ECONOMIC TRAJECTORY

RISKS

AND

DRIVERS

Shiran Fernando scrutinises the trajectory of Sri Lanka’s economy

The Central Bank of Sri Lanka cut policy rates in early June and again in July to signal the beginning of a monetary easing cycle. The June adjustment was the first time that rates have been cut since July 2020 and it ended a tightening cycle of policy rate increases that began in August 2021.

The Central Bank of Sri Lanka cut policy rates in early June and again in July to signal the beginning of a monetary easing cycle. The June adjustment was the first time that rates have been cut since July 2020 and it ended a tightening cycle of policy rate increases that began in August 2021.

There have been notable changes in the economy this year that led to this shift compared to the turmoil faced in 2022.

FALLING INFLATION A key reason for raising interest rates steeply last year was to arrest a pickup in inflation.

Though some of the factors that led to inflation were due to supply side economic issues related to higher global commodity and food prices arising from the fertiliser issue, demand also needed to be reduced from the elevated import environment that existed in 2021 and early 2022.

After inflation peaked at around 70 percent in September last year, the year on year rate has witnessed a downward trend. Headline inflation on the Colombo Consumer Price Index (CCPI) stood at 25 percent in May (from 35% in April) and is likely to slide further downward in the next few months.

The appreciation of the Sri Lankan Rupee against the US Dollar this year will also see further downward pressure on inflation as market pricing formulae for items such as fuel will be adjusted accordingly.

As such, one of the main reasons for monetary policy tightening last year has stabilised in 2023.

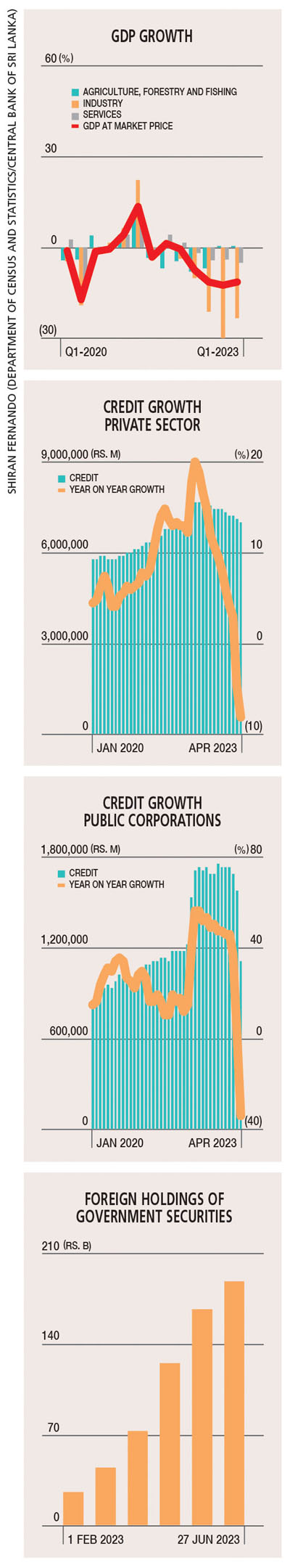

CONTRACTING CREDIT The high interest rate regime in 2022 (nearly 30% at times in terms of the prime lending rate) and slowdown in economic activity led to credit to the private sector contracting in absolute terms and on a year on year basis.

CONTRACTING CREDIT The high interest rate regime in 2022 (nearly 30% at times in terms of the prime lending rate) and slowdown in economic activity led to credit to the private sector contracting in absolute terms and on a year on year basis.

The absolute monthly contraction in credit had been taking place since June 2022. It will now most likely reverse with market interest rates falling from nearly 30 percent to below 20 percent in early July.

Private sector borrowings will most probably be supported by less government borrowing due to an increase in foreign financing inflows. There will also be less reliance by state owned enterprises (SOEs) on credit, given the cost recovery pricing for fuel, electricity, water and gas.

GROWTH SLOWDOWN The first quarter of this year saw GDP growth contracting by 11.5 percent, largely due to base effects. However, the first quarter of 2022 recorded only a marginal contraction of 0.5 percent.

Seen from a quarter on quarter perspective nevertheless, the pace of contraction is slowing down.

Industry contracted the most – by 23.4 percent – due to a slowdown in construction activity. Construction has been one of the worst affected industries due to the economic downturn and work stoppages on many governmental infrastructure projects.

Services also contracted despite the tourism industry doing better than last year. This could be due to a reduction of volumes in the retail and wholesale trades – with consumption dropping as a result of increasing prices and the higher taxation (both direct and indirect) environment.

Agriculture was the only bright spot with the sector showing growth in the first three months of this year, as well as a second consecutive quarter. It is slowly recovering from the fertiliser debacle and seeing improvements in outputs such as paddy.

The easing of interest rates will support businesses in terms of reducing the pressure on their working capital; and this will enable them to consider new investment opportunities due to the lower cost of capital.

Consumption, which plays a major role in the economic growth trajectory, will also recover in the second half, buoyed by the lower interest rate environment.

EXTERNAL SECTOR The balance of payments (BOP) pressure seen in 2022 has eased considerably this year.

Despite a slowdown in exports in the first five months of 2023, imports have also reduced. Remittances and tourism inflows, both of which remained weak last year, have improved in 2023 and resulted in more dollars being available in the market.

Furthermore, Sri Lanka has enjoyed a surge in foreign inflows to the local government securities (Treasury bills and bonds) market. From only about Rs. 22 billion in foreign holdings in early February, it has increased to nearly 200 billion rupees, which means that over US$ 500 million entered the market.

All these factors have eased BOP pressures temporarily.

GROWTH DRIVERS While lower interest rates will support economic activity through reduced financing costs, it won’t be sufficient to stimulate a sustainable economic growth path.

To achieve a growth target of between four and six percent that the country requires, careful calibration of reforms related to capital, land and labour need to be fast tracked.

The successful completion of both domestic and external debt restructuring will also support a lower interest rate regime. However, delays in completion and an escalation of inflation due to external reasons will continue to remain key risks.

Leave a comment