ECONOMIC SPOTLIGHT | 2022/23

TRANSITION FROM TURBULENCE

Sri Lanka must not only stabilise its economy but also address

long-standing structural problems – policy think tank

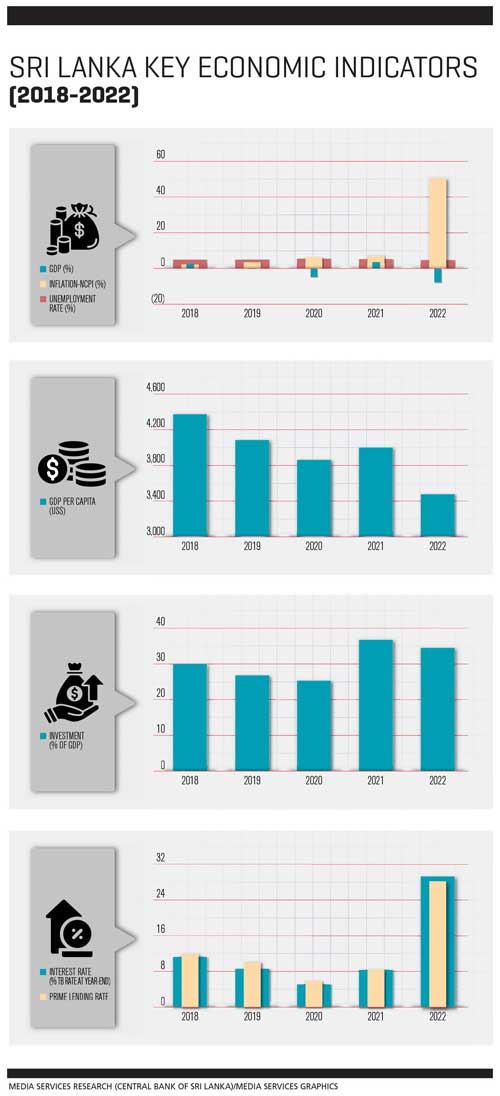

Sri Lanka’s economy registered its deepest economic contraction since independence, mainly driven by the ripple effects of the unprecedented economic crisis amid the domestic and global headwinds that reversed the post-pandemic recovery, according to the Central Bank of Sri Lanka.

According to provisional estimates provided by the Department of Census and Statistics, real GDP witnessed a substantial contraction of 7.8 percent in 2022 – a notable downturn compared to the 3.5 percent growth recorded in 2021.

Sri Lanka needs to implement structural benchmarks and meet quantitative performance criteria under the International Monetary Fund programme

Asian Development Outlook (ADB)

Persistent macroeconomic vulnerabilities characterised by deeply ingrained twin deficits stemming from prolonged budgetary shortfalls and external current account imbalances exacerbated throughout 2022.

These challenges were a result of delayed policy interventions to address the imbalances – and they were compounded by untimely and inadequately executed reforms in taxation and agricultural policies in recent years.

The Central Bank asserts that the implementation of substantial monetary policy tightening measures coupled with other initiatives aimed at mitigating balance of payments pressures proved instrumental in addressing the economic challenges.

Additionally, it notes that the adoption of unprecedented fiscal reforms – including changes in taxation, adjustments to utility rates and the introduction of a fuel rationing system among other measures – played a crucial role.

SERVICES In calendar year 2022, the Central Bank notes that despite the resilient performance of the services sector during the first quarter, which was buoyed by the gradual normalisation of post-pandemic activity, subsequent economic headwinds impeded further sectoral expansion. This culminated in an overall contraction of two percent year on year of the services sector.

INDUSTRY Year 2022 witnessed a 16 percent contraction in the industry sector, which was primarily attributed to the subdued performance of the construction and manufacturing subsectors.

This downturn was exacerbated by severe shortages in raw materials and escalating input costs. The sector faced additional challenges arising from the energy crisis and tighter monetary conditions, further impacting its performance. The construction subsector experienced a substantial contraction of almost 21 percent.

And simultaneously, manufacturing activities slowed down by 12.6 percent during the year.

These factors collectively contributed to the industry sector’s downtrend in 2022.

AGRICULTURE The agriculture sector, which has grappled with lacklustre performances since 2019, contracted by 4.6 percent compared to the previous year.

This was primarily attributed to shortages in chemical fertilisers and other agrochemicals, the higher cost of raw materials and disruptions in supply networks.

Several subsectors within the agriculture sector contributed to this decline – including the growing of rice, tea and vegetables; animal production; marine fishing and aquaculture.

INFLATION During the nine months ended September 2022, headline inflation underwent rapid acceleration, driven by price pressures emanating from various fronts.

Factors contributing to this surge included price hikes in the food, energy and transport sectors, with spillover effects from supply disruptions and a sharp depreciation of the Sri Lankan Rupee among other influences.

Accordingly, headline inflation – measured by the Colombo Consumer Price Index (CCPI) – spiked from 12.1 percent at the end of 2021 to 69.8 percent in September 2022. Subsequently, there was a moderation of the CCPI to 57.2 percent by the end of the calendar year.

The country’s overemphasis on infrastructure investment with borrowed funds needs to shift towards enhancing global competitiveness in exports

State of the Economy 2023 (IPS)

VIEWPOINTS The Asian Development Outlook (ADO) 2023 update in September 2023 highlighted the fact that Sri Lanka’s economy faced a contraction in the first quarter of the year, primarily driven by the industry and services sectors.

The Asian Development Bank (ADB) maintained its earlier forecast, indicating that the economy would remain in recession throughout 2023.

Despite the challenges however, there are optimistic signals for a modest recovery in 2024. The ADB noted that improvements in supply conditions, a rise in official international reserves, and the anticipated boost in consumer and investor confidence – especially with the implementation of the IMF programme – are expected to contribute to an economic recovery.

Meanwhile, parliament approved a framework to optimise domestic debt in July 2023. The ADO adds that “Sri Lanka needs to implement structural benchmarks and meet quantitative performance criteria under the International Monetary Fund programme, and ensure the timely completion of debt restructuring. Adverse weather could have a prolonged impact on agriculture. Also, outward labour migration, particularly by highly skilled workers, may constrain a recovery.”

The IMF reached a staff-level agreement with local authorities under an economic reform programme supported by a 48 month Extended Fund Facility (EFF). The arrangement was approved by the IMF’s Executive Board for a total sum of US$ 3 billion.

An IMF press release states: “The economy is showing tentative signs of stabilisation. Inflation is down from a peak of 70 percent in September 2022 to 1.3 percent in September 2023, gross international reserves increased by US$ 1.5 billion during March-June this year and shortages of essentials have eased”.

The statement cautions that despite these early signs of stabilisation, a full economic recovery is not yet assured. Growth momentum remains subdued with real GDP in the second quarter contracting by 3.1 percent on a year on year basis and high-frequency economic indicators continuing to provide mixed signals.

FISCAL AFFAIRS The Mid-Year Fiscal Position Report 2023 published by the Ministry of Finance and Mass Media states that positive signs in the economy can be witnessed in terms of the deceleration of inflationary pressures, enhanced foreign currency inflows through remittances and tourism earnings, an appreciation of the Sri Lankan Rupee, an increase in foreign currency reserves and the gradual dissipation of the adverse economic shocks witnessed in 2022 – including long queues for essential commodities, power disruptions, and social and political unrest.

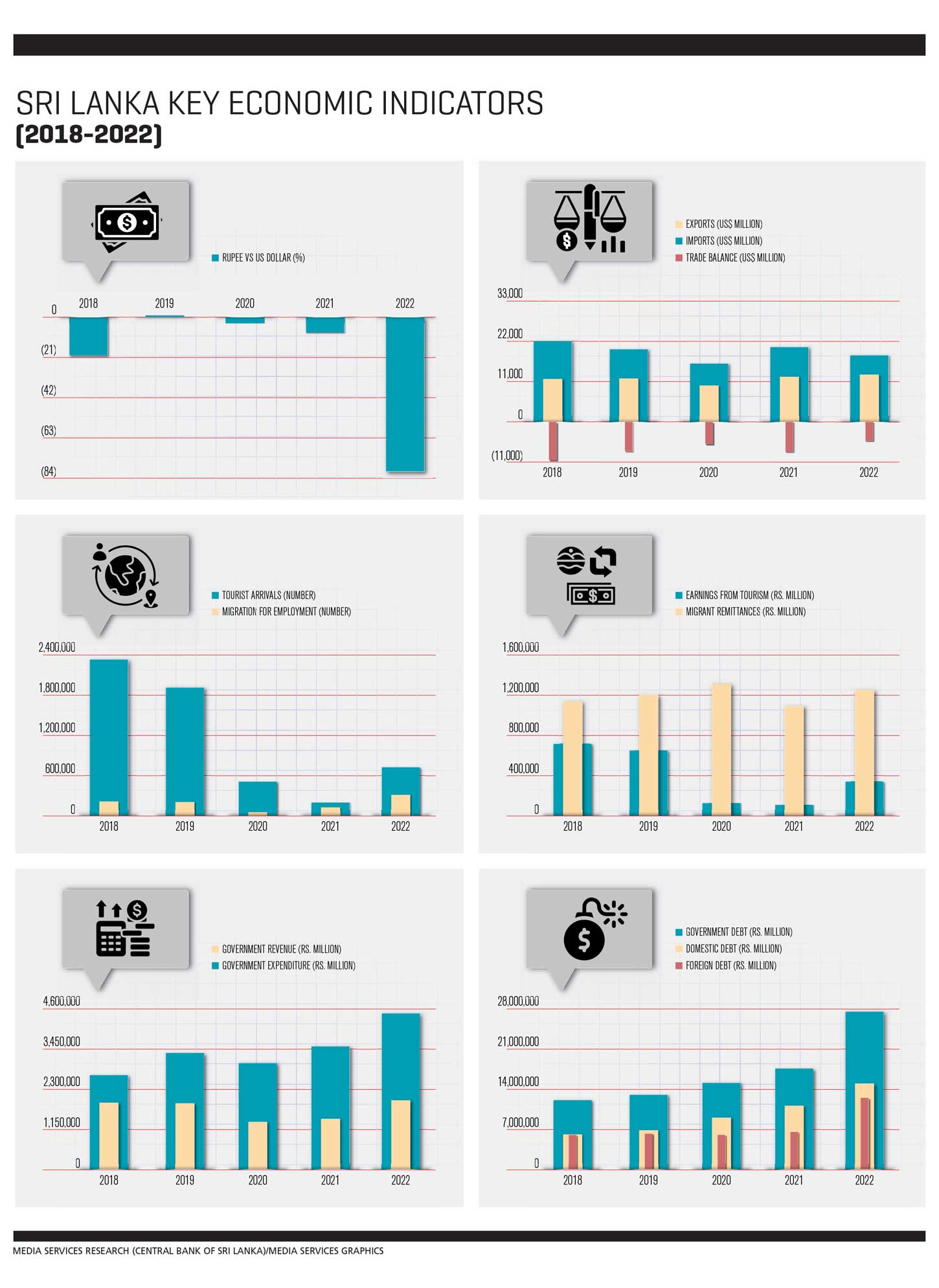

According to the report, positive developments in the external sector have led to a sharp appreciation of the rupee with an impressive 17.6 percent increase against the US Dollar recorded up to 28 June 2023.

However, despite this positive development, there have been challenges in export earnings, which experienced a notable decline of 7.7 percent in the first five months of 2023, it adds.

This decline was attributable to various factors including a fall in earnings from industrial exports such as textile and garments, rubber products, and food, beverage and tobacco, as well as petroleum products.

Subdued global demand and a shift in consumption patterns towards the services sector have also contributed to the decline in export earnings.

Similarly, there’s been a notable contraction in expenditure on imports, which recorded a substantial decline of US$ 2,010 million, reducing to 6,791 million dollars in the first five months of 2023.

This simultaneous reduction of both imports and exports contributed to narrowing the trade deficit, which amounted to US$ 1,925 million during this period.

In the first five months of calendar year 2023, workers’ remittances recorded substantial growth of over 75 percent, mainly due to a notable rise in forex inflows. This was primarily driven by a surge in the migration of Sri Lankan workers – particularly since the latter part of 2022.

Earnings from tourism exhibited a robust increase, rising by more than 30 percent to US$ 828 million between January and May 2023. This growth reflects the ongoing recovery in global tourism, with tourist arrivals reaching 524,486 during this term compared to 378,521 in the corresponding period of 2022.

Meanwhile, gross official reserves (inclusive of a swap facility of 1.4 billion dollars from the People’s Bank of China) stood at a noteworthy US$ 3.5 billion. And the rupee strengthened by 17.6 percent against the dollar at the end of June 2023.

In his column tiled Path to Recovery in the March 2023 edition of LMD, columnist Shiran Fernando outlined the challenges facing the local economy in the year ahead: “Sri Lanka has endured poor economic growth for more than a few years – and 2022 is expected to record the worst GDP contraction in its history. The economy contracted by 7.1 percent in the first nine months of 2022 with the full year’s figure expected to be between eight and nine percent.”

He continued: “In 2022, most businesses were either in a ‘watch and wait’ situation or survival mode as the macroeconomic environment worsened, and interest rates shot up to 30 percent since the investment climate wasn’t favourable due to uncertainty surrounding the political situation.”

“As a result, investment was a key drag on growth with government spending on infrastructure slowing down. This applied to the private sector as well. This trend can reverse in 2023 if dual factors come into play,”

He added: “While exports and investment should be the key drivers of long-term sustainable growth, consumption in the near term will be a key factor given that household consumption accounts for 60-65 percent of GDP. With increases in the cost of living, aggregate demand declined and consumption fell in 2022. However, the falls in the second and third quarters of last year (2022) were not as steep as the overall decline in GDP, highlighting a more resilient consumer sentiment than one would think.”

Fernando reiterated that 2023 will see fresh challenges for consumers with the revised tax regime kicking in, although it probably wouldn’t be as steep as most are expecting it to be. This is due to the fact that less than 15 percent of the working population will pay direct taxes such as pay as you earn (PAYE) or income tax.

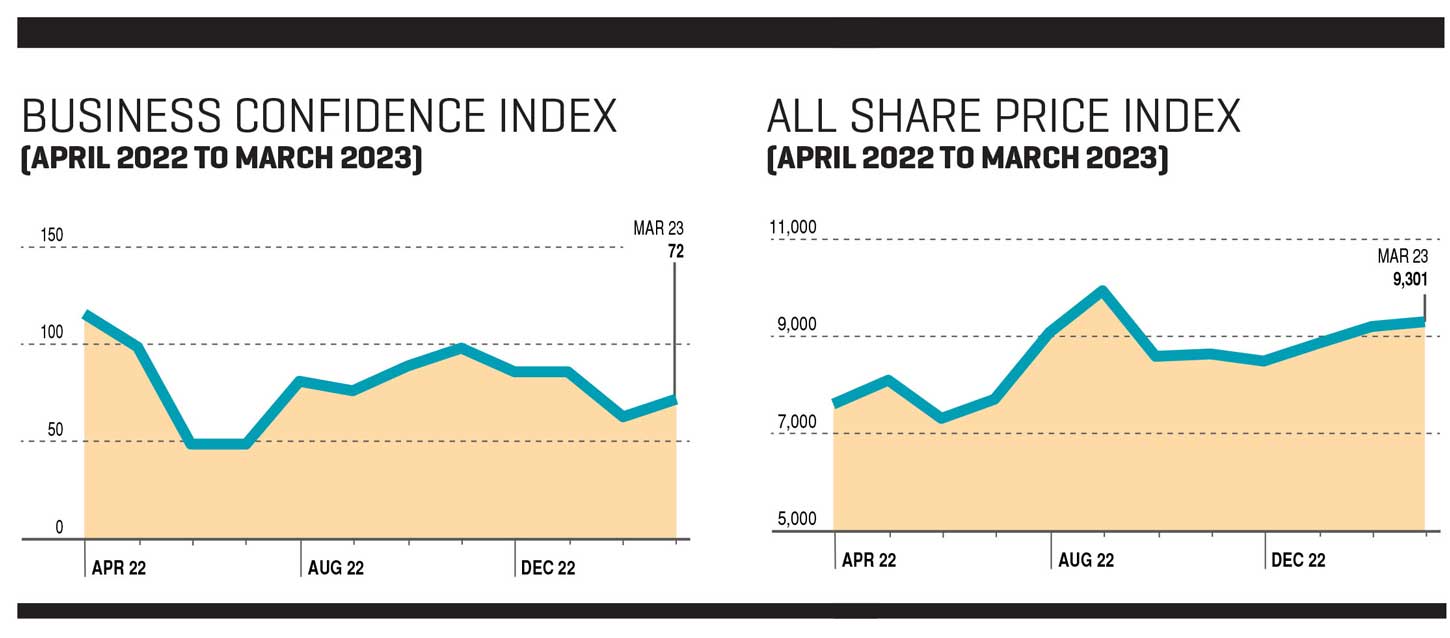

BIZ CONFIDENCE The LMD-NielsenIQ Business Confidence Index (BCI) – which will be the LMD/PEPPERCUBE Business Confidence Index from December 2023 – witnessed a shift in sentiment towards the conclusion of 2022 with the exclusive barometer falling by 12 basis points in December to settle at 86.

But by March 2023 – which marked the end of the financial year under review – the unique index witnessed a further decrease to 63 due to the economic crisis, the tax regime and an electricity tariff hike, reflecting the lack of confidence among the business community at the time.

POLICY REVIEW The State of the Economy 2022 publication released by the Institute of Policy Studies (IPS) in October 2023 focusses on ‘Economic Policy Choices: From Stabilisation to Growth,’ and highlights the country’s recovery from the worst macroeconomic policy deployment in its history.

The report notes that for 2023, the IMF predicts a contraction of three percent while the Central Bank holds a more optimistic view with a two percent shrinkage in GDP. Both anticipate a return to growth in 2024 but uncertainties linger due to social and political opposition to austerity policies, ongoing debt negotiations and volatile global economic conditions driven by geopolitical tensions.

Furthermore, the annual publication asserts that “to achieve sustainable economic growth, Sri Lanka must not only stabilise its economy but also address longstanding structural problems. The country’s overemphasis on infrastructure investment with borrowed funds needs to shift towards enhancing global competitiveness in exports.”