PRE POLICY-ANALYSIS

Pre Policy-Analysis

“Rates to be maintained paving way for future cut…”

First Capital Research – Mar 2023

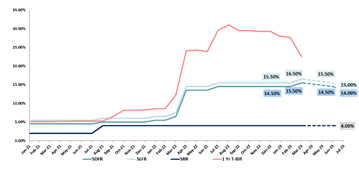

In a surprise move, CBSL raised the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 100bps to 15.50% and 16.50%, respectively at the monetary policy review on 3rd March 2023. The surprise move to raise policy rates by CBSL was done mainly in-order to fulfill all the prior actions to move forward and finalize the IMF Extended Fund Facility (EFF) arrangement, which was later signed on 21st March 2023. CBSL believes the latest move to raise rates will aid to lower the spread between policy interest rates and high market interest rates.

Key Arguments considered by CBSL for its policy stance on 3rd Mar-23

- To fulfill the necessary criteria to sign the board level agreement for the IMF EFF agreement.

- To lower the spread between policy interest rates and high market interest rates.

- To reduce the risk premia of yields on government securities.

- Enable faster reduction of inflation and to bring the targeted 2023E inflation between 4%-6%.

Arguments for relaxation in monetary policy

Facilitate a faster recovery of the economy

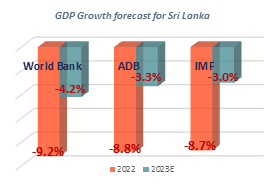

Sri Lankan GDP steeply contracted in 4Q2022 by 12.4% (cf. -11.8% in 3Q2022 and +1.4% in 4Q2021), which is the steepest contraction witnessed since 2Q2020 (affected by Covid-19 and lockdowns). The degrowth was largely attributed to the poor performance of the industrial (-30.1%) and services (-3.9%) subsegments. Moreover, inline with the GDP performance, earnings of the listed corporates were impacted during the quarter due to higher taxes and interest expenses. Meanwhile, Purchasing Manager Index (PMI) contracted in Feb-23 driven by subdued performance observed in New Orders, Production, Employment and Stock of Purchases. The decline in New Orders and Production was mainly driven by subdued demand observed in the manufacture of food & beverages, and textile & wearing apparel sectors. Furthermore, services sector PMI also contracted during Feb-23, driven by the declines observed in New Businesses, Business Activities, Employment and Backlogs of Work. With the deterioration in economic indicators, Sri Lanka’s economic growth outlook for 2023 on a global point of view too remains bleak with the World Bank forecasting a contraction of -4.2%, ADB forecasting a degrowth of -3.3% while IMF forecast stands at -3.0%. Hence, a monetary stimulus induced spending in the economy is appropriate to build economic strength.

Successful signing of the IMF- EFF board level agreement

On 21st Mar 2023, IMF Board approved a 48-month extended arrangement under the Extended Fund Facility (EFF) of SDR 2.286Bn (about USD 3.0Bn) to support Sri Lanka’s economic policies and reforms. The signing of the board level agreement also enabled Sri Lanka to receive its 1st tranche of SDR 254.0Mn (c.USD 333.0Mn). The EFF-supported program aims to restore Sri Lanka’s macroeconomic stability and debt sustainability, mitigate the economic impact on the poor and vulnerable, safeguard financial sector stability, and strengthen governance and growth potential. Moreover, signing of the IMF deal is also expected to improve the investor confidence on Sri Lanka, which we believe may improve investments to capital markets. The improved investments is expected to accelerate the decline in government security yields, which we believe will provide the platform for a possible policy rate cut.

Strengthening reserves position and stable currency

Sri Lanka’s reserve position improved to USD 2.2Bn in Feb-23 from USD 2.1Bn in Jan-23 and USD 1.9Bn in Dec-22. Despite the decline in exports below USD 1.0Bn for the second consecutive month, trade deficit reported a decline of 72.6%YoY to USD 449.0Mn whilst balance of payment reported a positive USD 317.0Mn cf. negative USD 1,697.0Mn with the turnaround largely stemming from the reduced trade deficit, increase in earnings from tourism (+3.3%YoY to USD 332.0Mn) and higher remittances (+82.0%YoY to USD 845.0Mn). Reserves are expected to register a substantial boost in Mar-23, with CBSL purchasing c. USD 900Mn absorbing the significant inflows into the economy following the confirmation of dates of the IMF board level approval. Further support followed with the IMF disbursing its 1st tranche of USD 333.0Mn of which the Govt. decided to settle India with USD 121.0Mn. Foreign reserves for Mar-23 is estimated to have crossed USD 3.0Bn mark while further inflows are expected from multi-lateral lenders (USD 7.0Bn inflows from ADB and WB promised between 2023E-2027E), fast recovery of the tourism sector (expected to reach USD 1.9Bn in 2023E from USD 1.1Bn in 2022), and steady inflows from remittances (USD 5.4Bn in 2023E cf. USD3.8Bn in 2022). The continued fast-tracked strengthening of the foreign reserves and stability of the currency provides reasonable leeway to ease monetary policy.

Restart private sector credit growth and improve business confidence

Private sector credit slid low for the 8th consecutive month in Jan-22 and recorded at LKR 7,318.0Bn compared to LKR 7,414.1Bn in the month of Dec-22. Sharp escalation in lending rates, restriction on imports and conservative lending stance in banks due to elevated impairment provisions have collectively discouraged the demand for credit resulting in a persistent downfall. Given the consecutive months of decline in private sector credit and the requirement to facilitate the expansion of the private sector contribution to national economy, we believe a downward adjustment in interest rates is a necessary action, to induce demand for private sector credit and restore financial stability within the banking system.

Inflation to record a faster decline

Inflation measured by the CCPI inflation recorded a further decline in the month of Mar-23 to 50.3% cf. 50.6% in Feb-23, inline with FCR expectations. The decline in inflation during the concerned period was largely as a result of the decline in food commodity prices (47.6% in Mar-23 cf. 54.4% in Feb-23) whilst non-food inflation ticked up to 51.7% cf. 48.8% in Feb-23 largely on the back of the steep adjustment in electricity tariff, which came into effect on 15th Feb 2023. Meanwhile, going forward we expect inflation to continue its disinflationary path benefitted by significantly high base effect in 2022, reduction of fuel prices, normalizing of global commodity prices and plunge in freight rates to below pre-pandemic levels. FCR expects inflation to tone down to c.16% by Jun-23 and c.10% by end of 2023. Given the consecutive decline in YoY inflation amidst no pressure from demand side, we believe a policy rate cut could pave way for monetary stimulus and enable a faster recovery of the economy.

Arguments against relaxation in monetary

Policy

100bps Policy rate hike in Feb-23, a deterrent for immediate relaxation in policy rates

In an effort to push forward the board level approval with IMF, CBSL raised policy rates during the previous monetary policy review by 100bps. The dominant factor resulting in the hike was to reduce the spread between policy interest rates and high market interest rates. With ambitious target of bringing down inflation to a range of 4.0%-6.0% by end of 2023E, CBSL may maintain policy rates at the current levels. Moreover, having raised policy rates during the previous review, a move to reduce policy rates during the next policy review is unlikely due to the sensitiveness of the economy. Moreover, the Government has also indicated that Sri Lanka may relax imports in the coming months (fully open economy by Jun-23), resulting in CBSL potentially taking a conservative stance to indirectly manage imports and reserve the country’s liquidity position.

Continues protests and delicate political condition

Local Government elections which has been postponed continuously, has yet again been postponed indefinitely after calling off the decision to conduct it on 25th Apr 2023 citing inadequate funds as the reason for the delay. The delay in elections coupled with severe taxes, substantial increase in electricity tariff and possible privatization of seven state-owned enterprises including much debated petroleum industry, Sri Lanka Telecom and Lanka Hospitals have prompted several protests around the country. Therefore, times of such uncertainty and unrest shall not welcome any significant changes in the monetary policy, hence discourages the possibility of a relaxation in rates.

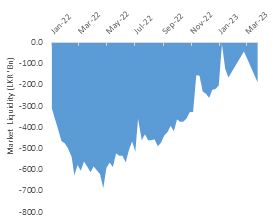

Overall system liquidity continues to remain negative

Overnight liquidity continued to display significant volatility during the month of Mar-23 as overall liquidity position continued to swing back and forth from positive to negative amidst liquidity injections from CBSL via Repo and Term Repo transactions. Since the last monetary policy review, overall banking sector liquidity has declined to LKR 27.4Bn cf. LKR 135.9Bn. Hence, it may not be suitable to relax policy rates at this juncture since it may result in a disequilibrium of demand and supply, which shall further aggravate financial instability in the economy.

Risk premia between bills and bonds continue remain wide amongst DDR concerns

Despite the continuous efforts by CBSL to bring down the risk premia in government securities, including surprise policy rates hike, and improving overnight liquidity through REPO and Reverse Repo injections, CBSL have failed to bring down high yields of government securities specifically in the mid tenor maturities due to concerns regarding domestic debt restructuring. However, following the creditor meeting last week similar to the longer tenors, the shorter tenors, specifically Treasury bills recorded the drastic plunge in yields with the indication of excluding the DDR process as only the CBSL holdings were targeted to be subjected to DDR. However, given the current uncertainty prevailing in the government securities market in relation to the most liquid mid tenor maturities, we believe the CBSL may adapt a wait and see approach at the upcoming policy review to push down the risk premia between policy rates and bonds in line with the request of the IMF.

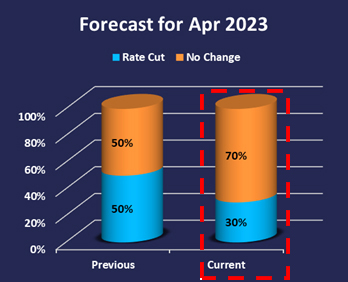

FCR Policy Rate Forecast

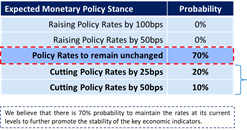

We believe that CBSL may consider maintaining the monetary policy rates at its current levels in the upcoming policy review meeting allowing a soft landing from its hawkish to dovish stance. However, considering both arguments for and against monetary easing, we have assigned a 70% probability for policy rates to be maintained at the current rates whilst 30% is allocated for a relaxation of policy rates.

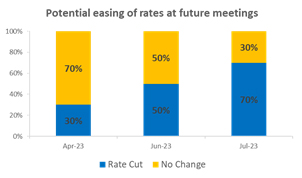

Having signed the IMF deal in mid Mar-23, Sri Lanka has been already promised with USD 7.0Bn of funds by the IMF, WB and ADB between 2023-2027. However, as per the IMF and with debt restructuring in play, Sri Lanka will on be accessing the global capital market in the year 2027. Thereby, with economic indicators stabilizing and economy projected to recover during 2H2023 with a drastic slow down of inflation 2Q2023 onwards, we believe a sizeable monetary relaxation may be required in the latter part of 2Q2023 with a view to stimulate economic growth and accelerate the decline with interest rates.

Expected Monetary Policy Stance

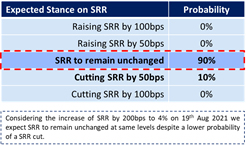

As per our view, at the upcoming policy meeting, there is a 70% possibility for CBSL to maintain the rates at its current levels allowing further strengthening of key economic indicators. Moreover, there is a 20% possibility to relax its policy rates by 25bps and a 10% probability for a rate cut of 50bps in order to prevent a major economic downturn as well as to signal the market participants a clear direction on the way forward. Moreover, considering the persistent improvement in liquidity in the banking system, we assigned a higher probability of 90% on the SRR to remain unchanged.