PREFACE

STAYING POWER PREVAILS

Prospering in adversity is the hallmark of LMD 100 corporates in 2021/22

Financial year 2021/22 will perhaps be revisited with a measure of nostalgia despite a third wave of the COVID-19 virus with a fresh variant (and ensuing lockdowns and quarantine curfews), and the social and economic upheaval that followed – none of which are conducive to business development and growth.

Transparency International’s 2021 Corruption Perceptions Index (CPI) places Sri Lanka in the No. 102 spot from among 180 countries and territories with a score of 37 out of 100 – on a scale of 0 (‘highly corrupt’) to 100 (‘very clean’). This rating has dropped eight places from where the nation stood back in 2020.

The CPI reflects perceived levels of public sector corruption according to experts and businesspeople. And it states that “this year, the global average remains unchanged for the 10th year in a row, at only 43 out of a possible 100 points. Despite multiple commitments, 131 countries have made no significant progress against corruption in the last decade.”

“Two-thirds of countries score below 50, indicating that they have serious corruption problems while 27 countries are at their lowest score ever,” it points out, in an observation that does not bode well for economies worldwide.

The agency goes on to say that “this is no coincidence. Corruption enables human rights abuses. Conversely, ensuring basic rights and freedoms means there is less space for corruption to go unchallenged. The 2021 CPI results show that countries with well-protected civil and political liberties generally control corruption better. The fundamental freedoms of association and expression are crucial in the fight for a world free of corruption.”

Meanwhile, the South Asia Economic Focus Fall 2022 report titled ‘Coping with Shocks: Migration and the Road to Resilience’ compiled by the World Bank states: “Sri Lanka faces an unsustainable debt and severe balance of payments crisis, which is having a negative impact on growth and poverty.”

It adds: “The fluid political situation and heightened fiscal, external and financial sector imbalances pose significant uncertainty for the outlook. Debt restructuring and the implementation of a deep structural reform program are critical for economic stabilisation. The crisis is expected to increase poverty substantially, making mitigation efforts a key priority.”

As observed in the report’s outlook mitigating the impacts on the poor and vulnerable remains critical, and reductions in poverty will require an expansion of employment in industry and services, and a recovery in the real value of incomes.

On the upside, the report says, a credible reform programme supported by financing from international partners could enhance confidence and attract fresh capital inflows.

In this latest edition of the LMD 100, Expolanka Holdings takes the top spot from Hayleys, which drops to second place in financial year 2021/22 – kudos to the former’s astounding consolidated revenue in excess of Rs. 694 billion.

Hayleys, which steps down to second place, recorded a bottom line of a little over 28 billion rupees in the period under review and a turnover of Rs. 338 billion. The conglomerate was the fifth most profitable with a profit after tax (PAT) of slightly over 28 billion rupees.

Meanwhile, LOLC Holdings (LOLC) – third once more on the LMD 100 Leaderboard – also holds on to its No. 1 slot for profitability, having recorded a post-tax profit in excess of Rs. 77 billion.

As for market capitalisation, which is also a prime indicator of corporate might, Expolanka Holdings takes first place with an equity value in excess of 400 billion rupees at 31 March 2021.

Fourteen LMD 100 corporations reported earnings in excess of Rs. 100 billion in financial year 2021/22 while five corporates among the 100 leading listed companies recorded losses.

In the 2021/22 edition of the nation’s pioneering listed company rankings, as many as 69 companies (60 in the prior year) recorded annual revenues between Rs. 10 billion and 100 billion rupees. In terms of bottom lines, 20 entities enjoyed a PAT of over 10 billion rupees.

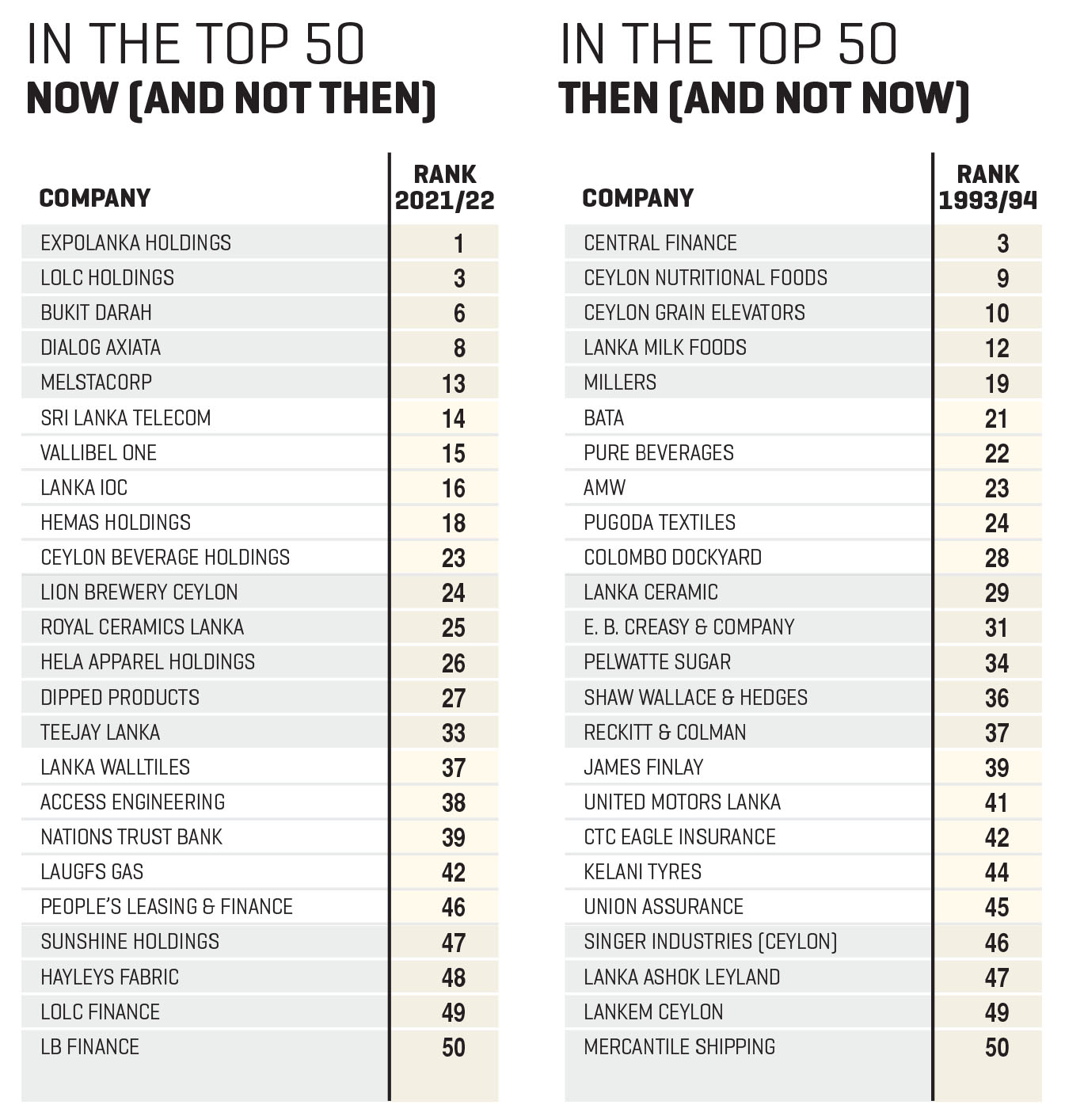

LMD’s pioneering rankings were first published 29 years ago in 1993/94 as The LMD 50. Twenty-four entities, which made an appearance in that first edition of the top 50, do not feature in the current iteration.

An equal number of corporates make an appearance in this edition of the LMD 100’s top 50 but were not in contention at the inception of the rankings – including the 2021/22 champion Expolanka Holdings and diversified conglomerate LOLC, which sits in third place on the coveted Leaderboard.

Aggregate revenue of the 100 leading listed entities has grown by 36 percent in the latest rankings whereas their combined bottom line increased by as much as 110 percent. To allow a sense of perspective, back in 1993/94, cumulative revenue rose by 20 percent year on year while profits spiked by 60 percent.