WORLD ECONOMIC OUTLOOK

GLOBAL GROWTH STORY

Shiran Fernando weighs the potential impact of a hard landing for the world economy

The global economic outlook is in uncertain territory once again. Last year, the prospects for world economic growth were promising – meaning that most forecasters expected a synchronised pace of growth where both major developed and developing economies were expected to build on what was achieved in 2017.

And in April 2018, the IMF stated that economic growth was enjoying its most integrated upswing since 2010. This was short-lived however, given the slowdown in the UK, Japan, Europe and China. The growth story has since shifted to being one of re-synchronisation on the downside.

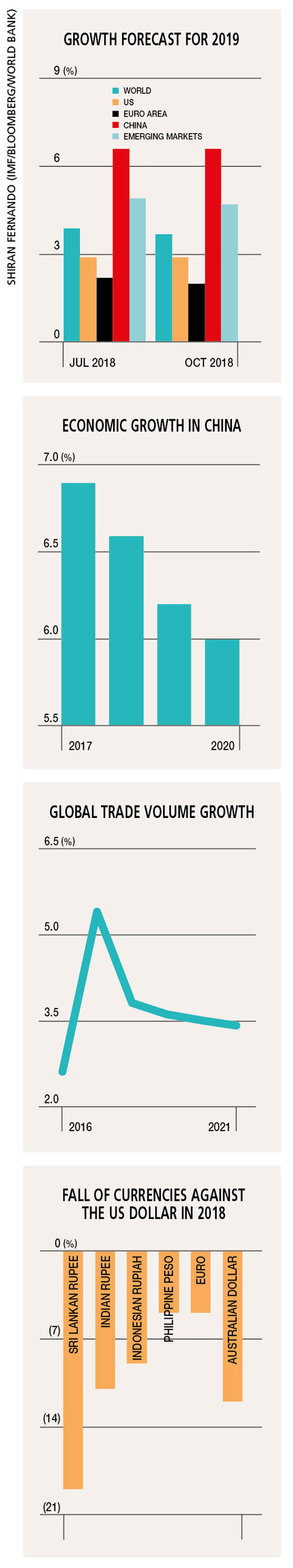

GROWTH BARRIERS The fallout from the ongoing US-China trade war has been a major factor. Factory readings from Asia have already sent early warning signs of the impact. China, which grew by 6.9 percent in 2017, is expected to grow by only six percent in 2022. Rising oil prices, a strengthening dollar and high yields in the US led to pressure on currencies with weaker fundamentals.

Countries such as India and Indonesia witnessed a currency depreciation of 11 and nine percent respectively against the greenback on the back of high capital outflows. Sri Lanka also recorded a steep currency depreciation of 19 percent last year.

LOW EXPECTATIONS The World Bank points to global growth of 2.9 percent in 2019, as revealed in its January update while the IMF expects growth to reach 3.7 percent. The latter forecast was made in October 2018 and could be revised in the IMF’s April update in the light of the latest developments.

The OECD expects growth to be 3.5 percent in the 2019-2020 period, according to its November 2018 forecast. Moreover, the general sentiment is one of global growth having peaked and weathering tough conditions to ensure a soft landing.

RISK FACTORS Many of the risks envisioned in the lead up to 2018 materialised in the year. The expectation is for these risks to linger and weigh more on growth.

The first high risk on the table is a set of trade tensions that have created uncertainty in terms of business planning and investment. According to the World Bank, global trade volume growth, which peaked at 5.4 percent in 2017, fell to 3.8 percent in 2018. Trade volume growth is expected to remain at about 3.4 to 3.6 percent over the 2019-2021 period. If all tariffs in the ongoing trade war are implemented, it could affect five percent of trade flows. As such, this trade outlook will be a drag on growth.

A sharp slowdown in China as a result of the trade dispute could in turn hit emerging market economies. Developed economy financial markets may react negatively as well. As a result of the above scenario and other factors that could result in a tightening of financial conditions, emerging markets such as Sri Lanka could witness acceleration in capital outflows.

There are other factors that could have a greater impact in 2019. Geopolitical and political tensions in the Middle East and Venezuela could lead to greater volatility vis-à-vis commodities such as oil. Uncertainty surrounding the outcome of Brexit is also weighing heavily on the economies concerned. The impact of the US government shutdown and its potential impact on cooling American economic growth is another concern.

OIL PRICES The downward movement in oil prices over the fourth quarter of 2018 was a positive for Sri Lanka. However, the question of whether it will continue to be that way depends on the outlook for oil in the year. The price of oil has been volatile in recent months with sharp weekly upward and downward swings, in response to data points and shifts in global sentiment.

Two factors are expected to weigh on the outlook for oil prices. The global growth outlook as detailed above will be a key driver of demand in the global economy. Further signs of a growth slowdown could mean that oil prices edge lower particularly if the driver of the slowdown comes from key markets such as China. The oil supply outlook is the other main factor – in particular, decisions to control or limit the supply of OPEC and other non-OPEC partners.

DOMESTIC IMPACT Taking the above points into consideration, it is apparent that Sri Lanka’s economic outlook could be even more challenging given the domestic risks. Slowing growth in key export markets such as the US and the EU is not healthy for merchandise export growth. Further volatility in emerging markets is not healthy for Sri Lanka’s bond market and the currency amid the risk of further outflows to developed markets.

However, if the slowing growth outlook results in the Fed reducing the pace of interest rate hikes, emerging markets such as Sri Lanka will benefit temporarily with inflows and a strengthening of domestic currencies. Lower oil prices arising from a weak growth outlook could also provide relief for Sri Lanka’s balance of payments.