REMITTANCE OUTLOOK

FOREX INFLOWS TO REBOUND?

Shiran Fernando reviews foreign remittance inflows and their likely trajectory in the year ahead

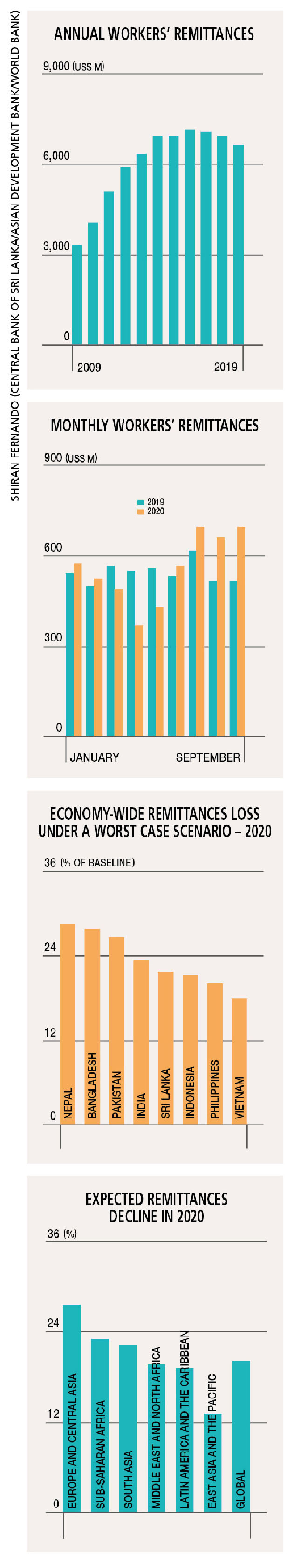

In April, the World Bank forecast global remittances to decline sharply by about 20 percent in 2020 due to COVID-19. The remittances of low and middle income countries were expected to fall by 19.7 percent due to job losses, and the vulnerability of employment and wages due to the economic crisis induced by the coronavirus pandemic.

Meanwhile, an Asian Development Bank (ADB) report in August projected that global remittances would drop by US$ 108.6 billion in 2020 in a worst case scenario and by 64 billion dollars in the baseline scenario.

According to World Bank forecasts for 2020, South Asia is expected to witness a fall in remittances of around 22 percent. Regions such as Europe and Central Asia, and Sub-Saharan Africa, are set to experience declines of 27.5 percent and more than 23 percent respectively.

ADB’s forecasts for South Asia are similar with the region projected to be worse off compared to Southeast Asia and Central Asia. In ADB’s forecast under a worst scenario, Bangladesh, Pakistan, Nepal and India are set to experience a larger fall in remittances than Sri Lanka.

The worst case scenario assumes that control of the domestic COVID-19 outbreak in a country and resumption of economic activities would take at least 12 months. But given the ongoing outbreaks, the timeline for a full recovery is uncertain in most countries.

Nevertheless, there is light at the end of the tunnel.

Similar to the bounce back anticipated by international forecasters for GDP growth next year, the World Bank expects remittances to rebound, rising by 5.6 percent to US$ 470 billion in 2021 although much lower than the 554 billion dollars recorded in 2019.

REMITTANCE INFLOWS Workers’ remittances are Sri Lanka’s largest source of foreign earnings – they amounted to about eight percent of GDP last year. Total inflows from remittances, which reached a high of US$ 7.2 billion in 2016, declined to 6.7 billion dollars by 2019. In the past, inflows helped bridge the current account deficit.

Due to the impact of COVID-19, like many other countries Sri Lanka witnessed the repatriation of migrant workers due to a loss of livelihoods, reduced pay and uncertain working conditions.

The repatriation of workers and impact of COVID-19 did result in an inflows decline over the period between March and May this year compared to the corresponding period of 2019.

However, in June, July and September, remittance inflows were higher compared to 2019 and 2018. As such, overall remittance inflows in the first nine months of 2020 were 2.4 percent higher than in the same period of the previous year.

There could be several reasons for the performance of remittances between June and September. It could have been driven by a full transfer of savings by migrant workers who were repatriated. If this was the case, the optimism around inflows growing could be short-lived.

Another reason may be that more inflows are occurring through formal channels such as the banking system.

This could be the case given the reduction in airline travel and limited ability to carry currency by hand. Furthermore, remittances could be counter-cyclical in times of crisis – i.e. migrant workers send more of their earnings or savings during a crisis to help their families back home.

PEER COMPARISON The Philippines depends heavily on remittance inflows with 8.4 percent of households receiving money from overseas. In fact, the country did witness an increase in inflows in June and July followed by a decline in August, leading to an overall fall of 2.6 percent for the first eight months.

Better than expected inflows in June and July amid a reopening of the economy saw the Philippines’ central bank revising its forecast for 2020 from a contraction of five percent to only two percent.

A similar trend was noted in countries such as Bangladesh, Nepal and Pakistan, which also saw falling remittances in March, April and May, before recovering in June, July and August. For example, in Bangladesh and Pakistan, inflows grew by 36 percent and 24 percent respectively in August compared to the corresponding month in 2019.

In August, Sri Lanka saw inflows rise by 28 percent, which explains that it too enjoyed higher forex remittances.

POLICY SUPPORT Despite the challenges that volatile remittances inflows may pose for the economy, the government will have to consider how it can support returning migrant workers by improving their social safety nets.

There could also be a need for policies to re-skill and potentially reintegrate them into the local landscape. This would be challenging given the limited job opportunities in the domestic market with industries less likely to hire in the prevailing environment.

For existing migrant workers, policy makers work towards safeguarding their rights – and of course, ensuring their safety during the pandemic.