ECONOMIC REVIEW

BUILDING GREATER RESILIENCE

Shiran Fernando examines the emerging economic indicators and provides an analysis of the outlook

In the May edition of LMD, this column highlighted the importance of economic resilience during COVID-19. At that point, it was uncertain how economies including Sri Lanka would cope with the impact of the pandemic.

And while it is only some seven months on from the imposition of the curfew, the Sri Lankan economy has displayed a high degree of resilience.

Let’s examine the performance of certain key indicators, and look ahead to what must be done to maintain this resilience and bring back a higher degree of macro stability to the economy.

GROWTH CONCERNS In terms of GDP growth, this year would be negative for most economies including Sri Lanka.

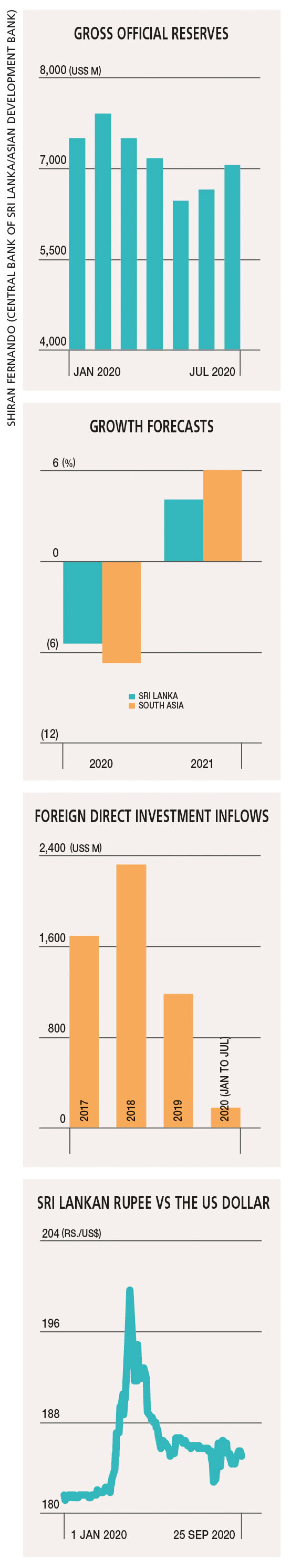

In its September forecast, the Asian Development Bank (ADB) said it expects Sri Lanka’s economy to contract by 5.5 percent in 2020, which represents an upward revision from the 6.1 percent contraction it anticipated in June.

Nonetheless, the expectations of forecasters such as the World Bank and IMF are within this range as well. A rebound is expected in 2021 with an economic growth forecast of four to five percent.

The quarter that bore the brunt of the impact was from April to June. In this period, India’s growth declined by nearly 25 percent while the UK’s fell by about 20 percent. Sri Lanka may also witness a steep decline given that the economy was at a virtual standstill from the last two weeks of March until early May.

However, since the reopening of the economy in May, Sri Lanka has recorded notable improvements in key indicators such as the Purchasing Managers’ Index (PMI) for both manufacturing and services. This augurs well for growth prospects in the second half of the year.

CURRENCY MOVEMENTS The Sri Lankan Rupee has remained resilient against the US Dollar, having reached an exchange rate of nearly 200 in early April.

Import restrictions imposed on various items have helped reduce government expenditure, thereby reducing the pressure on the currency. Imports fell by about 20 percent in the first seven months of 2020 compared to the corresponding period of the prior year.

The gazettes on import restrictions in August and September signal that the government will not incrementally reduce the items being restricted for importation. This will also depend on the position of reserves and debt refinancing. Furthermore, the currency has been aided by a weaker US Dollar.

RESERVES OVERVIEW Amid a steady currency, the Central Bank of Sri Lanka (CBSL) has also been able to increase its reserves, which rose from US$ 6.5 billion in May to 7.5 billion dollars by end August.

This cushion however, would have shrunk in October with the US$ 1 billion sovereign bond that was refinanced during the month.

BOLSTERING RESILIENCE The depletion highlights the need for the government to generate sufficient reserves to weather the impact of the pandemic in the next 12 months.

For this resilience to build further, Sri Lanka has to rely on foreign direct investment (FDI) inflows, and foreign inflows to the local Treasury bill and bond market, or be able to raise more debt in international capital markets. Securing an IMF or other multilateral financing arrangement would also help.

On the FDI front, Sri Lanka recorded inflows of less than 200 million dollars in the first seven months of 2020.

The Board of Investment (BOI) stated that it inked close to US$ 1.5 billion worth of agreements in the first nine months of this year – and if this were to be translated into actual inflows in the next three to six months, it would be a positive vis-à-vis improving reserves.

FOREIGN HOLDINGS Sri Lanka has also witnessed its foreign holdings of the local bill and bond market dwindle from around Rs. 500 billion in 2019 to less than 20 billion rupees by September. There is now an opportunity to once again attract foreign inflows into local debt albeit at a lower interest rate.

To support the Ministry of Finance, CBSL announced currency swap arrangements for investors to hedge volatility in the currency for a period of two years.

The third option would be to return to international capital markets to refinance existing debt. At the time of publication, with existing sovereign bond yields continuing to be in the double digits, it may not be the best time to do so.

Investors would also await policy direction from the national budget for 2021 and see if the country undertakes a reform process tied to an IMF arrangement.

Moreover, Sri Lanka’s exports displayed resilience in the period between June and August – albeit with some of the export growth related to personal protective equipment (PPE) orders. This momentum must be sustained from a merchandise goods perspective as well as the export of services. The latter is expected to perform much better with more focus from policy makers on promoting key segments such as ICT and business process management (BPM).