LOLC HOLDINGS

Laying claim to being Sri Lanka’s most valuable globally diversified financial conglomerate, the LOLC groupposted a record-breaking performance for the financial year ended 31 March 2021, achieving a colossalRs. 57 billion in profit before taxes. This feat is said to be a first for any corporate in the country – andthat too amid a challenging economic environment. The story of LOLC’s rise to becoming an elite bluechip within a span of four decades could best be described as nothing short of awe-inspiringwith the group surpassing competitors that have been in existence for over a century.

Laying claim to being Sri Lanka’s most valuable globally diversified financial conglomerate, the LOLC groupposted a record-breaking performance for the financial year ended 31 March 2021, achieving a colossalRs. 57 billion in profit before taxes. This feat is said to be a first for any corporate in the country – andthat too amid a challenging economic environment. The story of LOLC’s rise to becoming an elite bluechip within a span of four decades could best be described as nothing short of awe-inspiringwith the group surpassing competitors that have been in existence for over a century.

Q: When macroeconomic conditions are not ideal, how can corporates forge ahead?

A: Over the last couple of years, Sri Lanka has experienced an extended period where conditions have not been ideal. In such a climate, companies need to engage in strategic diversification instead of remaining in traditional industries – because if they come under pressure, their profits will shrink.

LOLC has strategically diversified into different industries and across borders, targeting and penetrating markets with faster growing economies than ours, providing us with a competitive edge in overcoming a less than ideal business environment back home.

Q: For corporates looking to build respect overseas, what are the vital pillars?

A: The most vital pillar is a strong operational backbone so that when entering new markets, you can safeguard against large preventable losses.

You need checks and balances, and superior processes, to meet all the new regulatory requirements. A balance also has to be maintained in empowering senior management in these markets.

Sri Lankan corporates certainly have the capacity to penetrate other markets as LOLC’s success in various countries has shown.

Q: How can corporate reputation give businesses a competitive edge?

A: Corporate reputation is critical for companies engaged in banking and financial services as balance sheets rest on reputation, rather than capital and operational capabilities.

Reputation is key – you cannot run a financial services institution or any other business without it, or else you won’t be able to attract or retain customers.

LOLC Holdings is conscious of its reputation, and strives to maintain an impeccable record and a neutral stance on political and controversial issues, which has given it a competitive edge.

Q: Can respect help businesses navigate through the pandemic?

Q: Can respect help businesses navigate through the pandemic?

A: To steer through a pandemic, you need internal and external stakeholders’ confidence, including employees, customers and regulators.

If companies maintain adequate levels of customer service, and operations and quality, they automatically demand respect. This leads to strong employee motivation, building customer confidence and fulfilling regulatory requirements – an approach that has helped LOLC Holdings navigate the pandemic.

Despite the global economic downturn, a pipeline of multilateral and bilateral funding has been available to LOLC and its operating companies, both locally and globally – this is testimony to these institutions’ confidence in the group due to its strong and unblemished track record, and potential for growth even during a turbulent period.

All of LOLC’s businesses recorded upward trends in profitability in the 2020/21 financial year, despite the adverse effects of the COVID-19 pandemic on Sri Lanka’s economy last year coupled with weak GDP growth in 2019.

Q: How can businesses create long-term value for stakeholders?

A: This can be achieved by investing in long-term growth and assets. LOLC Holdings is a long-term business builder, which is why we pursue strategic assets.

Last year, LOLC acquired five hotels that are considered to be among the best properties but will be profitable in 10-15 years. It’s important to invest for the long term while maintaining profitability and financial ratios in the short term.

Q: And how can corporates leverage respect earned during the pandemic?

A: Corporates can take their world-class products and services global. LOLC became a global leader in microfinance within 10 years and takes pride in saying that no other organisation matches our footprint in this sphere.

Through LOLC Holdings’ performance in Cambodia, Myanmar, Indonesia, the Philippines and Pakistan in Asia, as well as Zambia and Nigeria in Africa, it looks to bring prosperity to people at the bottom of the pyramid and serve as an example to corporate Sri Lanka. The group has established a footprint in the Maldives, Mauritius and Sierra Leone in the arena of non-financial services as well.

Laying claim to being Sri Lanka’s most valuable globally diversified financial conglomerate, the LOLC groupposted a record-breaking performance for the financial year ended 31 March 2021, achieving a colossalRs. 57 billion in profit before taxes. This feat is said to be a first for any corporate in the country – andthat too amid a challenging economic environment. The story of LOLC’s rise to becoming an elite bluechip within a span of four decades could best be described as nothing short of awe-inspiringwith the group surpassing competitors that have been in existence for over a century.

Q: When macroeconomic conditions are not ideal, how can corporates forge ahead?

Q: When macroeconomic conditions are not ideal, how can corporates forge ahead?

A: Over the last couple of years, Sri Lanka has experienced an extended period where conditions have not been ideal. In such a cli-mate, companies need to engage in strategic diversification instead of remaining in traditional industries – because if they come under pressure, their profits will shrink.

LOLC has strategically diversified into different industries and across borders, targeting and penetrating markets with faster growing economies than ours, providing us with a competitive edge in overcoming a less than ideal business environment back home.

Q: For corporates looking to build respect overseas, what are the vital pillars?

A: The most vital pillar is a strong operational backbone so that when entering new markets, you can safeguard against large pre-ventable losses.

You need checks and balances, and superior processes, to meet all the new regulatory requirements. A balance also has to be main-tained in empowering senior management in these markets.

Sri Lankan corporates certainly have the capacity to penetrate other markets as LOLC’s success in various countries has shown.

Q: How can corporate reputation give businesses a competitive edge?

A: Corporate reputation is critical for companies engaged in banking and financial services as balance sheets rest on reputation, ra-ther than capital and operational capabilities.

Reputation is key – you cannot run a financial services institution or any other business without it, or else you won’t be able to at-tract or retain customers.

LOLC Holdings is conscious of its reputation, and strives to maintain an impeccable record and a neutral stance on political and controversial issues, which has given it a competitive edge.

Q: Can respect help businesses navigate through the pandemic?

A: To steer through a pandemic, you need internal and external stakeholders’ confidence, including employees, customers and regu-lators.

If companies maintain adequate levels of customer service, and operations and quality, they automatically demand respect. This leads to strong employee motivation, building customer confidence and fulfilling regulatory requirements – an approach that has helped LOLC Holdings navigate the pandemic.

Despite the global economic downturn, a pipeline of multilateral and bilateral funding has been available to LOLC and its operat-ing companies, both locally and globally – this is testimony to these institutions’ confidence in the group due to its strong and un-blemished track record, and potential for growth even during a turbulent period.

All of LOLC’s businesses recorded upward trends in profitability in the 2020/21 financial year, despite the adverse effects of the COVID-19 pandemic on Sri Lanka’s economy last year coupled with weak GDP growth in 2019.

Q: How can businesses create long-term value for stakeholders?

A: This can be achieved by investing in long-term growth and assets. LOLC Holdings is a long-term business builder, which is why we pursue strategic assets.

Last year, LOLC acquired five hotels that are considered to be among the best properties but will be profitable in 10-15 years. It’s important to invest for the long term while maintaining profitability and financial ratios in the short term.

Q: And how can corporates leverage respect earned during the pandemic?

A: Corporates can take their world-class products and services global. LOLC became a global leader in microfinance within 10 years and takes pride in saying that no other organisation matches our footprint in this sphere.

Through LOLC Holdings’ performance in Cambodia, Myanmar, Indonesia, the Philippines and Pakistan in Asia, as well as Zambia and Nigeria in Africa, it looks to bring prosperity to people at the bottom of the pyramid and serve as an example to corporate Sri Lanka. The group has established a footprint in the Maldives, Mauritius and Sierra Leone in the arena of non-financial services as well.

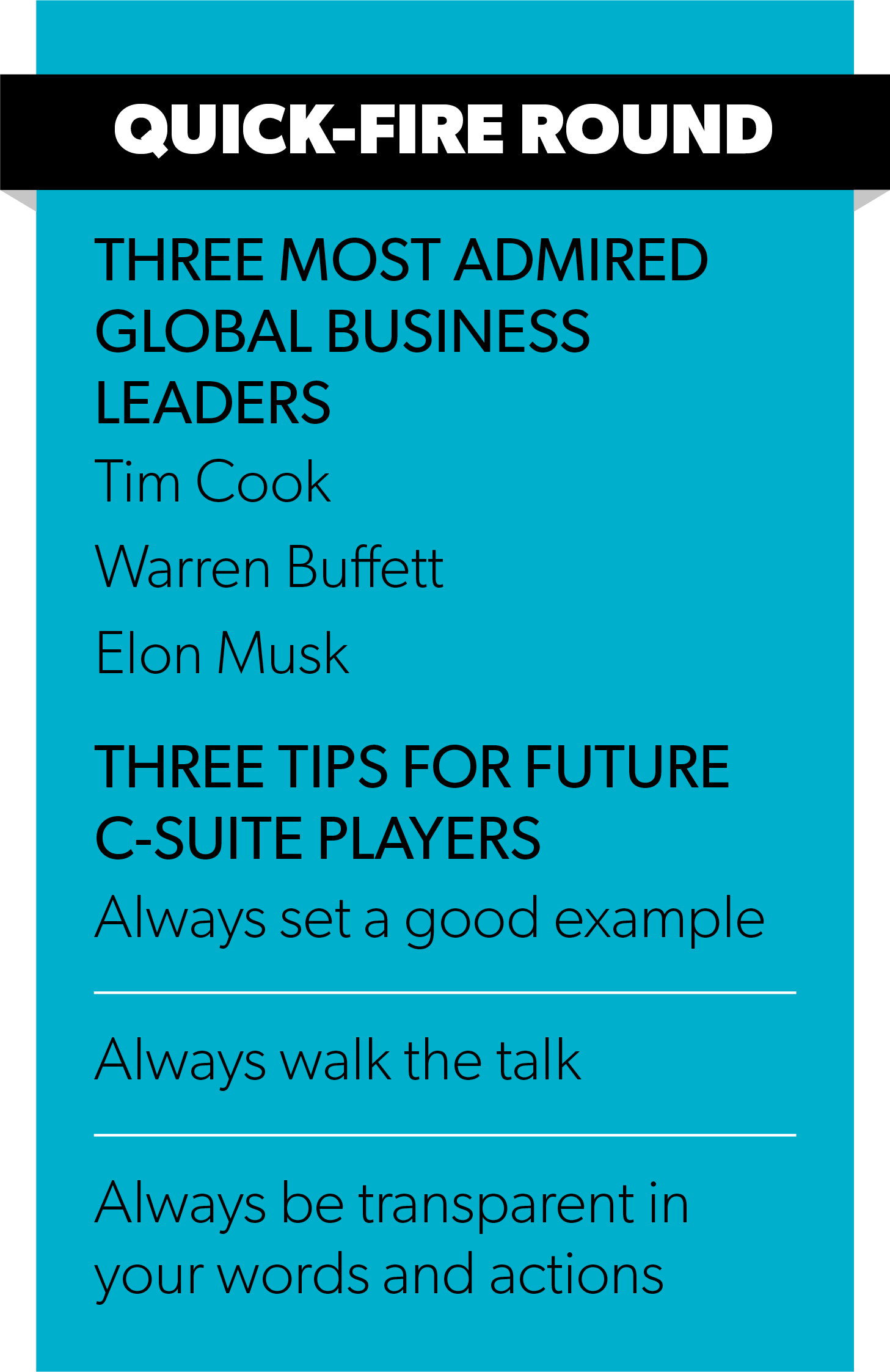

Kapila Jayawardena

Group Managing DirectorChief Executive Officer

www.lolc.com