THE TRADE DEFICIT

IMPORT EXPLOSION

Shiran Fernando analyses the push and pull factors in Sri Lanka’s ballooning trade deficit

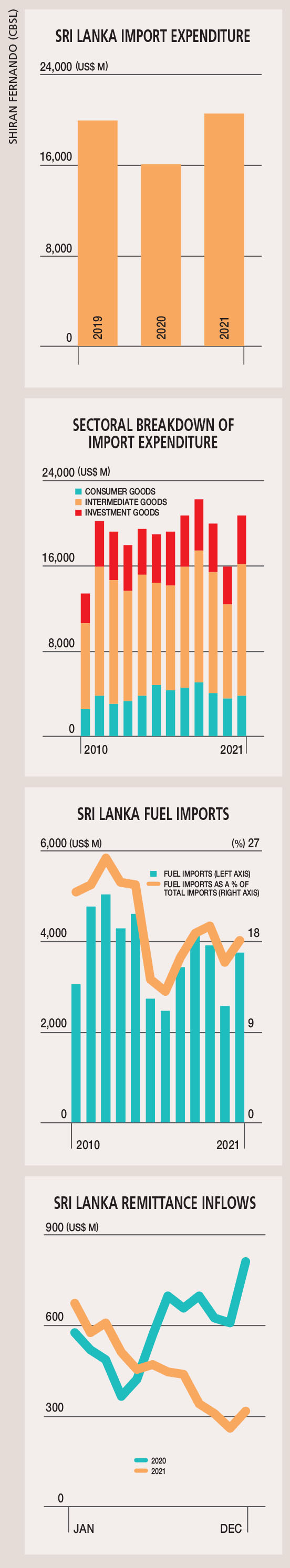

Sri Lanka’s import bill surged by over US$ 4.5 billion in 2021 compared to the previous year and was higher than it was in 2019. In addition to debt refinancing concerns, an increase in imports has also added to worries about dollar liquidity. December 2021 recorded the highest monthly inflow of some 2.2 billion dollars.

As a result, last year’s import expenditure increased by 28.5 percent, outpacing the strong export recovery of 24.4 percent. And consequently, the trade deficit expanded to US$ 8.1 billion in 2021 from six billion dollars in in the preceding 12 months. Let’s explore some of the main reasons for the increase in our import bill…

As a result, last year’s import expenditure increased by 28.5 percent, outpacing the strong export recovery of 24.4 percent. And consequently, the trade deficit expanded to US$ 8.1 billion in 2021 from six billion dollars in in the preceding 12 months. Let’s explore some of the main reasons for the increase in our import bill…

CONSUMABLES The consumer goods sector showed the least growth in imports compared to intermediate and investment items. By segmenting consumer goods into food and beverage, and non-food consumer goods, it is apparent that the latter has been driving growth. Non-food consumer goods rose by 48 percent in 2021 due to the import of medical items and pharmaceuticals – largely COVID-19 vaccines.

A key driver of consumer goods in the past has been vehicle imports; but with the ban on importing vehicles, the motor industry’s contribution was almost negligible in 2021. On the contrary, telecommunications and home appliances saw notable growth.

INTERMEDIATES This import segment grew by 37 percent in 2021, owing to a rebound in exports and a greater need for imported inputs, as well as the surge in commodity prices – viz. oil. The average import price of oil increased from US$ 52 a barrel in December 2020 to 85 dollars by December 2021. This led to fuel imports increasing by 47 percent – or US$ 1.2 billion in dollar terms. Fuel imports accounted for almost 18 percent of the total bill.

With apparel exports expanding by 23 percent, textile and textile article imports increased by 31 percent – or US$ 700 million – in 2021. Other imported intermediate goods such as base metals; chemical products; and plastics and rubber, as well as their related articles also saw notable increases.

INVESTMENTS With the reopening of the economy despite the on going pandemic, and resumption of most construction activities and flagship projects, the investment goods sector saw an increase in all sub-sectors.

Machinery and equipment imports rose by 29 percent while building materials and transport equipment increased by 21 percent and 14 percent respectively. Building materials expanded with higher imports of iron and steel, and their associated articles.

IMPORTS The Central Bank of Sri Lanka offers an analysis of the movement of import volumes and unit prices, which is provided as an index. According to this analysis, the unit price index has been higher since April 2021 compared to corresponding periods in the two previous years.

In certain months, the index was higher than 100, which indicates periods of rising commodity prices. In terms of volumes, most months in 2021 were in line with the previous year – although some monthly periods in early and late 2021 saw surges.

Therefore, one can conclude that a mix of both volume and value increases were key drivers of the surge in imports.

In some months, there could have been orders of excess capacity in terms of imported items, given the uncertainty with regard to the forex situation, as well as to ensure that there were sufficient raw materials for domestic production or export purposes.

RESERVES Given the low levels of US Dollar reserves in the country and a lack of dollars to finance imports, it’s difficult to see how imports can be sustained at recent levels. As such, policy makers have taken measures to curb the importation of items they consider to be nonessential.

The priority will shift to importing fuel and other inputs required for production. This situation is compounded by difficulties associated with opening of letters of credit for trade purposes.

Meanwhile, the balance of payments situation has been aggravated by a slowdown in remittances. Despite the incentives offered by the Central Bank, migrant workers are yet to remit as much as they did in 2020 or during pre-pandemic times.

In January, remittance inflows were under the US$ 300 million mark. As such, it seemed more than challenging to maintain our currency at its

level at the time… and indeed, the recent devaluation of the Sri Lankan Rupee was in response to that.

This could also deter excessive imports and provide a more realistic picture of the value of the rupee, given the levels at which it was trading in informal markets not long ago.

Higher interest rates, an increase in commodity prices and a weaker currency will likely slow down import volumes this year. However, the balance between repaying debt and managing much needed import inputs will determine the outlook.