THE TAX REGIME

TAILORED FISCAL REFORMS

Shiran Fernando explains how the new tax regime could prop up the economy

Sri Lanka’s taxes are rising, partly to catch up on the loss of revenue due to the tax cuts in 2019 and also to ensure that the primary budget deficit is back on track so that debt sustainability can be achieved.

However, the steep increase in taxes has received mixed reviews. So let’s explore the context and rationale for the tax changes, and how Sri Lanka can avoid some of its past mistakes.

KEY POLICY CHANGES At the time of writing, the tax changes proposed in the bill amending the Inland Revenue Act of 2017 are to raise corporate taxes for all sectors – except the likes of gaming, casinos and so on – to a singular rate of 30 percent.

For some sectors such as exports, there’s a jump from 14 to 30 percent while others will see an increase from either 18 or 24 percent to 30 percent.

Another change applies to personal income tax where the tax-free allowance has been reduced to Rs. 1.2 million annually from three million rupees. Incremental slabs will apply to every Rs. 500,000 with each slab increasing by six percent – with a maximum increase by the same rate.

Both these changes will have a telling impact on individuals as well as corporates. It is likely that working people will see a contraction in their disposable income, which will lead to a slowdown in consumption-led economic growth. And businesses will have less – vis-à-vis profits – to reinvest for future growth.

DRASTIC INCREASES Sri Lanka’s perennial economic woe has been its fiscal imbalances driven by poor tax collection rates. This has also led to the fiscal domination of monetary policy, which is managed by the Central Bank of Sri Lanka.

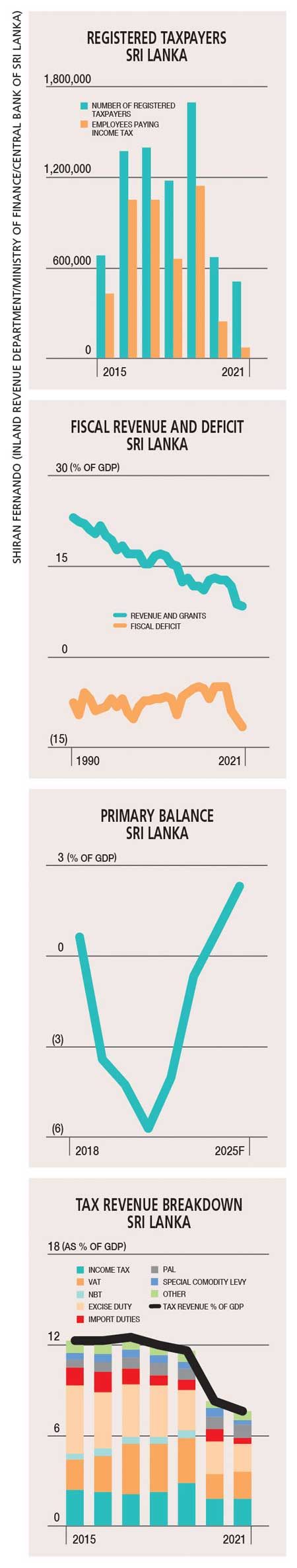

In 2008, Sri Lanka’s total revenue and grants as a percentage of GDP was 15.6 percent; this had almost halved to 8.7 percent by 2021.

The downtrend since 2008 was briefly reversed between 2015 and 2018 under the last IMF programme, which saw the enactment of the Inland Revenue Act. However, this was undone by tax cuts for both corporate and personal income in late 2019.

In that year, Sri Lanka had 1.7 million registered taxpayers in the system with around 1.14 million of them being employees who were paying tax. Following the tax cuts, the number of taxpayers fell to 507,095 and only 67,687 employees were paying income tax at the end of 2021.

This sharp unravelling of the tax base was the start of Sri Lanka’s economic troubles even before the onset of the COVID-19 pandemic; and it was this concern that forced credit rating agencies to warn of the consequences in December 2019.

The latest hikes are being pursued with the intention of increasing the tax base once again.

THE ROLE OF TAXES Higher tax collection rates will ensure that the deficits – in particular, the primary deficit – are managed and reduced. This in turn will tell us whether the taxes collected are sufficient to pay for interest payments relating to government borrowings.

In 2017 and 2018, Sri Lanka was able to register a primary surplus for the first time since 1954. Since then however, it has recorded deficits – and the estimate for this year is about four percent of GDP. Under the proposed International Monetary Fund programme, the primary deficit is expected to be turned around to a surplus of 2.3 percent of GDP by 2025.

This hinges on a substantial increase in tax revenues (estimated to be at least double the amount expected to be collected this year) with some degree of prudence in terms of expenditure.

The primary balance position is a critical variable in the debt restructuring analysis and the path for Sri Lanka to secure a viable IMF programme.

ECONOMIC GROWTH Higher taxes are likely to slow economic growth – due to the impact it will have on consumption and investment-led growth – in the context of rising interest rates and the steep and sudden depreciation of the rupee witnessed earlier this year.

However, the government can avoid the mistakes of the past in terms of a policy of slowing down growth. Policy makers must understand that a ‘slow growth economy’ may not result in the desired levels of tax revenues being collected.

To underscore the new tax regime therefore, the government will need to fast track pro-growth measures.

Some of these measures include reforming state-owned enterprises (SOEs) and ensuring that investment procedures are less bureaucratic, as well as reducing the cost of doing business. Such efforts will help businesses to reduce their cost of production or providing services and enable even competition at a global level.

These measures should be accompanied by other reforms related to land, labour and trade, which have been slow and delayed for decades.

Such reforms at macro and micro levels will build confidence that Sri Lanka won’t need to rely only on the IMF to achieve macroeconomic stability – and they will serve to ensure that we have the capacity to maintain stability on our own.

The latter is crucial to retain investors and talent within the country, and sustain businesses.

Leave a comment