ECONOMIC REFORMS

THE IMF REFORM AGENDA

Shiran Fernando explains the measures that are being taken to satisfy the global lender

Several economic reforms and key corrective measures are underway against a backdrop of the skyrocketing cost of living and growing anxiety about the global economy heading into a recession.

And Sri Lanka’s delay in approaching the IMF, greater flexibility vis-à-vis its currency, as well as changes to monetary and fiscal policy have resulted in a dire economic situation for the island.

While the steps being taken are encouraging, much more will need to be done if the country is to get back to pre-pandemic levels of economic activity.

Let’s explore so me of the recent changes that have taken place…

me of the recent changes that have taken place…

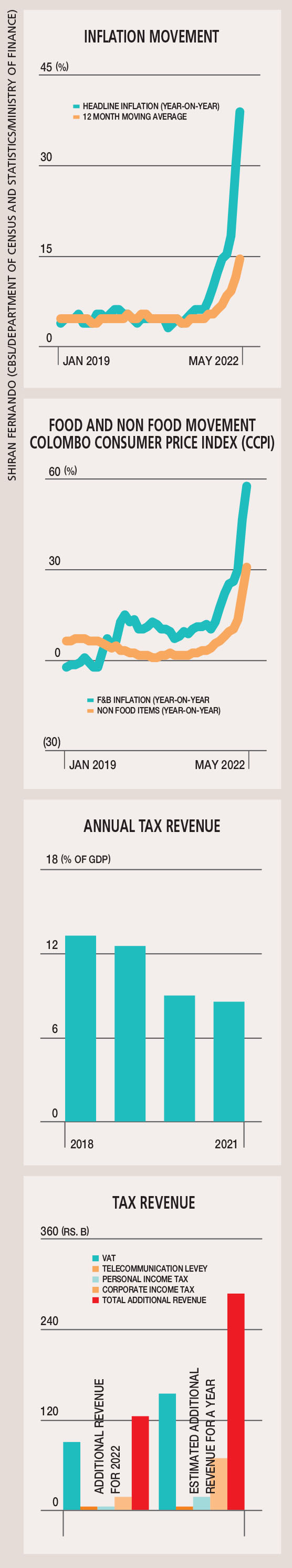

INTEREST RATES The Central Bank of Sri Lanka hiked interest rates in April to fall in line with rising inflation and match the expectations of the government securities market. Headline inflation had risen to 39 percent by May 2021 on a year on year (YoY) basis with the 12 month average registering 14 percent.

To offer some context to this, YoY inflation in December 2020 was 4.2 percent and 12.1 percent in the same month of 2021. This surge was driven by the cost of food, and rising prices of fuel, gas and other essentials. Other indicators – such as Advocata’s ‘Buth Curry Indicator,’ which tracks key consumer items, and was up 49 percent in April – reflected similar movements in the food index.

The second but very important factor is the need for interest rates to rise to support a reduction in printing money. On a weekly basis, the Central Bank offers Treasury bills at its auction (some weeks see Treasury bond auctions), which are taken up by the market (i.e. banks and primary dealers).

Similar in nature to a fixed deposit, the money collected enables the Central Bank to pass it on to the Treasury (Ministry of Finance) to meet payments such as public sector salaries. As a result of keeping interest rates lower – prior to the April hike – it printed money and purchased Treasury bills, which in turn provided funding to the finance ministry for its payments.

This manner of deficit financing through monetary printing also causes an increase in money supply, demand for imports and rising inflation.

Since the hike, the Central Bank has been able to accept what has been offered at most auctions – although at a higher rate of interest, given the increase in April. This has reduced the need for deficit financing through currency printing… though the stock of its Treasury bills and bonds is yet to see a downward shift.

The need is still there, given the gap between government revenue and expenditure.

TAX REGIME It is estimated that due to the tax regime revision carried out in late 2019, Sri Lanka lost about Rs. 500 billion in revenue. To put this in perspective, tax revenue dropped from Rs. 1,735 billion in 2019 to 1,217 billion rupees in 2020 with a slight increase to Rs. 1,298 billion by 2021. As a result of this, Sri Lanka saw double digit budget deficits in both 2020 and 2021.

Given the need to increase revenue and bridge the shortfall, Sri Lanka must send a strong signal reflecting its commitment to fiscal reform and consolidation. As a result, the new prime minister and minister of finance has announced several revisions to income and personal income taxes, VAT and customs duties to increase revenue.

The changes are expected to increase tax revenue by Rs. 125 billion this year and 292 billion rupees annually. There will be a limited improvement this year as most of the changes will need legislation and be implemented only by 1 October.

Implementation by that time provides space for discussion and legislation to be passed in parliament. These changes will not be enforced in one fell swoop due to their impact on the economic environment that the public is currently enduring.

KEY REFORMS The second half of this year will likely see more unpopular and difficult reforms being announced. This will help firm up the commitment, which the country and its policy makers are making, to avail themselves of the multi-year programme under the guidance of the IMF.

It will also help the debt restructuring process that will take place parallelly. The International Monetary Fund will need to be confident that the restructuring process ensures that external debt, which it considers unsustainable, would eventually be sustainable.

In addition to tax and monetary reforms, there will also have to be an emphasis on reforming state owned enterprises (SOEs) – particularly key entities such as SriLankan Airlines, the Ceylon Petroleum Corporation (CPC) and the Ceylon Electricity Board (CEB), which taken together have contributed 97 percent of the losses incurred by the 52 SOEs that are monitored by the Ministry of Finance.

These reforms will need to be implemented against a backdrop of sustaining social and political stability.

Leave a comment