GLOBALDATA

UK economy on verge of stagflation, observes GlobalData

The UK plans to completely phase out oil imports from Russia by the end of this year, which resulted in 43.7% rise in the fuel prices during January to July 2022. If the prices continue to rise without much expansion in the GDP growth rate, there is high risk that the UK economy is on the verge of stagflation, observes GlobalData, a leading data and analytics company.

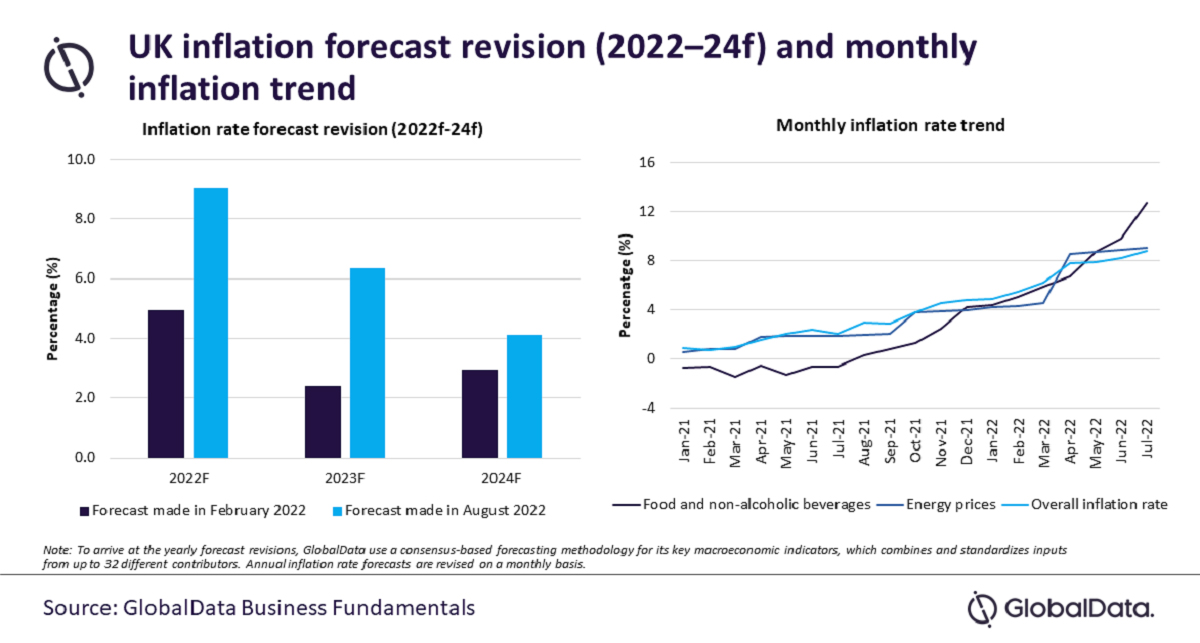

Bindi Patel, Economic Research Analyst at GlobalData, comments: “With soaring inflation levels, the purchasing power of the end consumer will continue to erode. Investments are expected to be subdued as investors may delay their plan to invest due to the rise in borrowing costs. Against the backdrop, GlobalData has revised its inflation rate projections of the UK for 2022 upward from 5.5% in February 2022 to 9% in August 2022.”

According to the Office for National Statistics, UK’s inflation rate increased to 10.1% in July 2022, from 9.4% in June 2022, the highest rate recorded since February 1982. Increasing food and energy prices made the largest contribution towards the high inflation in July 2022. Housing and utilities recorded price increase of about 20%, followed by food and non-alcoholic beverages, where prices increased by 12.7%, the highest monthly increase since May 2001.

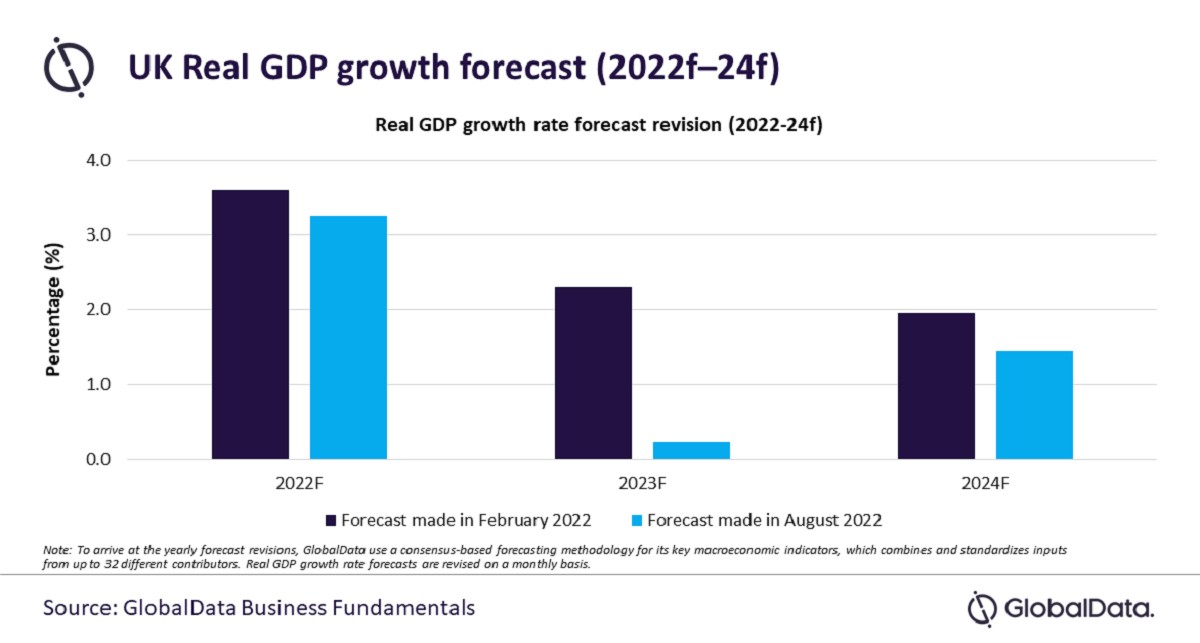

In terms of economic activities, the UK’s real GDP contracted by 0.1% on a quarterly basis in Q2 2022, as the country’s cost-of living crisis continued to increase. The contraction in Q2 2022 was mainly due to a fall in services output. In addition, there was a 0.2% decline in real household consumption, triggered by a sharp rise in prices of goods and services.

The Bank of England has already implemented six interest rate hikes during January-August 2022 to bring down the elevated level of inflation. In August 2022, the Bank of England increased its interest rate by 50 basis points (bps), highest in 27 years, taking to borrowing costs to 1.75%.

Rising prices, high borrowing costs and tough external conditions will impact the economic activities in the UK. GlobalData forecasts the economic growth of the country to slowdown from 5.7% in 2021 to 3.3% in 2022. In 2023, GlobalData expects the UK economy to witness a stagflation with real GDP projected to remain flat and inflation to stay at an elevated level of 6.4%.

From a pure macro standpoint, since private consumption is under pressure, business investment capped by a deteriorating profit outlook and exports constrained by slowing world growth, public spending is left to pull the cart ahead of the spring 2024 general election. It is therefore unlikely that 2023 will be a year of fiscal restraint.

Patel concludes: “The tightening of monetary policy continues to be the need of the hour, as inflation remains the key risk factor for the macroeconomic stability. The government must focus on various structural reforms to provide an impetus to growth in the medium-term.”