WORLD ECONOMY

ECONOMIC BALANCING ACT

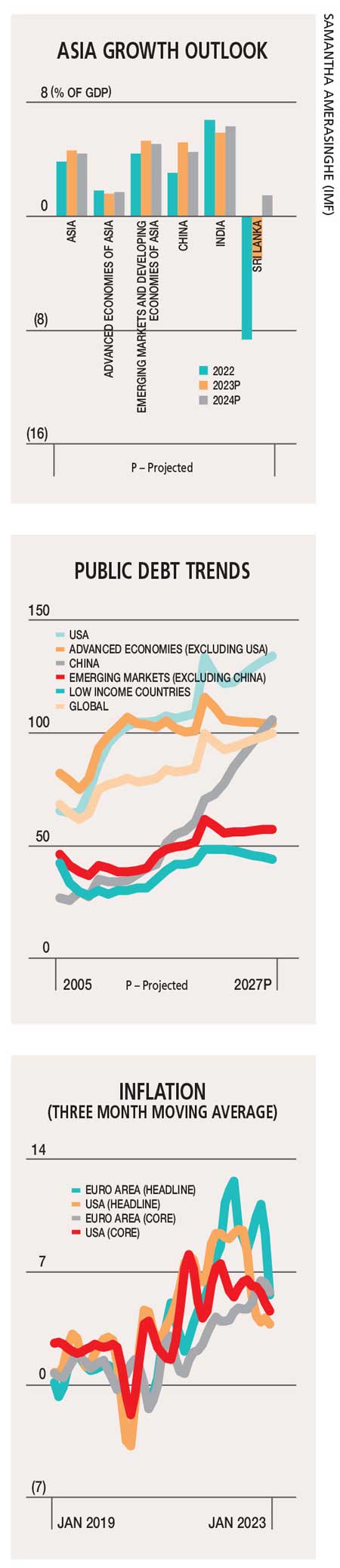

Samantha Amerasinghe cites numerous reasons to be both fearful and cheerful!

As far as the world economy is concerned, there are reasons to be both fearful and cheerful. With the recent release of the IMF’s World Economic Outlook, its Managing Director Kristalina Georgieva warns that the global economy is facing years of slow growth since it will only expand at an average annual rate of around three percent over the next five years. This will mark the weakest medium-term growth in the past three decades.

The path to robust growth is rough and murky, hindered by rising trade protectionism and geopolitical tensions. And with large emerging markets such as China being much better off now, the pace of economic expansion is expected to slow.

Against this somewhat sombre and challenging backdrop however, the world economy has performed much better than feared this year – and there are reasons to be cheerful.

For the coming quarters, the International Monetary Fund has reiterated the importance of central banks staying the course with high interest rates. For better medium-term prospects, defeating inflation is imperative.

The failure of Silicon Valley Bank and Credit Suisse, which exposed risk management problems at specific banks, as well as supervisory lapses, is concerning. But the quick and comprehensive actions of policy makers have steadied the course, and restored confidence in the markets.

That said, monetary authorities may be compelled to negotiate the difficult tradeoff between inflation and their financial stability objectives if the turmoil worsens, and be left with no other option but to cut rates.

On a positive note and contrary to predictions, none of the world’s largest economies – China, the US, the EU, India, Japan, the UK and South Korea – are in recession at a time when the Federal Reserve has raised US interest rates five percentage points.

The resilience of these economies, which comprise almost 70 percent of the global economy, coupled with the absence of any major financial distress in large emerging economies, suggests that any system-wide financial crisis is improbable.

Asia remains a dominant region and is expected to contribute about 70 percent to global growth this year with it expanding by 4.6 percent compared to 3.8 percent in 2022. Even with strong domestic demand and positive momentum from China’s reopening however, there’s no room to be complacent as the region still faces challenges from debt and financial vulnerabilities.

Beyond these risks, persistent inflation remains a challenge as it hovers above central banks’ targets, and core inflation (excluding food and energy) has also proven sticky. With real interest rates still low, central banks may need to keep interest rates higher for longer. Fiscal consolidation amid high debt and rising interest rates is another challenge.

Policy makers must strike a balance between supporting growth, protecting the vulnerable and addressing debt concerns.

Another reason to be positive about the world economy is that adverse supply chain pressures have eased and global challenges in moving goods are fast disappearing. The Federal Reserve Bank of New York’s supply chain pressure index is now well below its historical average while a separate indicator tracking the proportion of freight on stationary container ships waiting to enter ports is also back to normal levels.

Lower natural gas prices in Europe bode well for the global economy. The current market price of gas over the next three years is more than 70 percent lower than the European Central Bank’s (ECB’s) December forecast and almost 10 percent below its March prediction. Sustainably lower gas prices will boost incomes and consumption, as well as reduce inflation.

However, the increasingly strained political relationship between China and the US has the potential to lead to geo-economic trade fragmentation and huge inefficiencies. America and the EU have sought to reassure China that neither is trying to decouple their economies from the world’s largest manufacturer, and curtail a potential risk of major proportions.

Another reason for optimism is China’s emergence from its ‘zero COVID-19’ policy and its economic rebalancing towards domestic consumption.

But the IMF is concerned that China’s policy shift to higher domestic consumption could have significant implications for the region –especially for economies with sizable exports to the country – even though this is what global players have asked from the People’s Republic for decades.

Finally, a recent weakness in OPEC+ due to its inability to enforce production quotas to control world oil prices is good for consumers and the global economy.

The cartel seems to have lost confidence in its ability to influence the price of oil and fallen back to US$ 77 a barrel (from its recent peak of 85 dollars) when OPEC+ nations agreed to pursue a ‘Saudi first’ policy and cut oil production by a million barrels a day at the expense of its customers.

It is remarkable that 2023 has started well… at least, better than expected – but major risks are lurking. Further banking stress and persistently high core inflation will continue to cloud the outlook.

Policy makers must strike a balance between supporting growth, protecting the vulnerable and addressing debt concerns

Leave a comment