FINANCE SECTOR

CORPORATE RESILIENCE

Compiled by Yamini Sequeira

LET’S NOT MISS THE BUS!

Jayantha Rangamuwa laments the political stalemate and its impact on business

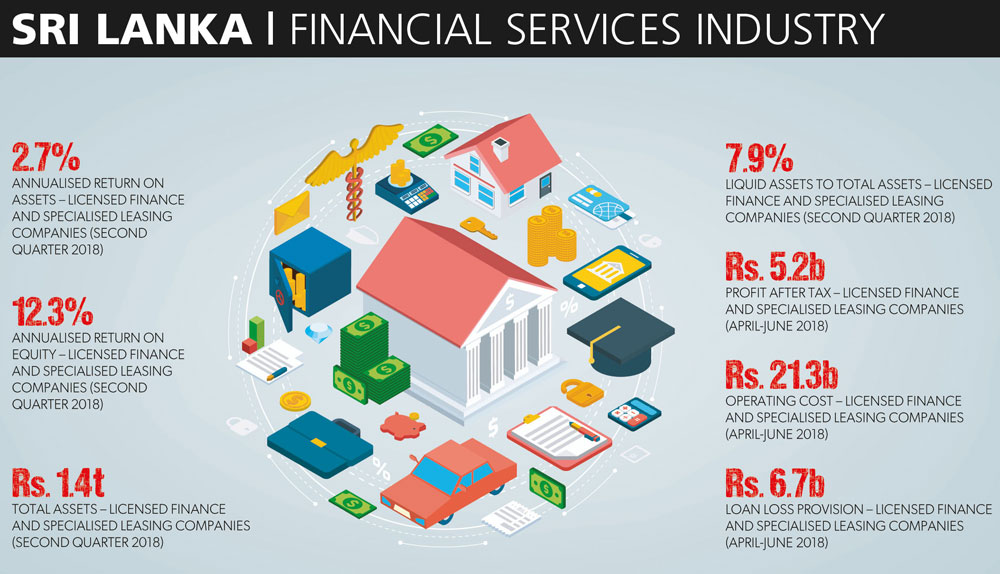

According to the Colombo Stock Exchange (CSE) and published data of financial institutions, business performance slowed last year. This has in the main been attributed to relatively high interest rates, moderate economic growth and the impact of natural disasters. Although capital and liquidity in most sectors were satisfactory, asset quality and profits witnessed a decline.

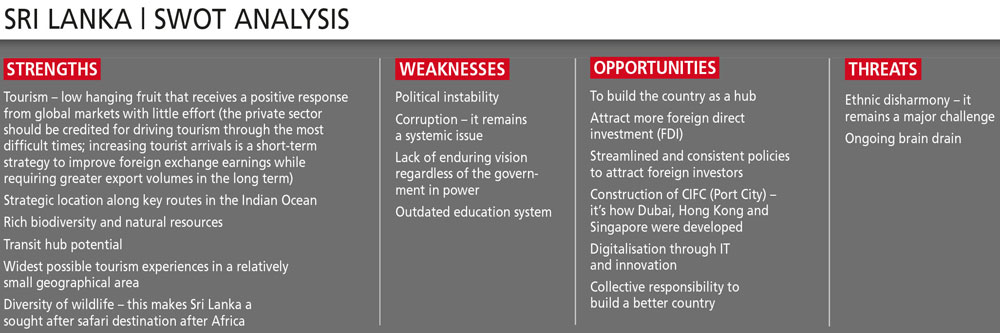

Jayantha Rangamuwa echoes the regulator’s assessment, acknowledging that the calendar year gone by has been tough on almost all sectors: “Arising from political instability, economic uncertainty prevailed during the latter part of the past year. Unfortunately, the political uncertainty continues.”

“The economic slowdown negatively affected the financial services industry by way of lower demand. It’s been a tough period for finance companies given the tax regime and interest rate environment. Further, the banking and finance sector has had to adapt to IFRS accounting standards, resulting in more provisions for bad loans,” he notes.

Rangamuwa adds: “Currency devaluation added to the dilemma. An increase in non-performing loans (NPLs) was also witnessed during the year as a result of the generally poor performance of the economy.”

RESILIENT NATURE He asserts that although the finance sector remained resilient, a slowdown across other sectors naturally affected demand for financial services: “The first two quarters of 2018 were good but the latter half of the year proved challenging.”

Rangamuwa explains that “sustaining strong performances is a huge challenge for finance companies in the light of economic factors and new regulations such as the loan to value ratio with which we have to comply since leasing is our principal business.”

“The newly introduced tax, the debt recovery levy (DRL) effective from 1 October 2018, takes off approximately 20 percent from net profit – this is on top of other taxes the sector has to bear. This tax will make it untenable for financial institutions to remain in the black,” he cautions.

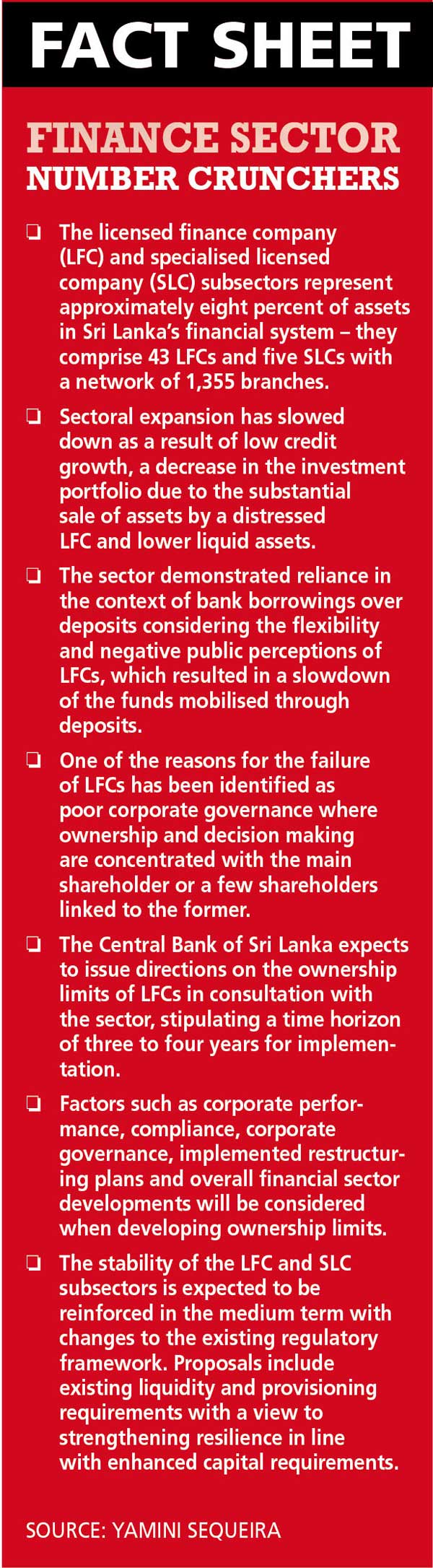

Credit growth and demand remained low mainly due to changes in macro-prudential policies and a slowdown in the economy. And sectoral lending activities showed signs of slowing down in response to macro-prudential policies implemented on vehicle loans.

CHALLENGES AHEAD Rangamuwa expects the situation to be even more challenging in the first half of this year.

He says that a fountain of prudent management sprinkled by common sense was needed to navigate the many macro waterfalls and rapids. Sound lending, as well as improved and aggressive collection and recovery processes – in addition to sound management of assets and liabilities – are critical factors for success.

“Financial services institutions need to be mindful that they’re dealing with public money and have a huge responsibility to remain accountable to society,” Rangamuwa stresses, adding that the finance sector is well regulated and any collapse of institutions has been purely due to mismanagement.

Rangamuwa avers: “There are 43 finance companies, and over 30 banks and specialised banks, which is way too much for a population of around 20 million that will be in the country at any given time.”

“Strong guidelines and supervisory controls are in place. Unfortunately, public memory is short and any financial crisis is easily forgotten in a short time. Financial literacy amongst customers is low. Although we boast about high literacy rates, this does not translate into financial literacy. It is the responsibility of the regulator, financial institutions and the people themselves to be more aware,” he emphasises.

In addition, he believes that there should be more mergers as this would help strengthen the sector with smaller companies struggling to be competitive amid enhanced capital requirements.

ECONOMIC RESURGENCE Rangamuwa is at pains to drive home the point that a rapid economic recovery is the need of the hour.

“We cannot afford to miss the bus once again – if the political stalemate continues, our economy and country will suffer. The authorities need to focus on building the economy and this should be the primary objective in the months ahead,” he states.

“We cannot afford to miss the bus once again – if the political stalemate continues, our economy and country will suffer. The authorities need to focus on building the economy and this should be the primary objective in the months ahead,” he states.

The leading credit rating agencies downgraded Sri Lanka’s sovereign rating following the political crisis late last year. Both Fitch Ratings and Standard & Poor’s (S&P) downgraded Sri Lanka’s sovereign rating, flagging multiple risks stemming from the ongoing political stalemate – and this has had a spillover effect on the country’s external debt refinancing, fiscal consolidation and policy outlook.

Accordingly, both rating agencies lowered Sri Lanka’s sovereign rating to ‘B’ from ‘B+’ while maintaining a ‘stable’ outlook on the economy. Rangamuwa laments: “The downgrading makes it difficult to raise capital overseas and weakens our bargaining power, not to mention higher premiums.”

Despite all obstacles that cropped up in 2018, the finance sector remained resilient. And Rangamuwa predicts that 2019 “will be more challenging, at least in the first half of the year. But as long as companies are managed prudently, they should survive.”

Meanwhile, he notes that many businesses in the SME sector are feeling the heat – most so in the construction industry, which is facing cash flow problems.

“Solid equity and sound fundamentals are the keys for any company to survive tough times,” he posits.

DIGITAL FUTURE Rangamuwa adds that the financial services industry cannot fail to miss the value of digitalisation as it provides a clear pathway for innovation and new delivery channels to be developed.

“The market has become very fluid and companies need to adopt a mix of strategies to cater to diverse segments to remain competitive. Digitalisation is very much here; we need to embrace it and make it a part of the marketing mix, and continue to evolve it further,” he states.

And the lack of skilled personnel remains a challenge in the sector. Rangamuwa lays the blame squarely at the door of the country’s education system, which isn’t preparing students to meet the demands of a modern economy.

In conclusion, he remarks: “Poverty continues to be a challenge and per capita income needs to be raised to reduce the number of people living below the poverty line. Having over 60 percent of our population living below accepted poverty levels isn’t something to be proud of as Sri Lankans – not at a time when the country is emerging as a middle income nation.”