ECONOMIC INDICATORS

INFLATION ON THE DOWNTREND

Shiran Fernando takes stock of the trajectories of key indicators

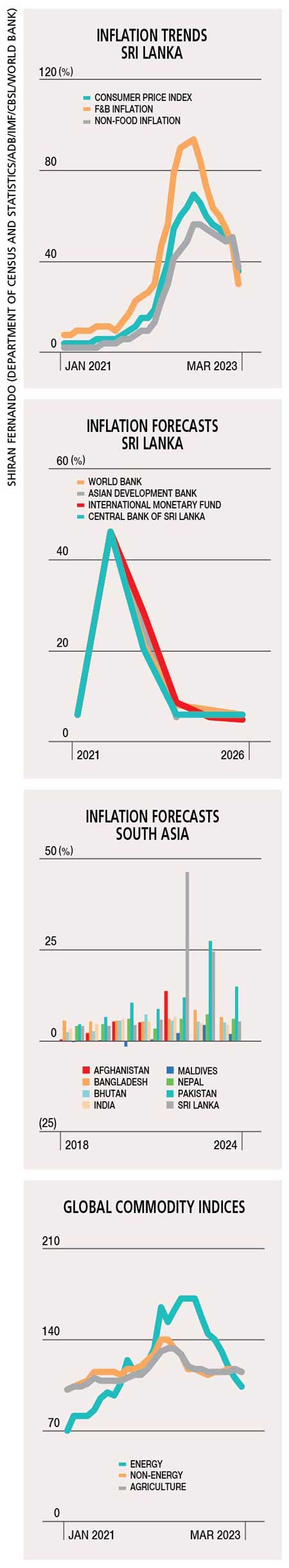

After peaking at 69.8 percent year on year in September 2022, the Colombo Consumer Price Index (CCPI) fell to 35.3 percent in April this year. While part of this decline is due to the base effects of higher inflation in 2022, a mixture of local and international factors on the demand and supply sides have helped ease inflation over the last seven months.

Another reason has been the impact of monetisation on the fiscal deficit that prevailed from 2020 to last year.

Although year on year inflation has declined, it doesn’t mean that prices haven’t increased. In the eight months from September 2022 to April this year, prices fell only in three times – meaning, in three of the eight months.

FOOD INFLATION Food and beverage (F&B) inflation peaked at 95 percent year on year in September 2022 and fell to 30.6 percent in April. F&B inflation has been lower than the overall CCPI figures since March; it has also been declining consistently on a monthly basis.

This reversal has been driven by improvements in the food supply, which was hampered by an overnight fertiliser ban in April 2021. Although the ban was subsequently reversed, the disastrous policy move had severe consequences for the harvest seasons that followed. However, a recovery of some sort was noted in the last season.

Imported food items have also benefitted with the easing of inflation in most regions and impact of a global slowdown.

The slowdown in key markets for certain food items has meant a corresponding retardation in the pace of price increases for the commodities that Sri Lanka depends on – either from a final product point of view or as a key raw material in the production process.

GLOBAL PRICES Global commodity and energy prices – in particular, oil – have fallen from the high levels of mid-2022.

This has eased inflationary pressures on most net energy and food import dependent economies in the region. Though agricultural prices have fallen at a slower rate than energy costs, Sri Lanka has benefitted from the decline of both F&B and non-food indices.

A slump in global oil prices has enabled Sri Lanka to reduce its fuel and gas costs this year. From being price controlled in the past, it is now market determined with a monthly pricing formula being implemented.

This is a key performance indicator of the IMF programme and will have to be continued.

Sri Lanka has maintained a fuel pricing formula since March 2022. During the previous International Monetary Fund programme, Sri Lanka implemented a similar mechanism but it was reversed in late 2019.

Movement of transport accounts for about 12.5 percent of the CCPI basket. Therefore, a decline in fuel prices will lead to a substantial reduction in the price of non-food categories. When transport costs decline, it impacts food categories due to lower logistics related expenditure and these savings can be passed down to consumers.

INTEREST RATES Due to the surge in inflation last year, monetary policy had to be adjusted sharply.

A 1.5 percent increase in the first quarter of 2022 was followed by a seven percent hike in April. These interest rate hikes were followed by one percent increases in the third quarter of last year and March 2023.

With policy interest rates rising by 10.5 percent, bank lending rates also increased sharply.

The benchmark Average Weighted Prime Lending Rate (AWPLR) rose by 7.9 percent at the beginning of 2022 and peaked at close to 30 percent by the last quarter of the year. As a result of the higher interest rates, lending by the private sector fell sharply and its credit growth dropped from 13.1 percent in 2021 to 6.2 percent the following year.

Due to the easing of inflation this year, interest rates have declined.

The AWPLR fell by around nine percent in the first four months of 2023 and stood at 21 percent at the end of April. While a further drop in inflation will drive interest rates down, the uncertainty regarding domestic debt restructuring has stalled this progress.

It is understood that treasury bills issued by the Central Bank of Sri Lanka will be profiled and treasury bonds will undergo a voluntary debt optimisation process. Uncertainty over the latter has resulted in treasury bonds hovering at around 22-24 percent.

MACRO-STABILITY Sri Lanka’s economy has been put to the test in the past few years. Stability on the inflation front and returning to single digit levels will help the country.

The expectation this year is for annual average inflation to fall from 46 percent in 2022 to the mid-20 percent level going forward. This should have a positive impact on greater demand and economic activity.

On the road ahead, it is important for market determined prices to continue and buffers built against external price shocks to rein in inflationary pressure.

While a further drop in inflation will drive interest rates down, the uncertainty regarding domestic debt restructuring has stalled this progress

Leave a comment