MONETARY POLICY

POLICY REGIME UNDER SCRUTINY

Shiran Fernando notes the use of monetary policy adjustments to regain market stability

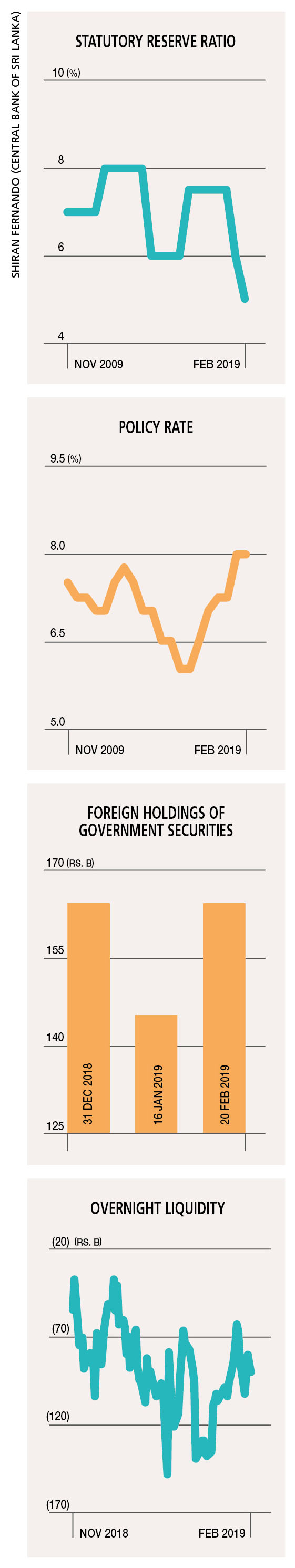

In February, the Central Bank of Sri Lanka (CBSL) revised the share that commercial banks are required to place with the monetary authority shortly after a reduction of it in November 2018.

The rate, more commonly referred to as the Statutory Reserve Ratio (SRR), was cut from six to five percent when CBSL’s Monetary Board met in February. Back in November, it was reduced by 1.5 percent.

MARKET SIGNAL CBSL may decide to cut the SRR to increase rupee liquidity in the market and thereby ease pressure on rates. Conversely, it may choose to raise the SRR if the opposite scenario were to arise – i.e. when there’s excess liquidity in the market.

At present, the Central Bank is coping with a consistent deficit of rupee liquidity in the interbank market. The reduction of the SRR is expected to release a larger quantum of rupee liquidity into the banking system. In theory, this is expected to translate into lower rates in the market given the increase in supply and eventually, the cost of funds.

Last November, there was a deficit in the market similar to what prevailed when the February cut was announced. The SRR revision in November released around Rs. 90 billion in terms of rupee liquidity. However, the deficit was only temporarily bridged; and it expanded to its previous level a few weeks later.

The Central Bank then had to resort to open market operations (OMOs) to manage the liquidity shortage until the subsequent one percent rate cut in February, which was expected to release another 60 billion rupees into the system.

NEUTRAL POLICY Despite changes in the SRR, CBSL maintains that it is pursuing a neutral monetary policy.

While it did cut the SRR in November, CBSL simultaneously raised the policy rate for deposits and lending. Short-term money market rates that were close to the higher upper bound – i.e. the policy lending rate (Standing Lending Facility Rate) – were also factored into February’s SRR cut.

The two adjustments with only a break of one monetary policy review (no change in December 2018) highlight a concern in terms of managing the dual problem – viz. pressure on interest rates to trend upwards and a weakening currency. It was also a surprising move given how temporarily the benefit of November’s SRR cut was felt.

However, the pressures of debt refinancing – such as fulfilling the US$ 1 billion sovereign bond that was due on 14 January using reserves – do not help the Central Bank and limit the impact of tools available to quell the shortage in market liquidity.

GROWTH CONCERNS Another concern that the Central Bank highlighted in its February statement referred to modest growth expectations.

The regulator expects subdued growth for the fourth quarter of last year, which was also impacted by political instability in the country. According to the CBSL, 2019 growth is expected to be ‘modest.’ As such, with growth below expectations, the future direction of monetary policy looks constrained.

Also, CBSL cannot raise policy rates to meet a liquidity shortage as this may come at the risk of increasing borrowing rates for investment or consumption. This could discourage investment or consumption led growth at a time when growth is subdued.

However, raising policy rates may come at the defence of the currency, which is sensitive to global market conditions. The Central Bank will also find it difficult to cut rates in the face of tight market conditions. And an easing of policy rates could spur demand side consumption resulting in an increase in imports, which may negatively impact the balance of payments position.

The direction of fiscal policy could further complicate the monetary policy trajectory. At best, maintaining a neutral monetary policy would be appropriate at present.

GLOBAL MARKETS Emerging markets faced unfavourable global financial market conditions for most of 2018. But this changed in the fourth quarter and has continued into 2019. Sri Lanka has also benefitted from foreign inflows returning to the bond market.

Low expectations for future Fed rate hikes have been a key reason for emerging markets to look favourable. This environment could remain positive if these expectations continue, and the impact of Brexit and the US-China trade war is somewhat muted.

In the last five years, the cycles have indicated that markets can be volatile with swings that are both positive and negative for emerging markets.

THE BIG PICTURE Monetary policy is delicately placed for the remainder of 2019 with a neutral policy to be tested – and the outcome to be based on the direction of fiscal policy, debt repayments and growth.

The performance of emerging markets is another factor that is worthy of consideration.