BUSINESS SENTIMENT

INDEX SETTLES IN A NO-GO ZONE

Biz confidence remains muted as the pros and cons on the economic front even out

Could there be a silver lining for Sri Lanka Inc. following the gradual fall in inflation? The answer hangs in the balance despite a notable decline in the Colombo Consumers Price Index (CCPI) to 25.2 percent in May – from 35.3 percent in the preceding month.

This decline was largely triggered by the Monetary Board of the Central Bank of Sri Lanka reducing its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) – by 250 basis points to 13 and 14 percent respectively – for the first time in three years. The Central Bank said that the cut in its benchmark rates would “help steer the economy towards a rebound phase.”

Meanwhile, import restrictions on 286 goods were lifted recently and this could lead to a sense of optimism in business circles – even though another 1,216 items remain on the restricted goods list.

Although the economic crisis has been partially alleviated – on the face of it, at least – concerns over the completion of debt restructuring negotiations – including local debt – by September in preparation for the next IMF programme review along with speculation about ‘what’s next?’ on the election front are taking centre stage in the corridors of business. Which perhaps is why business confidence remains muted.

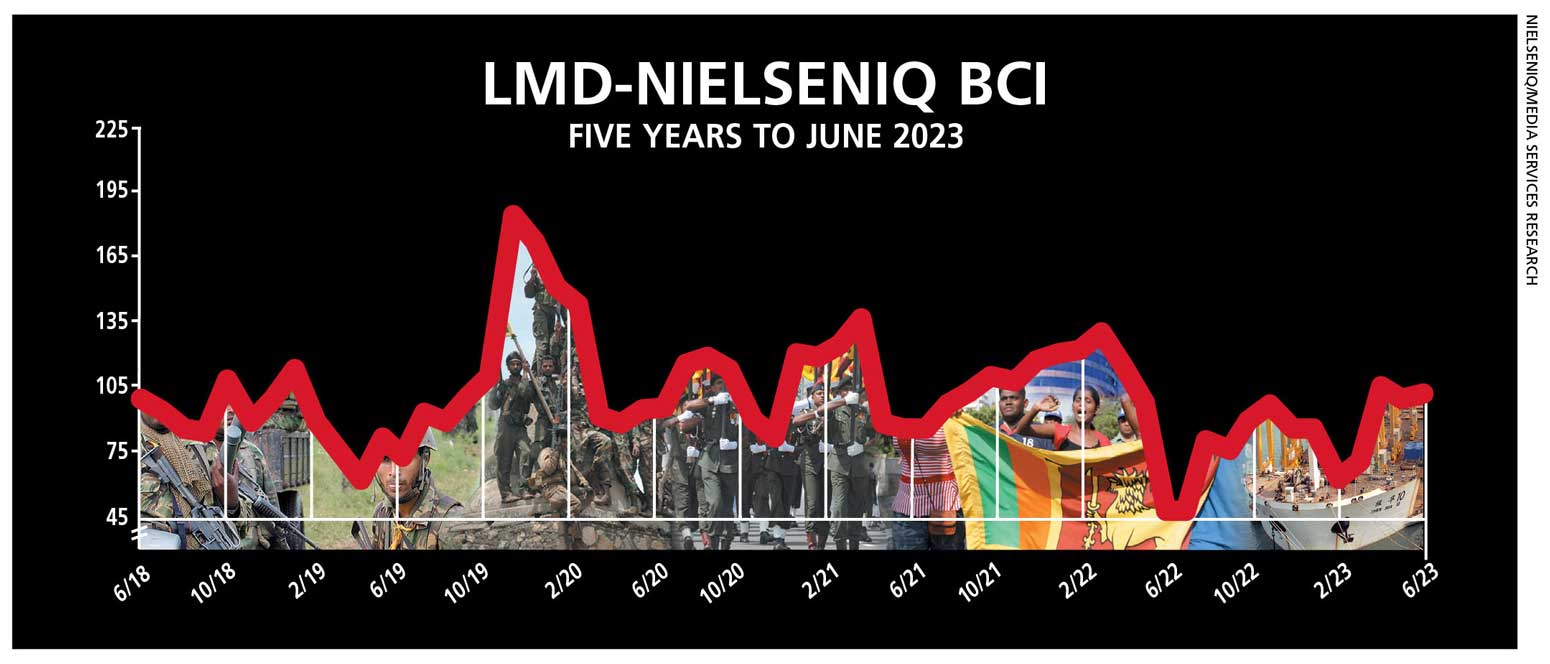

THE INDEX Against this backdrop, the LMD-NielsenIQ Business Confidence Index (BCI) gained a mere one basis point in June to register 103.

If one were to be thankful for small mercies, the barometer has gained ground from a year ago when the index plummeted to under 50 (49 to be precise) and is nearly 20 notches higher than the mean for the last 12 months.

In contrast, the BCI continues to languish at well below its all-time average of 124 points – one has to track back to March last year when the count exceeded this benchmark; and that as we know, was ahead of the mayhem that engulfed our island in April.

SENSITIVITIES All told, the sensitivities are numerous as outlined above.

Add to this list the volatility in the financial sector including the value of the Sri Lankan Rupee, the apparel-led export sector downturn on the back of fiscal turmoil in key markets such as the US and the fact that high taxes are taking their toll on businesses, and we could be riding the rollercoaster for the short term at least.

On the plus side of the confidence ledger, there could be more respite as a result of the slide in world oil prices and more good news on the inflation front.

PROJECTIONS NielsenIQ’s Director – Consumer Insights Therica Miyanadeniya cautions that “even though there is an undercurrent of improvement, the effects are still not felt by businesses…”

“Unless visible action is taken to improve the status quo, both the BCI and consumer confidence will continue to remain in an indeterminate state,” she adds.

As for our take, it hasn’t changed from what we said a month ago: “The burning question for the weeks ahead is whether the perceived pros will outweigh the cons – and if they do, we expect the BCI to stand firm and not fall below the psychologically important 100 mark.”