THE GREEN ECONOMY

HONOUR GREEN COMMITMENTS

Kiran Dhanapala elaborates on the importance of greening the country

The economy and livelihoods depend on natural capital (nature, biodiversity and ecosystem services), especially in agriculture, fisheries, spices, tourism, exports and so on. This natural capital, which is rapidly depleting, poses risks to businesses.

Nature includes living in the biosphere and interacting with parts of the Earth’s systems such as its climate. Biodiversity spans the variability between and within species in an ecosystem.

Ecosystem services are benefits that people obtain from using natural ecosystems such as clean air, filtered water, recreational spaces and so on – and all three aspects are considered greening.

Climate change is due to human activities and greenhouse gas (GHG) emissions. Nature and biodiversity loss results from land conversion, changes and overexploitation of natural resources, pollution and climate change. These can also intersect and make matters worse.

Policy actions and financial models to source the funds needed to restore nature and biodiversity are different to those which address climate change. Sri Lanka is highly vulnerable to climate change, and its biodiversity and capacity to provide ecosystem services are also eroding. These impacts will worsen, and affect our economy, people and island.

Most businesses focus mainly on inside-out impacts when reporting on sustainability. This often disregards nature based impacts. There’s also the need to factor in ‘outside-in’ impacts, which affect businesses such as climate related events…

Sri Lankan demands for a greener economic recovery are coming from civil society and the private sector. Environmental practitioners met with potential parliamentarians in the runup to November’s general election with a citizens’ manifesto.

This manifesto calls for the following.

❍ Honouring Sri Lanka’s nature conservation commitments under international environmental treaties.

❍ Refocussing developmental policies on conservation and environmentally responsible growth where nature is at the core of Sri Lanka’s economic recovery.

❍ Strengthening land use and sharing policies by firming up governance around protected and environmentally sensitive areas, state forests and so on, to minimise conflicts between natural ecosystems and human activity.

❍ Reforming state institutions to enable effective and independent environmental management, regulation and conservation with adequate financial and technical resources.

So how do we finance these recommendations – and more generally, the conservation of natural resources that are vital to our economic survival?

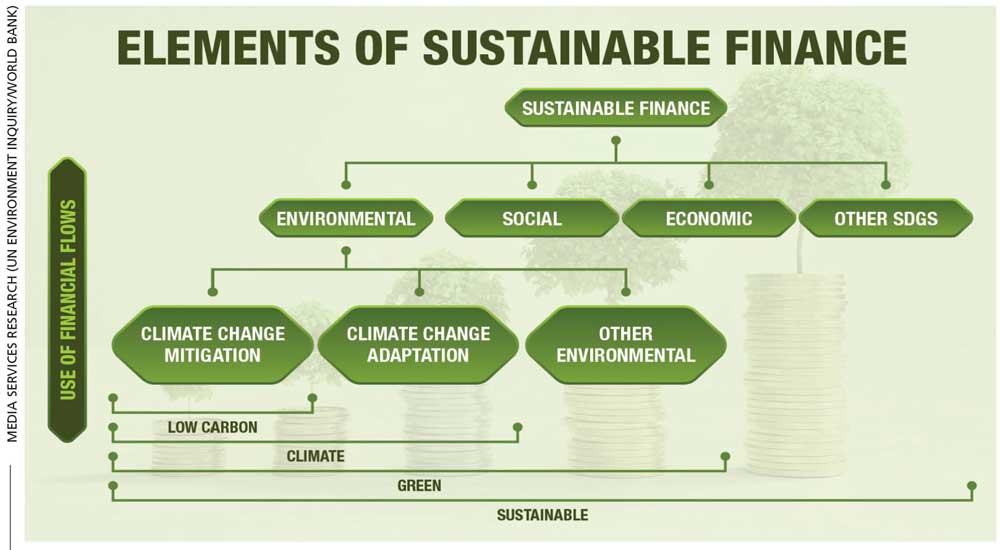

This issue has generated significant interest in Sri Lanka on sustainable finance.

The country is building its capacity gradually with a number of think tanks that are engaged in research and advocacy efforts. Financial institutions (FIs) including banks are also preparing proposals on green project initiatives for submission to various mechanisms including the Green Climate Fund (GCF).

DFCC was the first Sri Lankan bank to be accredited to GCF with several to follow. But an overarching and coordinated perspective of what the country needs is yet to emerge.

Nature can also be safeguarded with stronger social and environmental safeguards integrated in FIs’ credit risk assessments and review processes. And their position on investments in fossil fuel and other polluting agents also needs greater transparency.

This should be standardised across all financial institutions and be part of basic FI reporting as it affects existing finance and its impacts. It’s also necessary to attract new finance for greening efforts.

So what do we need to do to leverage and enrich our natural capital assets?

❍ Strengthen the understanding of nature’s role in business, industry and the economy.

❍ Make climate vulnerability data public to help businesses and FIs factor in climate risks as part of due diligence processes.

❍ Invest to strengthen weather intelligence, meteorological forecasts and climate related support systems, to understand risks and respond better (this includes rainfall, reservoir flows, stream flow data, floods and so on).

❍ Build capacity to identify and scope projects that contribute to greening – including monitoring and verification of outcomes and impacts.

❍ Strengthen interdisciplinary knowledge of environmental economics and finance, debt and nature investments, and links between science and economics (such as specifying ecosystem services and valuing the benefits).

❍ Build awareness about the added value that investing in nature will bring to ensuring sustainable community benefits.

❍ Track international experience in green financing (especially in highly indebted countries).

❍ Build awareness and capacity among stakeholders – especially FIs – on green finance and adaptation finance, and nature based investments and instruments.

Leave a comment