THE LITMUS TEST | 2022/23

THE ROUGH AND TUMBLE

Financial year 2022/23 was played out by corporate Sri Lanka

against a backdrop of a nation in turmoil playing catch-up

In the face of a debilitating economic crisis, political uncertainty and tax hikes – not to mention unprecedented shortages of essential commodities – the nation found itself in a state of turmoil for most of financial year 2022/23.

In recent years, businesses have navigated a series of dramatic challenges, skilfully sidestepping and manoeuvring their strategies and operations to dodge the obstacles the nation and world at large have thrown at them.

The rot set in when the then head of state propelled the nation into an unprecedented constitutional crisis in late 2018, which was followed by the Easter Sunday bombings of April 2019 and then the 18 month long pandemic in early 2020.

And as if three consecutive years of mayhem wasn’t enough, the nation came to a virtual standstill in April 2022 when the people came out of their homes and offices to demand ‘system change’ – originally in a peaceful vigil and eventually, in a violent struggle that led to the former president fleeing for his safety and calling it a day.

And while Sri Lanka Inc. remained resilient in the face of adversity during this time, financial year 2022/23 shed light on the damage caused by events of recent years; and if the interim financials of the leading listed companies for the current financial year (2023/24) are anything to go by, the state of business continues to be on edge.

This edition of the LMD 100 offers a comprehensive assessment of the performance of the island’s leading listed entities in a year that we earnestly hoped for change and economic respite – though that was far from the realities that continue to plague a nation in distress.

And while there’s hope that a silver lining will soon appear on the horizon, the reality continues to be that Sri Lanka isn’t out of the woods – not by any means.

LEADERBOARD Expolanka Holdings, the premier transportation and logistics conglomerate, secures the top slot in the LMD 100 for financial year 2022/23, marking its second consecutive year at the helm of the rankings.

A range of sectors – viz. transportation; capital goods; diversified financials; food, beverage and tobacco; energy; and banks – feature on the coveted Leaderboard this year.

The capital goods export-oriented conglomerate Hayleys maintains second place behind Expolanka for the second consecutive year. And LOLC Holdings, an entity in the diversified financials sector, maintains its grip on the podium’s third position.

Carson Cumberbatch, the food, beverage and tobacco giant, climbs one rung up the ladder to fourth place in the LMD 100 rankings. Following closely in fifth place is fellow conglomerate Bukit Darah (also in the food, beverage and tobacco sector), demonstrating an improvement of one spot from the previous financial year.

The energy giant Lanka IOC (LIOC) enjoyed a remarkable climb up the pecking order, surging 10 places to claim sixth place in the 2022/23 rankings. Meanwhile, Commercial Bank of Ceylon (ComBank) maintains its seventh position from the previous year.

And John Keells Holdings (JKH) drops to eighth position in the pecking order – the capital goods conglomerate slipped from No. 4 in the 2021/22 rankings.

Hatton National Bank (HNB) secures ninth place, advancing from No. 11 in 2021/22 while Sampath Bank moves up two places to round off the top 10 listed companies for financial year 2022/23.

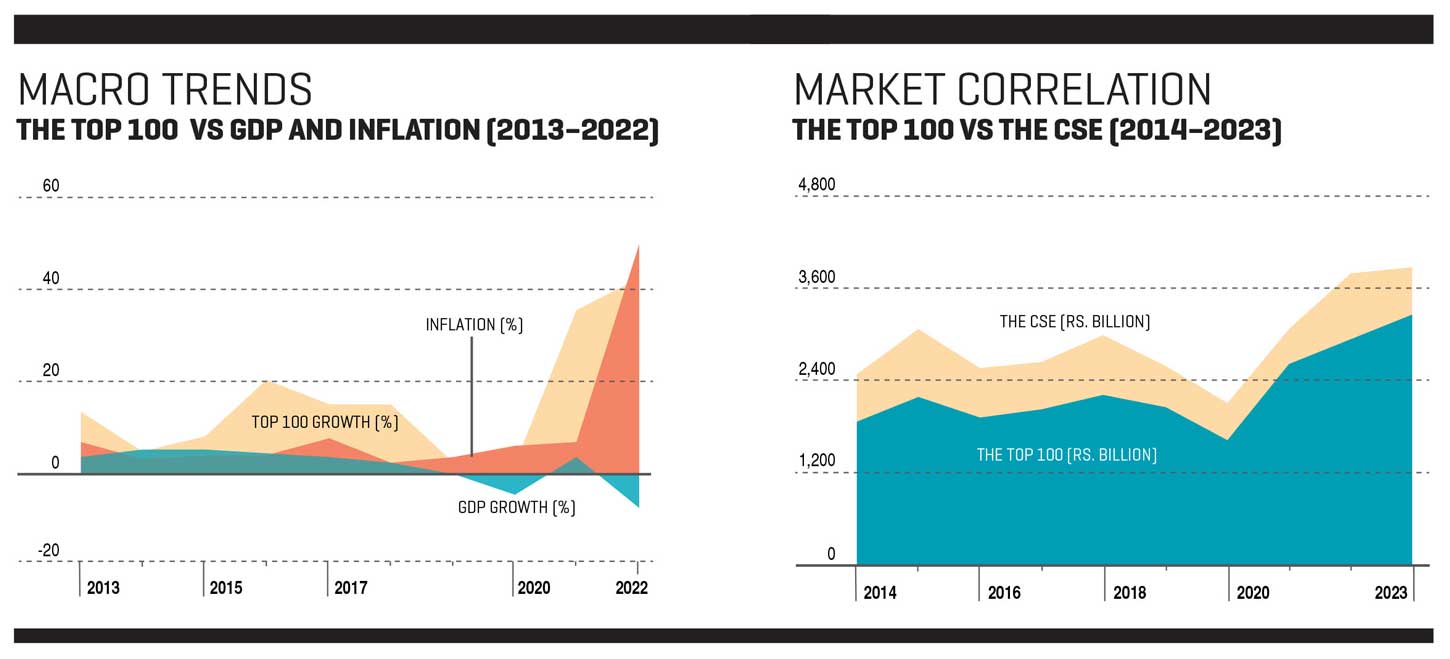

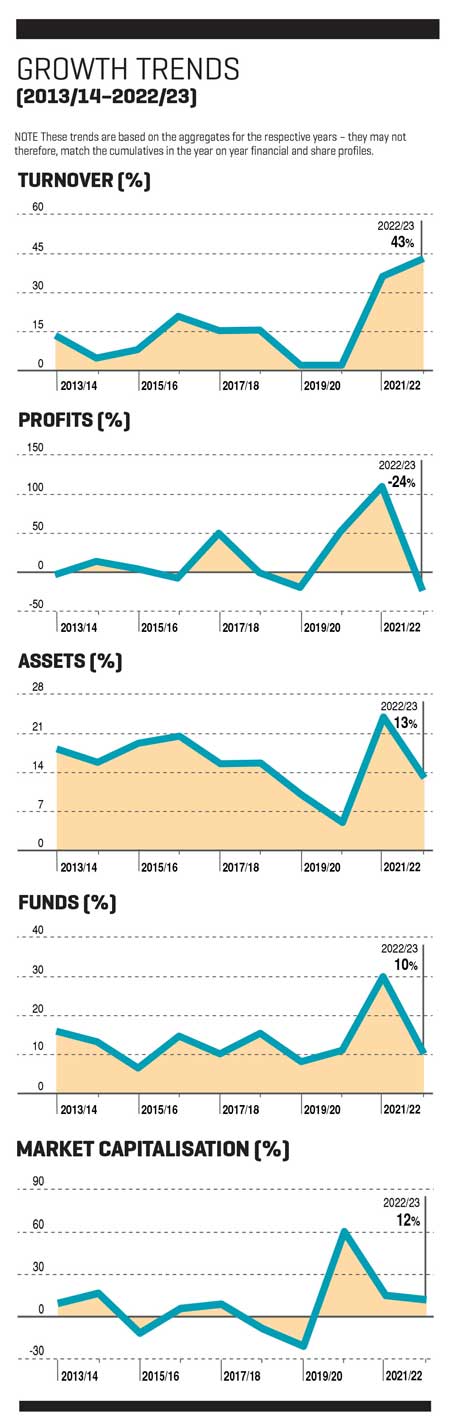

REVENUE STREAMS The cumulative revenue of Sri Lanka’s 100 leading listed companies reached Rs. 7,691 billion in financial year 2022/23, reflecting a healthy annual growth of 43 percent.

This robust top line performance represents an improvement on the previous financial year, when the aggregate turnover of LMD 100 entities surpassed Rs. 5,389 billion.

And in financial year 2022/23, a noteworthy 73 companies (vs 61 in the prior financial year) within the LMD 100 achieved an annual turnover surpassing 20 billion rupees.

The 19 highest ranked corporates – Expolanka, Hayleys, LOLC, Carsons, Bukit Darah, LIOC, ComBank, JKH, HNB, Sampath, CT Holdings, Cargills (Ceylon), Dialog Axiata, Melstacorp, Ceylon Cold Stores, Vallibel One, Hemas Holdings, National Development Bank (NDB) and Sri Lanka Telecom (SLT) – breached the Rs. 100 billion turnover mark.

BOTTOM LINES It is here – i.e. post-tax profits – that the impact of the multiple crises spoils the party. In financial year 2022/23, the cumulative profit after tax (PAT) of the LMD 100 (Rs. 544 billion) shed 24 percent in comparison to the previous year (of nearly 712 billion rupees).

And the loss making LMD 100 companies has risen to 10 from among the 100 whereas in the preceding financial year, this count stood at seven.

Nine quoted companies (led by LIOC – Rs. 37.7 billion) reported a PAT in excess of 20 billion rupees, which is the same number as in financial year 2021/22.

TAXATION In financial year 2022/23, an LMD 100 corporate paid out in excess of 2.2 billion rupees on average in taxes with an aggregate tax bill of Rs. 227 billion for the LMD 100 as a whole.

The comparatives for 2021/22 were 1.6 billion rupees and Rs. 166 billion respectively.

Expolanka contributed nearly Rs. 8 billion in taxes, reflecting a 42 percent reduction from the previous period. Other substantial contributors to the nation’s tax coffers included Melstacorp (Rs. 19.8 billion), Bukit Darah (over 15 billion rupees), Hayleys (more than Rs. 15 billion), Carsons (in excess of 15 billion rupees), Ceylon Tobacco Company (CTC), which forked out nearly Rs. 14 billion in taxes, and Distilleries Company of Sri Lanka (DCSL) – Rs. 12 billion.

ASSET VALUES Three of the nation’s most prominent private sector commercial banks – viz. ComBank (almost Rs. 2.5 trillion), HNB (nearly 1.8 trillion rupees) and Sampath Bank (Rs. 1.3 trillion and counting) – along with the diversified financials corporate LOLC (in excess of 1.5 trillion rupees) reported assets exceeding 7.2 trillion rupees on their balance sheets.

And in cumulative terms, the LMD 100’s total assets appreciated by a noteworthy 13 percent to over Rs. 19 trillion.

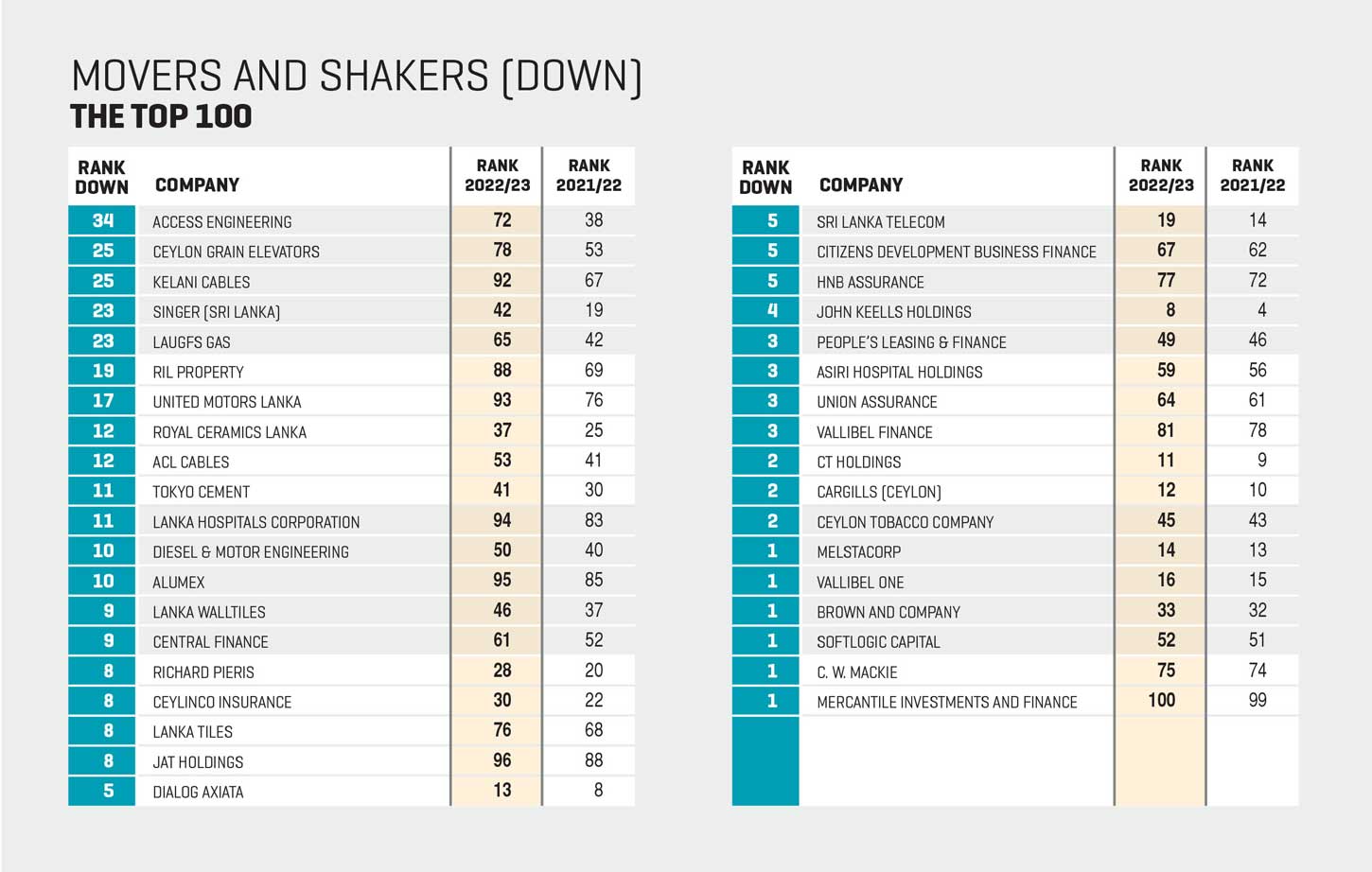

MOVERS AND SHAKERS John Keells Hotels rose in the rankings, progressing from 73rd to 55th in the 2022/23 period, claiming the prime spot in the LMD 100’s most notable movers list.

LOLC Finance improved its ranking from the previous financial year to reach 34th place (from 49), and Dilmah Ceylon Tea Company also made significant progress by rising from No. 79 to 66th in the 2022/23 edition of the LMD 100.

Furthermore, a total of 45 leading listed corporate entities improved their rankings in the 2022/23 edition of the LMD 100.

SECTOR RANKINGS In the period under review, the capital goods sector continued to dominate; it claims the top position with a cumulative turnover exceeding Rs. 1,609 billion.

This represents over 21 percent of the LMD 100’s combined revenue, accounts for around 14 percent of total assets and approximately 23 percent of shareholders’ funds in financial year 2022/23.

Additionally, the capital goods sector contributed 21 percent to the LMD 100’s cumulative profit after tax during the same period.

Following closely, the food, beverage and tobacco sector emerged as the second largest player in the LMD 100, reporting an aggregate income surpassing 1,539 billion rupees. The sector captured a little over a fifth of the top 100’s cumulative revenue in the 12 month period.

And the banking sector made its mark as the third from among 16 sectors represented in the 2022/23 edition of the LMD 100. Its aggregate assets account for more than 45 percent of the LMD 100’s total.

INVESTOR YARDSTICKS Expolanka takes the lead in market capitalisation with a value of nearly Rs. 270 billion at 31 March 2023. Following closely, LOLC Finance captures second place with a market cap surpassing 198 billion rupees on the same date. And in third place is JKH ((almost Rs. 194 billion).

THE FUTURE In November 2023, the Ceylon Chamber of Commerce acknowledged that one of the main challenges faced by Sri Lanka’s economy has been macroeconomic mismanagement.

As part of its budget review, the chamber said a resolute approach must be taken to address past missteps.

Key among the measures introduced is the enforcement of fiscal forbearance in monetary policy through the Central Bank of Sri Lanka Act, and the strengthening of fiscal rules via the Public Finance Management (PFM) Bill.

Moreover, the nation’s most influential chamber noted that these initiatives are foundational for re-establishing effective macroeconomic management.

The chamber also emphasised fiscal discipline and adherence to the IMF’s Extended Fund Facility (EFF) programme targets, recognising them as pivotal for achieving macroeconomic stability.

“The introduction of practical measures such as requiring a Tax Identification Number (TIN) for opening bank accounts, building plan approvals, vehicle registration and land purchases will increase the number of tax files and thus broaden the tax base – [they] are steps towards enhancing tax revenue efficiency,” the chamber added.

At the same time, in its commentary on the budget proposals, Fitch Ratings cautioned that the projected targets will be challenging to meet, even with the economic recovery that is expected to continue next year.

Fitch notes: “The fiscal deficit is set to be wider than our current forecast of 7.1 percent of GDP in 2024 in the light of new data, even after excluding bank recapitalisation costs, and the revenue-GDP ratio will be lower than we had assumed.”

It adds that “the primary surplus goal for 2024, excluding bank recapitalisation, is broadly in line with the 0.8 percent of GDP projected by the IMF in March [2023] when it approved Sri Lanka’s US$ 3 billion Extended Fund Facility (EFF). We also see the revenue target as relatively aligned. However, the government’s expenditure target for 2024, at 22.2 percent of GDP, is somewhat higher than the 19.7 percent the IMF had envisioned and well above the revised budget estimate for 2023.”

As for an international perspective, the IMF’s World Economic Outlook (WEO) published in October 2023 (titled Navigating Global Divergences) highlights in its overview that the global recovery remains slow with growing regional divergences, and little margin for policy error inflation and uncertainty.

It says that the baseline forecast for world economic growth will slow from 3.5 percent in 2022 to three percent in 2023 and 2.9 percent in 2024. Advanced economies are expected to trend down from 2.6 percent in 2022 to 1.5 percent in 2023 and 1.4 percent in 2024, as policy tightening starts to bite.

The WEO says emerging market and developing economies are projected to experience a modest decline in growth from 4.1 percent in 2022 to four percent in both 2023 and 2024. Global inflation is forecast to decline steadily, from 8.7 percent in 2022 to 6.9 percent in 2023 and 5.8 percent in 2024, due to tighter monetary policy aided by lower international commodity prices.

Core inflation is also projected to decline more gradually and inflation is not expected to return to target until 2025 in most cases. The report says: “Monetary policy actions and frameworks are key at the current juncture to keep inflation expectations anchored.”