MUTED GROWTH PROSPECTS

Shiran Fernando notes that expectations are less than optimistic for the global economy

The global economy, which was impacted by COVID-19, has been resilient in the last two years. And as the world enters a third year of the pandemic, expectations are less optimistic since new variants have spread rapidly.

Although these aren’t as deadly as previous strains, they’re causing disruptions to the global economic recovery and normalisation of supply chains.

Let’s explore some of the key economic trends that could play out in the 12 months ahead.

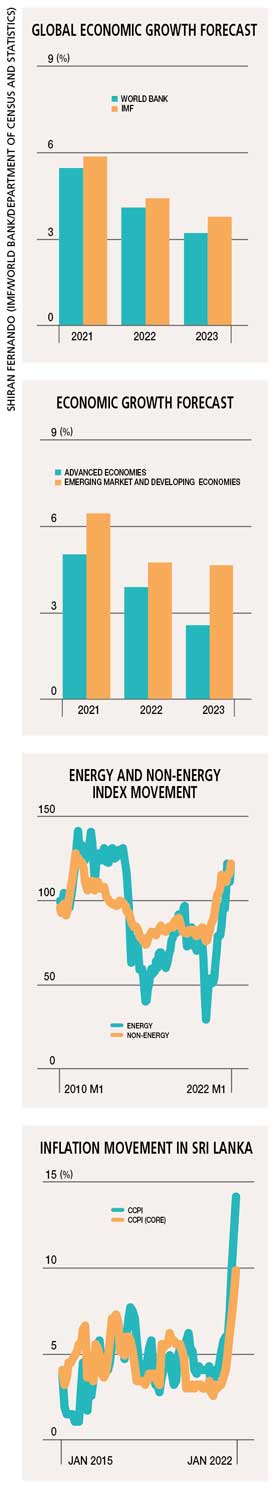

GLOBAL GROWTH According to the IMF, global growth is expected to reduce from 5.9 percent in 2021 to 4.4 percent in 2022 – i.e. 0.5 percent lower than the forecast in October 2021. Meanwhile, the World Bank is expecting global growth to be around 4.1 percent this year.

GLOBAL GROWTH According to the IMF, global growth is expected to reduce from 5.9 percent in 2021 to 4.4 percent in 2022 – i.e. 0.5 percent lower than the forecast in October 2021. Meanwhile, the World Bank is expecting global growth to be around 4.1 percent this year.

And growth is expected to slow down further in 2023, to 3.3 percent and 3.8 percent, according to the World Bank and International Monetary Fund respectively.

A slowdown in global growth is driven by advanced, as well as developing and emerging economies, slowing down in growth relative to 2021. Countries such as the US and China, and regions like the EU, are also following this trend.

The IMF revised its projection for the US down by 1.2 percent in January, citing supply shortages, faster than expected changes in monetary policy and the minor impact from the ‘Build Back Better’ fiscal package.

A similar downgrade was seen for China as well, reflecting a slowdown due to lockdowns and financial stresses in the property market.

INFLATION OUTLOOK Most economic forecasters felt there would be inflationary pressures in the economic rebound period; but the forecast was for this to be transitory rather than long term.

In 2021 however, there was a surge in prices of most global commodities such as oil and food, adding to inflationary pressures the world over.

Commodity prices have also risen due to an increase in demand as well as supply chain disruptions owing to the pandemic. This has resulted in most import dependent economies importing inflation at higher prices.

This was the case in most countries – with the US recording its highest level of inflation in over 40 years and other nations such as the UK also registering new highs.

The IMF expects inflation to last longer in 2022 than previously forecast. Average inflation in advanced economies is expected to be 3.9 percent while emerging and developing nations will most likely see a rate of 5.9 percent this year.

Supply-demand imbalances should normalise with a shift from consumption of goods to services in the year ahead, and 2023 may see inflation easing further.

FOCUS ON SRI LANKA Global inflation movements will be important as Sri Lanka navigates double digit inflation.

Late last year, the surge in inflation – due to a mix of imported inflation together with higher fuel and food prices – resulted in continuous month on month growth.

With food supply constraints prevailing due to the fertiliser crisis, Sri Lanka is importing items such as rice to compensate. As such, the global movement in these indices will matter in containing inflationary pressures.

Exporters will also need to reconsider their pricing, depending on the movement of prices in source markets. Commodities such as tea and rubber may also fetch higher prices, depending on demand and the ability to absorb higher costs.

In 2021, exporters saw higher exports of most items due to demand, and increased volumes and unit prices. However, oil price movements will probably be a greater factor in Sri Lanka’s price pendulum. As predicted by some forecasters, oil will cost more than US$ 100 a barrel in 2022 although others feel it will hover around current levels. Given Sri Lanka’s foreign exchange shortage, higher oil prices could make life even harder all round.

INTEREST RATES With the rise in inflation, there’s been pressure on global interest rates to increase too and for there to be a shift in monetary policy.

The US Federal Reserve signalled this last year; but the pace is expected to be much faster now. The European Central Bank (ECB) and other global monetary policy regulators including that of the UK are also expected to raise their rates.

Rapidly fluctuating interest rates are likely to disrupt emerging and developing economies with investors withdrawing funds from risky prospects to safe haven assets such as US Treasury bonds.

This would add pressure on Sri Lanka too and local interest rates may rise. At present, the Central Bank of Sri Lanka has raised rates twice – once in August 2021 and then again in January. Lending rates have also risen by three or four percent in the last six to eight months.

The expectation is for a few more hikes in response to the normalisation of global interest rates to ease demand concerns from hikes in inflation and take pressure off the external side with policy makers keen to hold on to the currency.