LMD 100 Q&A

LOLC HOLDINGS

Q: What are your key achievements in 2022?

A: The LOLC Group is proud of its achievements in the year financially, as well as fulfilling its social responsibility.

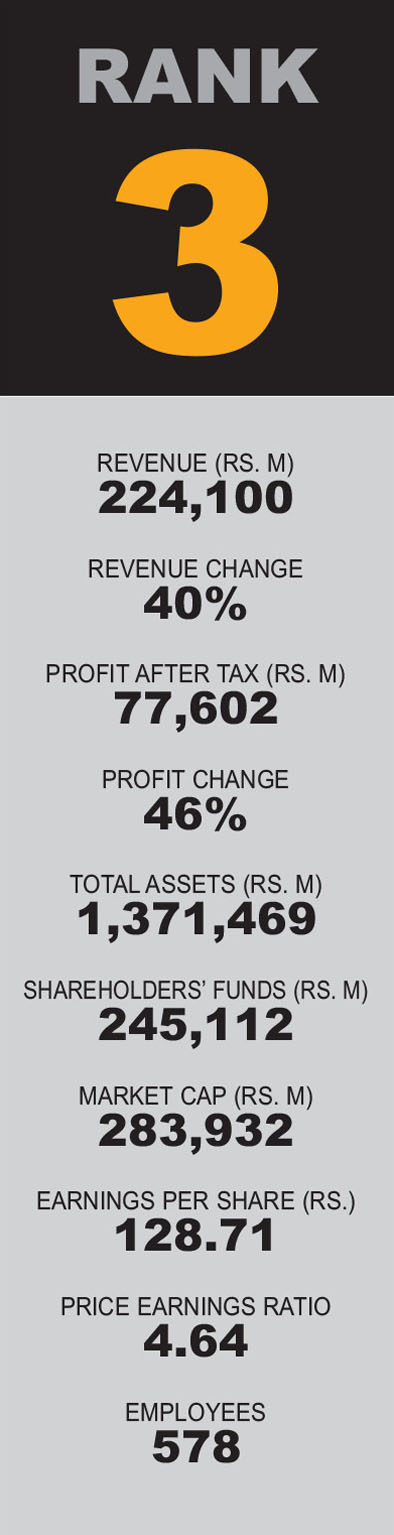

The Group became Sri Lanka’s most profitable listed conglomerate for the fourth consecutive year. Despite adversities, LOLC recorded strong earnings for financial year 2021/22 with a profit of Rs. 77.6 billion, reflecting a 45 percent growth over the previous year and underscoring strong stakeholder value creation.

I am proud of our employees in Sri Lanka and overseas operations for their contribution to this achievement.

The Group created history by effecting the largest merger in Sri Lanka’s financial services history by amalgamating LOLC Finance, and Commercial Leasing and Finance, thereby creating the largest and most profitable non-banking financial institution (NBFI) in Sri Lanka.

From a growth perspective, we established our footprint in six new countries, bringing our global presence to 22 nations spanning Africa, Asia and Australia.

In the backdrop of the financial crisis, our ‘Divi Saviya’ programme supported four million severely impacted people through the provision of food rations. This is the largest social development initiative of its kind in Sri Lanka to be carried out by a corporate.

As a leading conglomerate in the country, we feel it is our duty to support vulnerable segments of the population to overcome this crisis and get back on their feet.

Q: Could you elaborate on the role of corporates in Sri Lanka’s economic revival in the medium term?

A: Corporates have to play a major role in leading the country out of the current crisis by focusing outwards – driving exports, diversifying businesses and branching out overseas, to create value and mitigate risks.

LOLC’s decision to go global over a decade ago ensured that the Group remains a force to be reckoned with. Our global reach has helped us to create value in each of the countries whilst overcoming their economic problems.

Corporates should engage in community development initiatives – especially in these difficult times where a large portion of the population has been severely impacted due to the economic crisis.

Q: How about the country’s risk profile?

A: The country’s risk profile is precarious because of the mountain of foreign and local debt. With the rescheduling of foreign debt, cash flows in foreign currencies will be better.

We are seeing increased remittances and tourism earnings. Tea exports are doing well and prices remain strong. If oil prices decline, it will be a bonus for Sri Lanka.

All these factors combined should see fairly strong cash flows, supported by rescheduling debt.

The Port City (CIFC) and free trade zones should witness some solid funding from overseas to catalyse the economic revival of our country.

However, it would seem that the challenge in 2023 will be rupee (rather than external) debt.

Q: How has your sector been impacted by the economic climate?

A: Our global diversification has helped mitigate the impact to the Group from any country. In financial services, we saw an increase in nonperforming loans and provisioning. The nonpayment of international sovereign bonds by the government led to increased provisioning.

The plantation sector witnessed resurgence; and as the largest producer of tea in the country, this has had a positive impact on our profitability.

A positive trend in tourism will augur well for our leisure business in Sri Lanka. Our hotel in the Maldives, which will be completed in 2023, would create a strong revenue stream for LOLC.

Group Managing Director

Chief Executive Officer

Q: How is climate change impacting the business agenda in Sri Lanka?

A: Climate change is here to stay. As a Group, we have been working on reforestation for the past six years. LOLC is running many projects to reduce dependency on grid electricity and other environmental sustainability initiatives.

The business agenda for corporates should be sustainable operations and renewable energy.

Q: Outline your group’s plans for the future…

A: Starting off in Cambodia in 2007, we expanded our global footprint to 22 countries and will continue to diversify globally.

In 2023, we should be present in India as well… though I see the most potential in Africa – a global emerging tiger – as African countries are demonstrating strong economic growth and good governance structures.

Corporates have to play a major role in leading the country out of the current crisis … driving exports, diversifying businesses and branching out overseas

Telephone 5880880 | Email info@lolc.com | Website www.lolc.com