THE BIG PICTURE

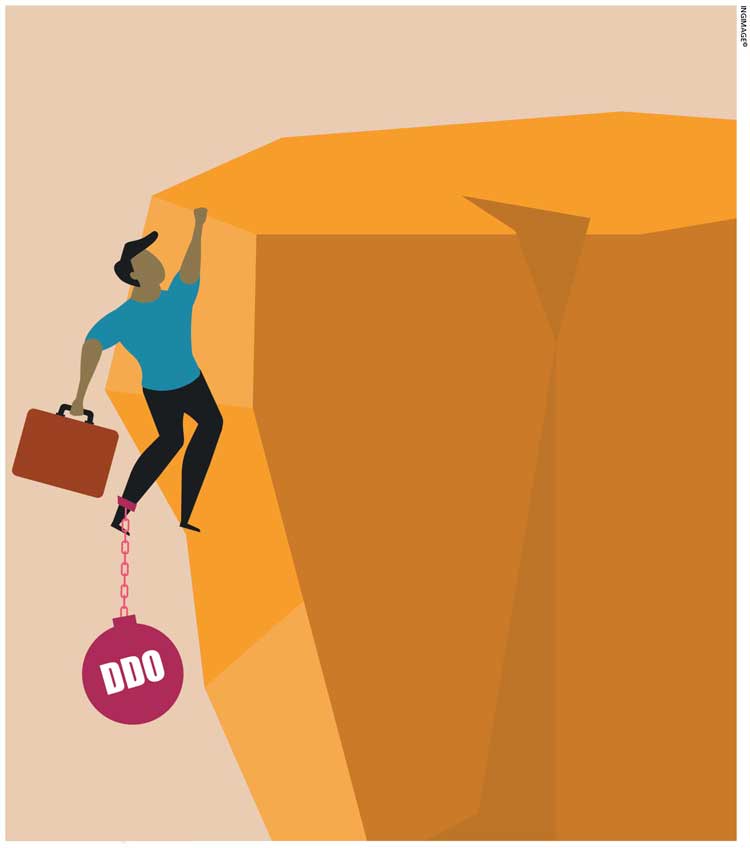

JUST DESERTS? The dreaded domestic debt optimisation (DDO) framework, which was approved in parliament on 1 July, has by and large received a seal of approval from the private sector.

Led by the Ceylon Chamber of Commerce, Sri Lanka Banks’ Association (SLBA) and Joint Apparel Association Forum (JAAF), the business community commended the architects of the DDO for protecting the banking sector amid speculation to the contrary during the countdown to D-Day.

Meanwhile, the Governor of the Central Bank of Sri Lanka is on record saying that “we didn’t want to take a risk of a run on banks,” adding that the local debt restructure plan will help reduce Sri Lanka’s debt-GDP ratio from 128 percent in 2022 to 95 percent within 10 years.

The Committee on Public Finance (COPF) approved the process too but flagged its concerns – particularly the DDO’s impact on superannuation funds and the Employees’ Provident Fund (EPF). In a Twitter post, its chairman highlighted the burden on people’s life savings, adding: “This raises questions about #equity and #transparency.”

In addition to safeguarding the banking sector, the prospect of falling interest rates in the months ahead will bolster confidence, in that businesses can look forward to securing the funds they need to tide over the squeeze on cash flows – and going forward, pursue expansion and reignite Sri Lanka’s engine of growth.

The big picture however, is that Sri Lankans continue to be punished for the sins committed by the very people they elect to run office.

Let’s not forget that as we embrace an ageing population, the so-called silver economy will rely on the pensions that working people have accumulated; and as such, it is imperative that these funds are protected in the medium to long term – even if they’re destined to realise less interest income.

As for the proposed extension of government debt – by means of exchanging treasury bonds of superannuation funds for bonds that will mature later – the fact that more than a third of the Rs. 8.7 trillion treasury bonds presently in circulation are superannuation-held tells the story of a DDO framework that we’re told is an absolute necessity if Sri Lanka’s external debt restructuring negotiations are to reach a ‘happy ending.’

Leave a comment