OIL-WAR NEXUS

RADAR ON THE PRICE OF OIL

Samantha Amerasinghe believes that oil prices could rise amid conflict

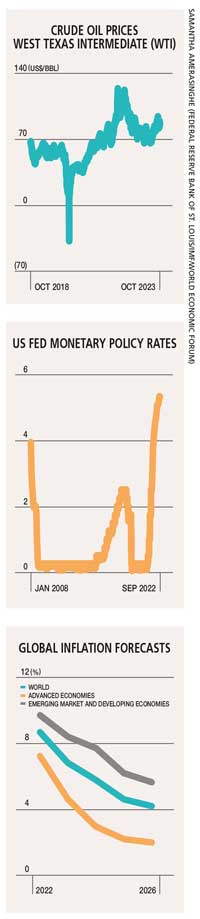

An escalation of the Hamas-Israel conflict has reignited fears that the price of oil could breach the US$ 100 a barrel mark. Central bankers are worried that this could threaten their efforts to tame high inflation in the coming months. A further concern is that recession is often caused by sharp increases in oil prices.

Meanwhile, the IMF estimates that a sustained 10 percent increase in the price of oil shaves 0.15 percentage points off global economic growth and adds 0.4 points to inflation in the following year.

The best case for the world economy is that the war is contained to an Israeli ground assault on the Gaza Strip and the price of oil stabilises around its recent level of 80-90 dollars a barrel.

A second scenario would involve a broader regional war that drags Iran into the conflict eventually, and creates major global risks by disrupting energy supplies and pushing oil prices up – potentially to US$ 150 a barrel.

This could send inflation back to double digits in the US and Europe, and the threat of a global recession may prompt central banks to cut interest rates.

At the end of October, oil and gas flows from the Middle East remained largely unscathed. Nevertheless, there are concerns that rising regional tensions could block the Strait of Hormuz, which is a key transit route for seaborne cargo of oil and gas from the Middle East to the global market. This could drive oil prices higher.

At the end of October, oil and gas flows from the Middle East remained largely unscathed. Nevertheless, there are concerns that rising regional tensions could block the Strait of Hormuz, which is a key transit route for seaborne cargo of oil and gas from the Middle East to the global market. This could drive oil prices higher.

The chief concern is not about a shortage in oil supplies as such but the transport of liquid gold to market through the Strait of Hormuz in the Persian Gulf. This passage is a vital energy channel for international markets, and more than 20 percent of the oil consumed globally and a third of the world’s seaborne gas shipments move through this strait.

Europe’s gas supplies from Qatar, which is the world’s leading exporter of LNG and a longstanding supporter of Hamas, could come under severe stress if Iran seeks to block the route. Qatar is Europe’s second largest source of LNG after the US.

Last year alone, around 16 percent of Qatar’s exports were despatched to the EU. These supplies have become even more crucial as the EU stopped pipeline gas imports from Russia due to the war in Ukraine.

Israel does not have substantial oil reserves. To exacerbate the problem however, gas flows to Egypt – which typically exports about 50 percent of its gas on seaborne tankers to Europe – have been limited due to the Israeli government shutting down production at a major gas field off its southern coast.

This stoked fears about LNG supplies to Europe despite its record high levels of gas storage for the winter.

According to market watchers, the US may soon toughen its sanctions on exports of oil from Iran due to Tehran’s close ties to Hamas and Hezbollah. Some experts believe there is a 25 percent chance that Iranian oil output could fall by a million barrels a day as a result of such sanctions.

Similarly, a slump in Russian oil output for the same reasons could lead to higher oil prices next year. But if Saudi Arabia, which is restricting its output, increases its exports to help steady the market, the impact of these sanctions could be eased.

Riyadh, which is the Middle East’s largest oil and gas producer, will have a critical role to play. According to the International Energy Agency (IEA), Saudi Arabia is now producing about nine million barrels of oil a day. Russia, which is a key ally of OPEC+, has a similar production capacity.

For major oil and gas producers, higher prices will bring rich economic rewards – but only to a certain extent.

If prices move substantially above 100 dollars a barrel, the high cost will likely cause economic activity to slow down and curb the demand for oil. This could be favourable for Saudi Arabia as it would be an incentive to increase production and rein in prices.

The stakes are high for both the US and Russia.

Rising oil prices could spell defeat for President Joe Biden at the US presidential election next year while for Russia, higher oil prices are vital to shore up its coffers as it continues its war in Ukraine.

Many factors could disrupt the current demand and supply dynamics as the world heads into 2024. According to the IEA, we are going to witness ‘demand destruction’ with global oil demand set to grow at a slower pace next year due to difficult economic conditions and greater energy efficiency (such as the increase of electric vehicles) hitting consumption.

Though the global economy is not as dependent on oil as it was in the 1970s, it still matters – and as these multiple crises unfold, markets will continue to remain anxious.

Leave a comment