THE ECONOMY

PERVASIVE ECONOMIC CLIMATE

Corporates grapple with a multitude of unpredictable economic whirlwinds

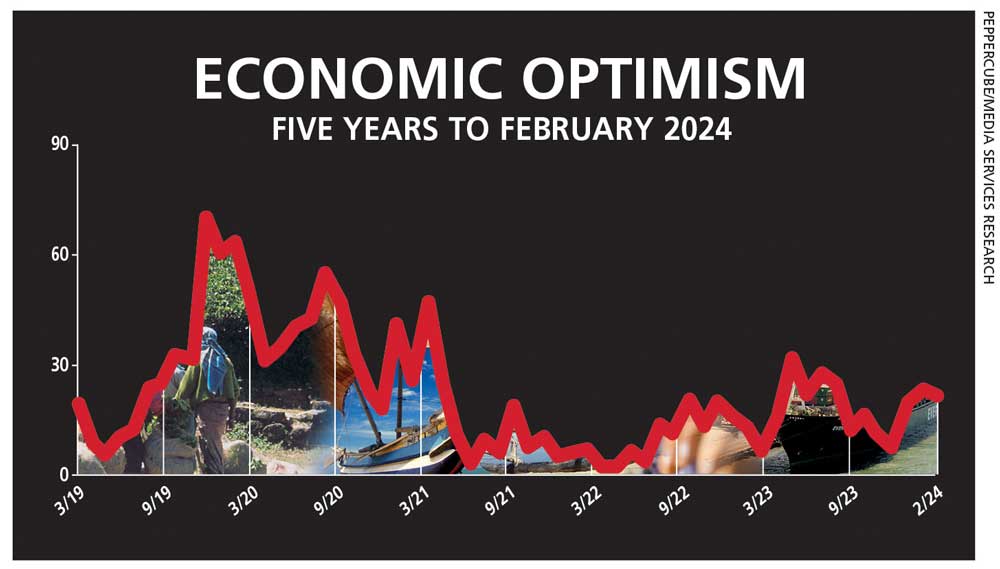

Businesses continue to grapple with a widespread sense of uncertainty – and this sense of ambiguity is mirrored in the latest findings of the LMD-PEPPERCUBE Business Confidence Index (BCI) survey.

This comes amid the Ceylon Chamber of Commerce’s Outlook Report 2024 stating that the country’s economic growth is poised for a modest recovery this year – and the Governor of the Central Bank of Sri Lanka Dr. Nandalal Weerasinghe affirms that there are positive signs of three percent growth.

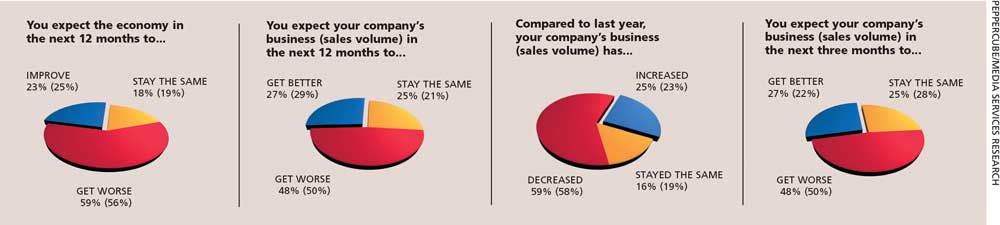

THE ECONOMY Amid such claims, 23 percent of survey participants too are positive about the economy ‘improving’ over the next 12 months despite the two point drop from January (25%).

Eighteen percent of respondents anticipate the economy will ‘stay the same,’ which reflects a percentage point difference over the previous month (19%).

But most tellingly, nearly six in 10 (59%) expect the economy will ‘get worse’ – up three percent from January’s 56 percent, although this outcome represents a 14 percent improvement from three months ago.

SALES VOLUMES In February, hopes that sales volumes will ‘get better’ over the next 12 months waned with 27 percent anticipating so – that’s a two point drop compared to the preceding month.

A quarter of survey participants (25%) expect their numbers will ‘stay the same,’ representing an increase from the previous 21 percent. And the proportion anticipating sales volumes to ‘get worse’ declined to 48 percent – down from 50 percent in the month prior.

In addition, only 25 percent of respondents report ‘increased’ sales volumes over the previous 12 months, reflecting a dip from January (23%). Sixteen percent say their numbers ‘stayed the same’ – down three percentage points from the preceding month. And 59 percent – i.e. one percent more than in January – disclose a ‘decrease’ in volumes.

Looking at the three months ahead, there’s a sense of gloom surrounding sales volumes ‘getting better’ with only 27 percent expressing optimism, which is five percent higher than last month.

Additionally, a quarter (25%) anticipate sales volumes to ‘stay the same,’ marking a three percent drop.

Despite these nuances, the prevailing sentiment remains subdued as nearly half (48%) of survey participants expect their sales to ‘get worse’ over the next three months.

INVESTMENT CLIMATE Optimism regarding the investment climate remains similar to January with three percent polling ‘very good.’

However, there’s a notable increase in the proportion of respondents who view prospects as being ‘good,’ rising to 17 percent (from only 7% in the previous month).

Thirty-two percent of respondents perceive the climate as fair while a majority of executives (48%) still consider the outlook to be ‘poor’ or ‘very poor’ – although this is an improvement from the two-thirds that said so in January.

EMPLOYMENT PROSPECTS February saw a decline in job prospects with only 23 percent indicating an intention to expand their workforce (January – 28%).

And more than half (59%) plan to maintain current staff levels while 18 percent anticipate downsizing over the next six months, marking an increase from six out of 100 respondents in the previous month.