MOST VALUABLE CONSUMER BRANDS

PROFILE

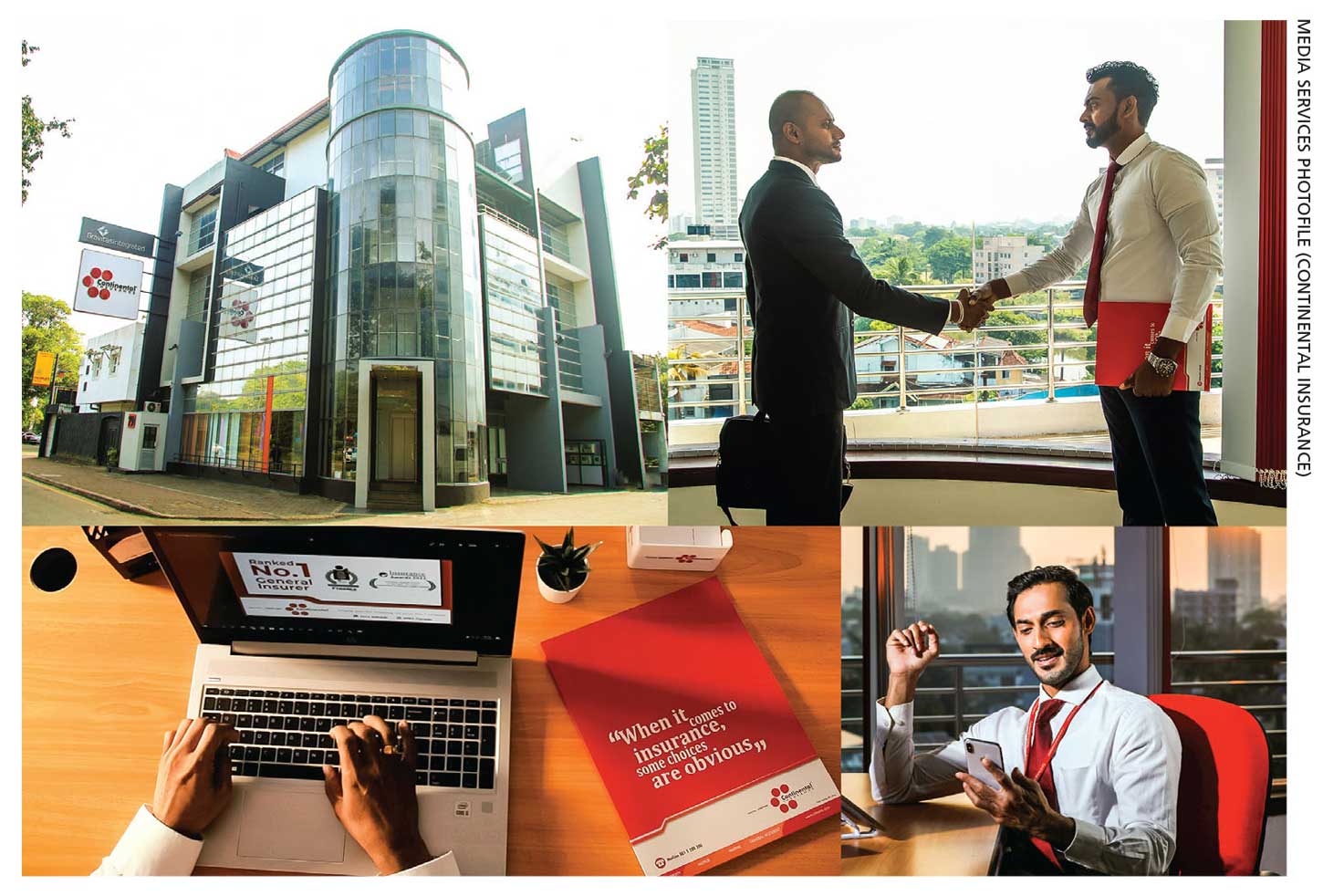

Continental Insurance

Q: How would you trace the brand history and strengths of Continental Insurance (CILL)? What is the growth potential in the market for your brand?

A: CILL is a relatively young brand in the insurance sector. At the time of its launch over a decade ago, we took the bold step of creating our own brand rather than piggybacking on the strength of our parent. This was contrary to what was generally practised in the financial services industry.

After 13 years, and with assets over Rs. 10 billion in our balance sheet and a significant market share, we have proven that our brand identity and values are well recognised by customers.

Maintaining a strong brand image throughout is one way of doing this – however, branding alone will not create brand loyalty

The organisation has always made substantial investments in improving our customers’ experiences through enhancing infrastructure, educating staff and continuously monitoring the customer experience.

Even though the ongoing economic crisis has eroded the disposable incomes of our customers and made them more price sensitive, the recent shift in consumer spending patterns – towards more responsible spending – is favourable for enterprises such as ours.

In 2022, CILL ventured into life insurance in the belief that our brand is mature and strong enough to carve out its own space in Sri Lanka’s life insurance sector.

Q: How did your organisation navigate the economic crisis?

A: The financial services industry was one of the most adversely affected by the economic crisis. As an insurer, it’s fundamentally important for us to preserve customer confidence in our brand and for customers to trust us with their hard-earned money.

Since inception, our strategy has been to build resilience and the financial strength of our business by implementing a disciplined approach to building our insurance portfolio, as well as our investments, which prepared us well for the challenges of the past few years.

Some of our business segments were affected by the economic crisis. However, we remained focused on segments that were less affected. Despite the economic crisis, we reported the highest growth in revenue in our history – in 2022 – and managed to add a few of the most prestigious clients to our portfolio, which is a testimony of our reliability as an insurer that’s appreciated by leading corporates.

CILL’s growth and service during the recent challenging times were recognised internationally with the bestowal of the ‘Fastest Growing Non-life Insurance Company Sri Lanka’ recognition at the Global Banking and Finance Awards 2022 and the ‘Domestic General Insurer of the Year – Sri Lanka’ accolade at the Insurance Asia Awards 2022.

Q: What is your assessment of the ongoing economic crisis on brands and branding?

A: Traditionally, it has been common for branding to take a backseat during tough times. However, we believe that as with building a financial buffer, businesses also need to continue accumulating strong brand capital to have a stronger chance of navigating challenges during and after a crisis. The ongoing economic crisis will shape the way customers and businesses behave on the way forward.

Q: What role can brand investments play in accelerating business recovery in the prevailing macroeconomic environment?

A: The financial services industry is one of the most sensitive to the economic crisis. Therefore, building trust among our customers in times such as these is crucial for sustaining growth.

Maintaining a strong brand image throughout is one way of doing this. However, branding alone will not create brand loyalty. We will continue to align our brand strategy with long-term business strategies to provide meaningful benefits to customers.

Q: In your view, what is the importance of reputation and integrity for businesses?

A: In the general insurance sector, we rely heavily on customer and policy retention for growth. Most of our products are annually renewable but continued for a longer term; and therefore, building long-term relationships with customers is a must.

The reputation and set of values that we represent play an equal role as pricing and service levels in customers’ decisions to stay with us in the long run.

And the positive aspect of this is that it enables us to capitalise on the investments made in building the underlying set of values, which the brand represents. It also allows us a degree of freedom in pricing, as well as deciding what segment of customers to build long-term relationships with.

Therefore, the display of integrity is no longer a choice. Staying true to the brand promise is a staple, which we strive to build into every aspect of our business.

Telephone 5200202 | Email chaminda@cilanka.com | Website www.cilanka.com