THE TRADE DEFICIT

FUEL ON THE FLAME

Shiran Fernando examines ramifications of Sri Lanka’s narrowing trade deficit

The trade deficit narrowed last year, falling to its lowest level since 2010; this was driven by higher exports and lower imports. The reduced deficit, as well as performance of exports and imports, needs to be understood to determine if this trend will continue and impact our currency.

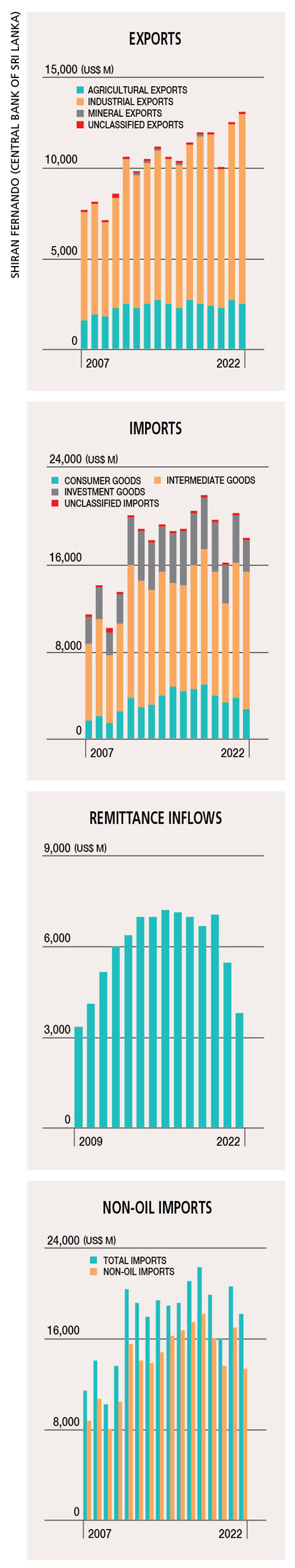

MERCHANDISE Exports crossed the US$ 13 billion mark for the first time. Despite the impact of the economic crisis, which saw shortages of fuel and essential items, the private sector continued to display resilience and met its export commitments.

The spike in merchandise exports amounted to 4.9 percent, driven by an increase in apparel exports (10.7%); and gems, diamonds and jewellery (62.8%). Meanwhile, other industrial exports such as petroleum products rose by 7.9 percent.

However, agricultural exports fell by 5.9 percent due to declines in tea (5%), rubber (1.8%), coconut (5.9%) and spices (18.9%).

Apparel exports, which was the key driver in 2022, is expected to decline in the first half of this year. In January, related exports fell by 18.8 percent compared to the growth recorded in the same month last year, resulting in an overall drop of 11.3 percent.

This was due to the lower demand from key markets such as the US, EU and UK. The curtailment of inventory by brands in the face of slowing demand is the reason for this outcome.

DROP IN IMPORTS Last year saw imports decline by 11.4 percent compared to 2021 with non-fuel related imports dropping more (20.7%). This reduction was driven by most food and beverage categories along with others such as white goods – including home appliances.

DROP IN IMPORTS Last year saw imports decline by 11.4 percent compared to 2021 with non-fuel related imports dropping more (20.7%). This reduction was driven by most food and beverage categories along with others such as white goods – including home appliances.

Investment goods also fell by 32.1 percent with declines in all subcategories. A culmination of import regulations on these goods – coupled with a slowdown in construction activity owing to the higher cost of credit, the unavailability of goods and an increase in prices – would have led to this reduction. Import regulations also had an impact on certain consumer and intermediate goods.

The main driver of imports was fuel. This saw a 30.8 percent rise because of an increase in global oil prices during the year and a scarcity of dollars, which reduced Sri Lanka’s bargaining power and resulted in more expensive spot purchases.

As a result, fuel costs rose by US$ 1.2 billion to 4.9 billion dollars on a cumulative basis in 2022, which accounted for 26 percent of the country’s total import bill for the year.

Data for January indicates that imports continue to remain subdued compared to the beginning and end of last year. A slowdown in exports such as apparel is also expected to result in a substantial decline in intermediate goods.

The challenge for Sri Lanka will be to manage fuel and other commodity-based imports that fluctuate in line with world prices. Despite an overall slowdown in global growth, commodities have not declined as much as expected due to geopolitical factors and the ongoing conflict in Ukraine.

DOLLAR INFLOWS Remittances have picked up in recent months and are now in excess of US$ 400 million, which is encouraging.

Tourism inflows have also improved – with both January and February recording over 100,000 tourist arrivals apiece. Cumulatively, these two should shield the expected fall in exports while balancing our fuel import needs.

For both remittances and tourism to grow, Sri Lanka will have to avoid further undermining of confidence in the economy. The government can ill afford another black swan event this year; it will have to ensure that the country is safe, and the continuous availability of food, fuel and healthcare services.

SRI LANKAN RUPEE The movement of the local currency hinges on external flows and developments vis-à-vis the IMF.

Recently, the Sri Lankan Rupee has appreciated against the US Dollar – driven by market sentiment in accessing the International Monetary Fund’s programme, improved dollar liquidity in the banking system on the back of higher remittances and tourism inflows, and the announcement of a US$ 400 million facility from the IFC to three banks in Sri Lanka.

This movement underscores a turning point in the narrative surrounding the economic crisis, and could continue if debt restructuring talks are positive, following confirmation of the IMF’s Extended Fund Facility (EFF) on 20 March.

From an exports perspective, 2023 will be about managing market share in key markets and working with customers to tackle falling demand. Key markets are likely to recover in the second half of the year and export businesses must be prepared for this.

Sri Lanka can expect an improvement in its agricultural exports, which declined last year owing to the fertiliser crisis. Overall, the policy environment has to be conducive to removing barriers that stymie exports, and strategise to gain market access through free trade agreements (FTAs) and other measures to do away with tariffs for exporters.

It’s important not to lose the necessary sense of urgency to drive more exports of goods while continuing to facilitate offshore services, which have been steady in recent years.

Leave a comment