ONLINE BANKING

NEOBANKS ON THE HORIZON

Taamara de Silva notes that digital only banks will be the future of banking

While the digital revolution is disrupting the relationship between banks and clients, the advent of the pandemic accelerated the adoption of contactless banking and remote access through digital channels. And though traditional banks have only gradually embraced technology, online banks have disrupted the banking space with a pure mobile offering.

For most of us, banking has been synonymous with a branch, long queues and paperwork involved with every transaction. Not anymore! New digital only banks, also known as neobanks, are increasing their market share across the globe.

For most of us, banking has been synonymous with a branch, long queues and paperwork involved with every transaction. Not anymore! New digital only banks, also known as neobanks, are increasing their market share across the globe.

Even though the key demographic that favours such banks are millennials and gen Z, we’re experiencing a paradigm shift towards online-based services that can be easily offered through digital only banks.

With the limitations placed on physical interaction, banks are left with little or no choice but to adapt to contactless banking. Since it’s commonly accepted that familiarity breeds satisfaction even after the pandemic recedes, people may continue to rely on neobanks – and thus make branch networks and in-person banking redundant.

The speed of change is key for most large banks as they try to adopt and compete with burgeoning fintech apps and digital only banking solutions.

Since the lockdowns, there’s been a 72 percent rise in the use of fintech apps in Europe, according to a study conducted by Ernst & Young. Among the reasons cited is the swift and seamless on board process, which is a primary differentiator from traditional banks.

However, digital engagement is a double-edged sword for banks. Even though digital services are functionally adequate, they lack personalisation and emotion that forge strong customer relationships.

Unlike typical banks that have plush corporate offices, extensive branch networks and an abundant workforce, digital online banks hardly require physical branch offices and the personnel costs to staff them. Therefore, their overheads are greatly reduced, and neobanks can offer customers lower fees and higher interest rates on deposits.

The value proposition of digital only banking is greatly enhanced as these banks leverage the cloud to further reduce capital expenditure and gain agility over traditional banks, with their on-premises data centres, networks and legacy application infrastructure.

Moreover, digital banking appeals to young audiences in particular as they begin their careers or are still in school – and they will eventually be the heirs to inter-generational wealth. Either way, they’re always on the go and are extremely comfortable with performing tasks on their smartphones.

For instance, the success of Alibaba’s Ant Financial in China, which serves small enterprises, has grown into a US$ 20 billion business in two years and illustrates the value of a bank/e-commerce union. Offering simple ways to obtain loans, Ant Financial has rapidly become one of the biggest lenders to small businesses in China.

With the mass proliferation of smartphones and apps, banks will need to invest in improving the digital experience and provide personalised services to retain loyal customers.

Commodities are products that have high degrees of standardisation, price transparency and easily accessible alternatives. This is precisely what we are beginning to see in the financial services industry too. The sooner banks realise that they’re caught in the commodity trap, the better off they are.

While the situation looks bleak, there are two mutually exclusive approaches that traditional banks can take: they can either accelerate their innovation trajectory or fully embrace being a commodity player.

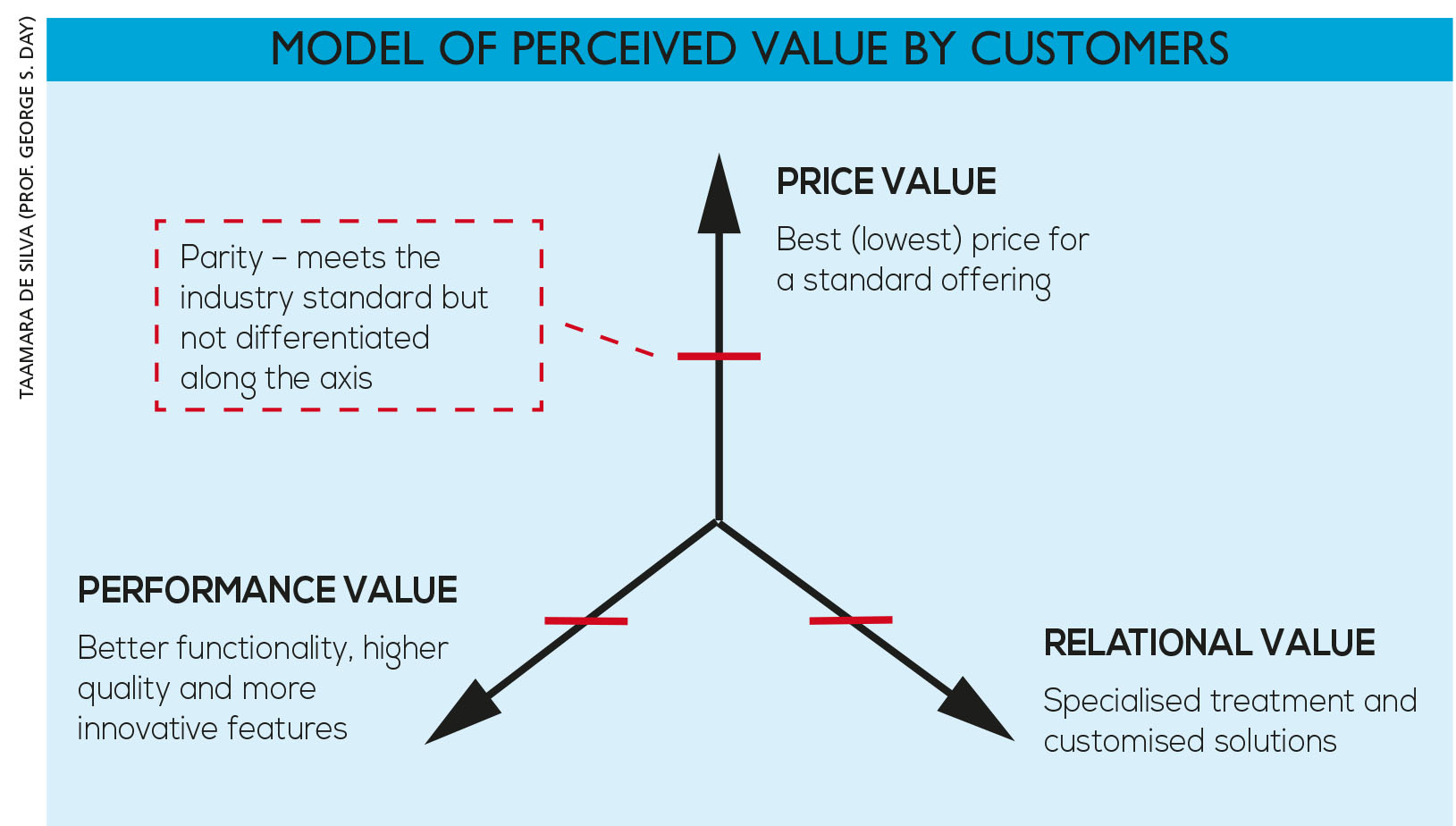

The model introduced by Prof. George S. Day demonstrates how customers perceive value for a given product. By standing out along any of the three axes and maintaining a parity position along the other two, a bank can start to differentiate itself from competitors and substitutes.

For traditional banks however, there’s marginal room for price-based competition due to decreasing margins and increasing price transparency. Furthermore, performance-based innovation is highly unlikely due to the availability of existing third party services.

What banks should ideally do is leverage their existing brand and customer base to deepen their relational value. They need to drive engagement across the customer relationship life cycle. Self-service options, mobile ATMs, and tie-ups with third party merchants and institutions, can be alternatives to their bricks and mortar distribution network.

Despite the stiff competition from neobanks, traditional banks still have a fantastic opportunity to thrive if they can retain the trust of customers and effectively utilise their capital to implement the right strategies.

Central to success is advanced technology and a digital ecosystem, which takes costs out while delivering better products and customer experiences.