MONETARY POLICY

INFLATION PROJECTIONS AND CREDIBILITY

Shiran Fernando discusses the scope of inflation targeting and expectations

The new Central Bank of Sri Lanka Act No. 16 of 2023 has introduced more insights into the development of monetary policy in this country. Legislation governing the monetary authority changed in September last year when the Monetary Law Act of 1949 was repealed. The main aims of the new law are to introduce a flexible inflation targeting framework and implement a flexible exchange rate.

Under this framework, the Central Bank of Sri Lanka and minister of finance have agreed on a five percent quarterly headline inflation target for the Colombo Consumer Price Index (CCPI).

The governing structure of the Central Bank has also changed with two main boards managing it instead of the previously singular monetary board. So the governing board oversees the administration of the Central Bank while the monetary board is responsible for formulating monetary policy.

MONETARY POLICY Under the new framework, the Central Bank has to publish a report biannually, explaining the movement of inflation together with projections. This will provide a better understanding of monetary policy decisions, and offer guidance to the market and public regarding the outlook. The last report was released in February.

Currently, the Central Bank is easing its monetary policy cycle with reductions made in policy rates since the second half of 2023. And thanks to the gradual disinflationary trend since last year, compared to the record highs of 2022, there is space to reduce interest rates.

However, heading into 2024 with changes in taxation – namely VAT – the concern is that inflation will remain above the targeted level in the short term. The Central Bank expects inflation to exceed these targets before reducing to expected levels in the medium term.

The regulator expects inflation to peak in the third quarter of this year due to changes in the tax regime and the base effects of the slowdown in inflation during the same period in 2023. But the report highlights the reality that due to weak demand, the economy will continue to operate below capacity in the absence of a demand side impact on inflation.

What’s more, the Central Bank also captures the corporate sector’s inflation expectations, which have assumed an upward trend since the beginning of this year but will ease towards the end of 2024.

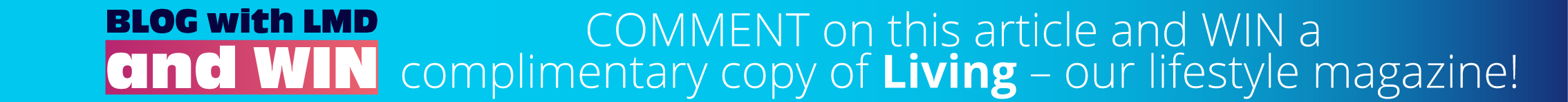

POLICY RATES The current downward movement in policy rates translates into a decline in market rates. For example, the 12 month Treasury bill yield in the primary market fell to 10 percent in late February from 12.9 percent at the end of 2023.

A slowdown was observed for three and six month Treasury bills, which fell by over four percent in the same period. According to the Central Bank, the decline in market rates will help stimulate investments and consumer spending, which could boost demand.

A counterbalance to this is the continued path of tight fiscal policy by raising more tax revenue and the expected recapitalisation of selected banks. In the first 11 months of 2023, Sri Lanka was able to turn a primary balance – i.e. the budget deficit, less interest expenditure – compared to deficits in the past few years.

This change in fiscal position is helping the government to maintain surplus cash flows to meet domestic debt repayments. The borrowing requirements of the Central Bank at Treasury bill and bond auctions have reduced in recent months, and helped ease monetary policy with lower interest rates.

RISK FACTORS The Central Bank has identified risks that may affect its projections for growth and inflation. Export risks due to the slowdown in global demand of key trading partners are a priority, given ongoing global conflicts.

The regulator also cited labour shortages and a decline in productivity due to skilled migration as further reasons for industry and services growth being tepid. There is also concern about the impact of climate change on agriculture.

Some positive factors that could tilt growth upward include the faster recovery of the tourism industry, an improvement in industries such as construction and an increase in activity at the Port City Colombo.

Underpinning all of this is the assumption that the IMF programme will continue along with the necessary structural reforms.

The risks regarding projections consider factors that could lead to higher or lower inflation. A sustained increase could revolve around the second round of impacts of the recent VAT amendments.

And the impact of adverse climatic conditions on agriculture could influence the food supply chain and put pressure on prices. Uncertainties surrounding geopolitical tensions also pose risks for key commodities such as food and oil, which Sri Lanka imports.

BETTER OUTREACH The success of countries that adopted inflation targeting revolves around anchoring inflationary expectations to the market and public, by building credibility and confidence in the projections.

Publications such as the Central Bank’s biannual report will help communicate realities better. More outreach to the public and market will be required to anchor these expectations as Sri Lanka’s forward journey continues.

Leave a comment