BANKING SECTOR

ROAD MAP TO RECOVERY

Compiled by Yamini Sequeira

SWALLOW THE BITTER PILL!

Sriyan Cooray wants us to rise together – since we have fallen together

Sri Lanka’s banking sector, arguably a nerve centre of the national economy, presently shoulders unprecedented challenges as it grapples with soaring impairment charges attributable to both loan book factors and exposure to the government’s international sovereign bonds (ISBs).

The depletion of capital adequacy levels has compelled banks to cut back on their growth projections and maintain the status quo. And macroeconomic factors, which are closely linked to the health of the banking sector, are having a dampening effect.

What’s more, soaring inflation has eroded people’s spending capacity and high interest rates have made servicing loans more expensive.

On the other hand, economic activity has slackened considerably – as reflected in the contraction of GDP – and is causing revenue pressures, labour redundancies and so on. The combined effects of these realities are dire as they directly translate into worsening debt servicing by clients.

CHALLENGES Sriyan Cooray observes that “sector capital adequacy has been heavily affected. It’s imperative that this is addressed through an infusion of new capital, which is also a challenge due to several factors. Foreign investor confidence is nonexistent due to the restricted default rating of the sovereign.”

“Domestic conditions are also dire, given the prevailing macro conditions. Even in terms of raising debt capital – particularly those that are Basel III compliant and need to have a minimum tenor of five years – such borrowings will see banks committing to historically high interest rates in the mid to long terms. This will adversely increase banks’ overall cost of capital and thereby affect returns to shareholders,” he points out.

A possible haircut on the banking sector’s exposure to ISBs issued by the Government of Sri Lanka and domestic debt restructuring are two major challenges for which it is bracing itself. Exposure to state-owned enterprises (SOEs) and the new tax regime are also challenges, he says.

As for immediate steps to resolve the challenges facing the banking sector, Cooray explains that “there should be clarity sooner rather than later as regards the government’s approach to its debt restructuring programme.”

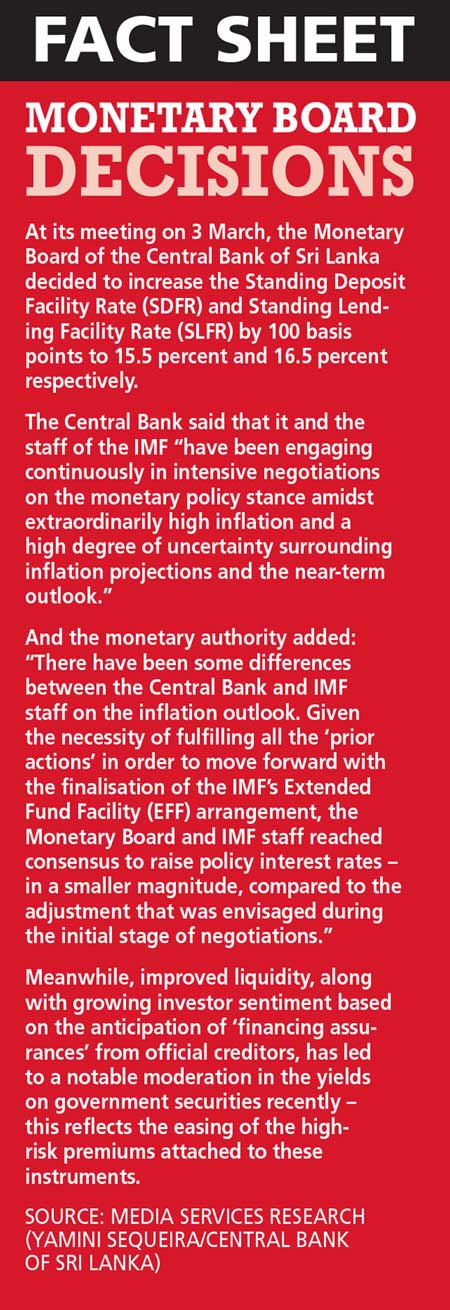

He continues: “The IMF’s relief programme should be expedited since it will help clarify the direction and magnitude of these policy actions. And the banking sector should be supported in preserving its capital adequacy – therefore, excessive taxes should be revisited.”

Given the state of the economy, there are no stand-alone fixes to get only the banking sector up and running, he avers.

Instead, Cooray says it is “imperative that there’s clarity on policy, a conducive tax regime, fiscal discipline, committed plans for SOE restructuring, eradication of corruption, efficiency enhancements of SOEs and so on, all moving into action from discussion.”

“The debacle we are in has affected the entire economy – and as we have fallen together, we should rise together as well,” he declares.

RESILIENCE He notes: “The sector collectively stood up to the challenges over the last three years, achieving a delicate equilibrium across the critical imperatives of preserving shareholder value, safeguarding customer health and ensuring employee wellbeing.”

“One of the unprecedented challenges was the foreign currency deficit, which severely frustrated our customers and their plans. For some customers, it was their children’s education; for others, it was their integrity with business partners that was at stake. All the banks did their best to support customers and thereby helped minimise multifold disruptions,” Cooray maintains.

Support from the regulator – particularly with regard to extending moratoria to borrowers, and relief on industry capital adequacy and liquidity levels – augured well for banks.

The rapid progress the sector made in being digitally powered in recent years has stood it in good stead, and kept banking services alive even at the height of pandemic driven lockdowns and fuel shortages.6

He affirms that the Central Bank of Sri Lanka has been quite supportive: “It is resource rich, often well-versed in new developments and has facilitated knowledge enhancements for the [banking] sector.”

“Revisions to regulator mandated threshold levels in capital, liquidity and so on in response to economic conditions have supported banks through hard times – while of course, preserving the stability of the sector,” Cooray adds.

ECONOMY As for the economy in the weeks and months ahead, he avers: “Both high inflation and the new taxes have eroded people’s purchasing power. Given the state the economy is in, I am sceptical about quick fixes – particularly because these problems are the result of the disastrous twin economic policies of printing money and tax cuts, which were adopted from 2019 onwards.”

“Increased tax revenue and controlled expenditure are critical for the government to bridge the fiscal deficit but the timing of this – i.e. when people are already severely affected – throws its effectiveness into doubt. The only quick fix would be to revisit taxes to shift the burden and address inflation,” he suggests.

SUSTAINABILITY Commenting on corporate sustainability, Cooray states: “I think the conventional formula of corporate sustainability as defined by ‘the three Ps’ – people, planet and profit – is a good guide.”

He elaborates: “A corporate’s function with shareholder invested funds should focus on all these aspects with uncompromised equilibrium. Employee wellbeing, community empowerment through entrepreneurship, and focussed support for women and differently able people are some examples.”

“The commitment to a healthy planet is the responsibility of every corporate, irrespective of the sector. And of course, any business needs to be profitable for its shareholders,” he notes.

Cooray prescribes the following measures: “There needs to be fiscal discipline, and a strong commitment to a structured and time bound plan to meet the IMF’s requirements. The wellbeing of citizens will have to be considered since unrest, protests, strikes and so on will only further damage an already ailing economy, and disrupt progress.”

“We all lament the fact that 2022 was the most challenging year in post-independent Sri Lanka. My view – and I earnestly hope to be proven wrong – is that 2023 will present greater challenges,” he posits.

Cooray sums up: “It’s vital that key economic indicators – such as inflation, and foreign exchange and interest rates – are rectified. This calls for a significant effort as they’re all interrelated.”