the credit rating downgrades resulting in a severe forex liquidity crisis. This culminated in the government announcing an external debt service suspension in April last year.”

He continues: “The severe forex liquidity constraint was felt across the economy – particularly from the second quarter of 2022 – with shortages of fuel, medicines, cooking gas and other inputs needed for economic activity.”

This situation triggered a wave of cascading consequences for banks. Difficulty in supporting customers’ imports resulted in low trade volumes; and high interest rates affected the margins of customers, adversely impacting the ability to service their debts.

Other problems included fewer lending opportunities due to corporate customers postponing their investment decisions; the deterioration of customers’ credit quality in vulnerable sectors; inadequate capital availability due to rising impairment provisions; the inability of staff to report to work due to the fuel crisis; and the exodus of staff from our shores.

OVERSIGHT It helped that the banking sector remained highly regulated with effective risk frameworks in place. This would help banks absorb stress factors better and contribute to the gradual recovery of the economy.

In Manatunge’s view, the immediate challenge is to maintain the regulatory requirements for capital since the crisis forced the Central Bank of Sri Lanka to relax the same for licensed commercial and specialised banks.

Exploring new markets could also be difficult for financial services institutions – especially given the rating downgrades suffered during the crisis

According to the regulator however, banks are required to build their capital positions to pre-crisis levels within three years.

The recent IMF report on Sri Lanka also places emphasis on financial system stability. The Central Bank – with the assistance of the Asian Development Bank (ADB) and World Bank – has initiated a diagnostic study regarding the nine largest banks in the country. In its first phase, an asset quality review of the two largest state banks and three biggest private banks was completed recently.

By July, the International Monetary Fund expects the Central Bank to develop a road map for financial sector restructuring and recapitalisation, to address capital and forex liquidity shortfalls.

ROAD BUMPS Manatunge observes that “with the ending of moratoriums and due to the economic challenges faced by borrowers over the past two or three years, a rise in non-performing assets (NPAs) can be expected. However, banks are working with customers to restructure their facilities in line with the expected cash flows.”

“Due to various challenges faced by diverse industries during the crisis, it will be important to adopt a prudent strategy in relation to lending with a renewed credit risk appetite. With the gradual reduction in inflation and interest rates, the pressure on borrowers is expected to ease. It will be important to maintain a quality loan book,” he adds.

The government has gradually begun to pay the money owed to contractors in the construction industry, and several other business and industry segments. This will in turn help the relevant parties settle their dues to the banks and revive their operations.

SOCIAL ISSUES Apart from sustaining profitability, the banking sector also faces other problems such as the brain drain.

Banks also need to play a larger role in mitigating climate change by enabling sustainable investments and funding environmentally-friendly initiatives, empowering women in entrepreneurship and improving their financial literacy, and supporting SMEs.

They must implement effective corporate governance practices that prioritise effective anti-money laundering (AML) and combatting the financing of terrorism (CFT) measures; and ensure that bank activities comply with policies, laws, regulations and ethical standards.

UNCERTAINTY Amid the prevailing uncertainty as the sector gears up for local debt restructuring and the impact it could have on banks, government officials have said that only Treasury bills held by the Central Bank (which account for 62.4% of the total T-bill stock) would be considered for domestic debt restructuring. For Treasury bonds, a voluntary domestic debt optimisation operation is envisaged.

“The government and its advisors are expecting to initiate negotiations with major T-bond holders to gauge possible options and constraints. It is very important to ensure financial sector stability to support economic revival as expected by all stakeholders,” Manatunge emphasises.

He believes that the ongoing IMF programme will support consolidation efforts with regard to the economy.

“Furthermore, it will help boost the confidence of foreign and local investors in relation to prospects for economic recovery. It is important to maintain policy consistency, political stability and a conducive business environment so that investors will be encouraged to engage in greater investment activity,” he prescribes.

The gradual drop in inflation and interest rates will help increase investments, along with support for exporters and SMEs, and the importation of substitutes with a view to achieving long-term sustainable growth in foreign currency liquidity.

Effective sustainability governance is necessary for corporates to achieve sustainable development. This includes setting sustainability goals and targets, monitoring and reporting on sustainable performance, and ensuring that sustainability is integrated into decision-making processes at all levels of the organisation.

Looking ahead, Manatunge believes that “the economic challenges will undoubtedly cascade down to multiple industries. Therefore, maintaining the portfolio quality in advances will be an uphill task.”

“This year too is expected to present many challenges, the biggest being the looming debt restructuring [process], and its expected impact on capital and liquidity of banks,” he concludes.