FINANCIAL INCLUSION

SERVING UNBANKED SEGMENTS

Taamara de Silva emphasises the urgent need to pay heed to the fledgling informal sector

Across the developing world, underprivileged communities are often excluded from formal sector opportunities. They live and work in the informal economy not by choice but necessity. However, as producers and consumers of goods and services, their contribution is integral to the financial ecosystem.

Without access to formal financial services, destitute families are compelled to rely on informal mechanisms such as friends and family, rotating savings schemes, pawnbrokers, moneylenders and ‘seettu schemes.’

These mechanisms are insufficient, unreliable and often too expensive. As a result, unbanked communities are systematically deprived of the opportunity to be connected to an ecosystem that enables them to make the most of what they have and lead better lives.

The term ‘unbanked’ is broadly used to distinguish people who don’t have bank accounts and can be recognised as proxies to financial exclusion. Positive correlations have been identified between increased financial inclusion and lower inequalities, indicating that inclusion can tackle poverty and empower communities at the grassroots level.

Accordingly, financial inclusion has taken centre stage as a priority on the global development agenda. Statistics indicate that approximately 1.7 billion people lack access to financial services. On a global scale however, around 1.1 billion unbanked adults possess a mobile phone. That’s roughly two-thirds of all unbanked adults and a clear opportunity for mobile banking.

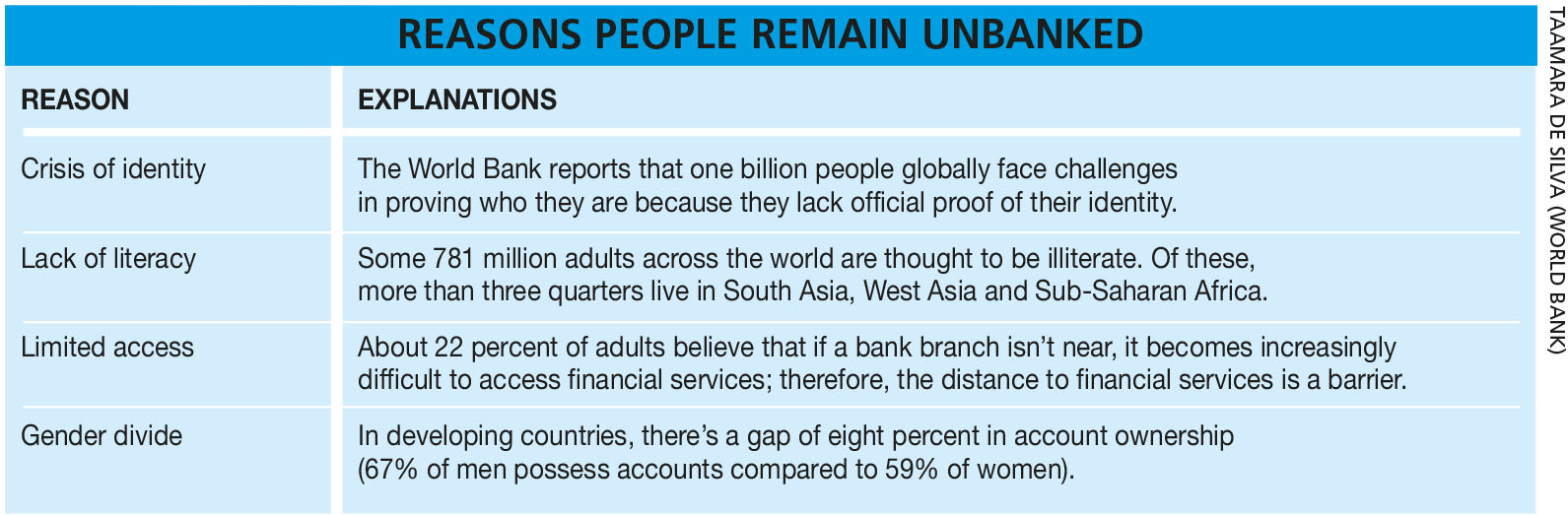

The World Bank has identified the most common reasons for why people don’t maintain bank accounts. A lack of sufficient money has been cited as the main reason while the cost of opening bank accounts and ensuing transaction fees make traditional banking services quite expensive.

Distance is yet another factor and so are the documentation requirements associated with opening a bank account. In some regions, distrust of the financial system acts as a barrier while religious reasons have been identified in certain communities.

Micro-retailers (petti kada) have major issues sourcing working capital. If they can access low-cost short-term finance, they can keep high rotation products in their stores more easily and their business momentum will grow.

Despite the informal sector providing a reasonable service, it robs people of certainty and legal protection. Since informal sector finance isn’t consistent and cannot be scaled, it deprives the wider economy of much needed liquidity.

And let’s not forget that it can potentially harbour criminal activity since there aren’t any ‘know your customer’ (KYC) requirements. This not only cripples the ability of a nation to develop but tends to divide the masses along economic and gender lines.

We’ve witnessed a major push to boost financial inclusion through innovations such as biometric identification cards, and gender and economic class gaps have narrowed. But a large share of the population is yet to come on board.

Among unbanked adults who are economically active, self-employment is the most common form of work. But in turn, a lack of presence in the formal banking sector limits their access to loans and insurance – both of which require credit histories.

Banks are subject to extensive regulation and high costs related to money handling. This leads to costly overheads, which means their services become more expensive. However, mobile banking is seemingly cost-effective since it doesn’t require physical infrastructure and human interaction to the degree that traditional banks do.

Traditionally, mobile phones acted as information and payment devices for people who already possessed bank accounts. However, financial service providers are targeting unbanked communities through a robust set of financial services including savings and credit.

Despite this, most mobile operators possess a limited understanding of the financial needs and habits of the unbanked – i.e. their saving, borrowing and payment habits; what they want; whom they trust; and how they buy. Even though a few operators have gained insights by trial and error, this approach is both costly and slow.

It all comes down to finding the right balance across three imperatives – viz. customer convenience, low costs, and compliance with security and financial regulations.

Serving the unbanked cannot be achieved in silos. Cooperation is required between multiple parties including the government, telcos, major brands, financial institutions and new solution providers. Everyone needs to mobilise and be prepared to work together in the long run because meaningful change does not take place overnight.

The battle for financial inclusion is not about creating completely new behavioural patterns or building entirely new markets. Nor is it about providing simple access to the financial mainstream. It’s about how genuine players and regulated providers can do a better job of outperforming the informal sector.

The requirements and regulations of the formal financial services itself act as a barrier for the informal community. Most informal businesses and the self-employed tend to move from one place to the other, taking advantage of the location. In general, this is in good faith and the best interests of their businesses or self-occupation to gain more business and therefore earn a higher income.

Most of them have no permanent place of residence. So, when the KYC or bank forms request to fill who they are or where they’re from, these people from the informal sector feel lost and like misfits. Another crucial aspect is the high interest rates charged for the microscale businesses which itself is a burden for the self-employed and cottage industries. Hence, most of these informal players turn to the ‘seetu’ system where they habitually end up spending for more.