LMD DECEMBER 2024 – COVER STORY

Renewed Ambitions

Sri Lanka stands at a pivotal crossroads, fresh off a general election that ushered in a new administration poised to confront the lingering effects of an economic crisis.

Sri Lanka stands at a pivotal crossroads, fresh off a general election that ushered in a new administration poised to confront the lingering effects of an economic crisis.

In recent years, the nation has faced rampant inflation, crippling debt and severe shortages of essential items – challenges that are seemingly and tentatively under control, thanks to tough economic reforms and difficult policy decisions.

According to the World Bank biannual Sri Lanka Development Update – titled Opening Up to the Future – the country’s economy is stabilising with growth expected to reach 4.4 percent in 2024, surpassing earlier forecasts.

The report attributes this positive outlook to four consecutive quarters of growth, primarily driven by the industry and tourism sectors, and supported by critical structural and policy reforms.

Against the backdrop of this evolving economic landscape, David Sislen stepped into a critical role as the World Bank’s Regional Country Director for Maldives, Nepal and Sri Lanka in July.

A dual citizen of the US and Italy, he brings over two decades of leadership experience at the World Bank – including his role as a Practice Manager of Urban, Disaster Risk Management and Land in Latin America.

Armed with degrees in economics from Johns Hopkins University and geography from Macalester College, Sislen brings both analytical rigour and practical experience to Sri Lanka’s complex development challenges.

In this exclusive interview, he shares insights on a nation at the crossroads – one that is rich with potential but constrained by formidable hardships.

– Compiled by Tamara Rebeira

The journey is far from over. More is needed in the medium term…

David Sislen

Q: What were your first impressions of Sri Lanka at the time of your appointment in July – and how has your perspective evolved since then?

Q: What were your first impressions of Sri Lanka at the time of your appointment in July – and how has your perspective evolved since then?

A: Having read so much about Sri Lanka and its challenges – political and economic – over the past few years, I really didn’t know what to expect when I had the chance to visit for the first time in early July, shortly after being appointed to my new role.

But I was absolutely amazed by the resilience of both the people and economy!

The incredibly warm reception I received from the authorities reflects the close relationship between the World Bank and Sri Lanka. And I think there is a genuine sense that when times were challenging, the World Bank stood by the people of Sri Lanka, supporting difficult policy decisions that have clearly paid off.

Since then, Sri Lanka has become a real beacon for the world, demonstrating what an open, contested, free and fair election, and smooth democratic transition can look like. While I acknowledge the risks ahead, I’m extremely bullish about Sri Lanka’s future.

Q: In your view, what are Sri Lanka’s main strengths that have contributed to its image on the global stage?

A: At this moment, I think Sri Lanka has a lot of credibility internationally. The successful completion of negotiations with both official and private creditors, the smooth political transition, its strategic location in the fastest growing region of the world and an economy with substantial growth potential all contribute to Sri Lanka’s positive international image.

This isn’t to say that capitalising on these strengths will be easy.

The aftermath of the 2022 economic crisis has left many people struggling – poverty has increased, food insecurity is widespread, health outcomes have deteriorated and the urgent need to create good jobs is central to Sri Lanka’s medium-term recovery.

Sri Lanka was globally recognised in the 1960s and ’70s as a model for social services in healthcare and education, as well as its competitiveness in manufacturing and value added products. But Sri Lanka has lost significant ground – by 2020, exports were only 15 percent of GDP.

So this dual challenge of regaining export competitiveness while simultaneously taking care of the country’s most precious asset – its people, many of whom are hurting – will define the coming years for Sri Lanka, I think.

Q: The World Bank has initiated several funding programmes in Sri Lanka. What are the organisation’s immediate priorities and long-term plans for the country? And how do these align with Sri Lanka’s development goals?

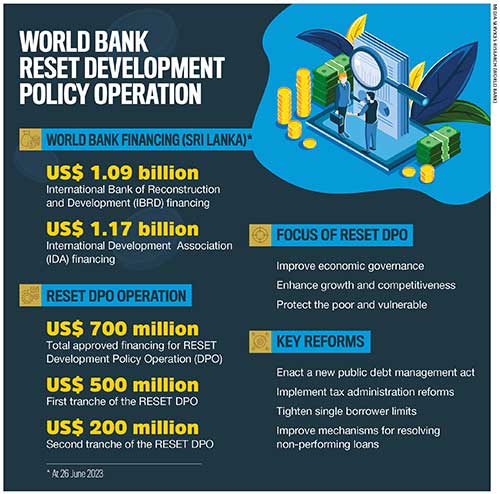

A: This is the last year of IDA20 – the three year cycle of funding for the International Development Association (IDA), which is the window of resources that Sri Lanka accesses through the World Bank.

Right now, we are working on two exciting programmes – one in the agriculture and water management space, to help support irrigation, environmental management and agricultural development; and the other that uses innovative finance to guarantee public-private investment for renewable energy independent power producers (IPPs). Incredibly cool stuff.

In the longer term, some of the areas where I think we will double down our commitment are around the energy transition and Sri Lanka’s great opportunity to bring in private capital to support renewable energy; making key investments in social safety nets and hopefully, being a partner in smart reforms to help put in place a modern safety net programme; continuing our commitment to investing in rural development, and the whole nexus of water management, environmental stewardship and agricultural sector development; and making important investments in infrastructure to unlock the potential of the economy.

Needless to say, continued engagement on macroeconomic policy matters will also surely be part of our programme.

Q: A decision was reached in September with the IDA to obtain a grant of US$ 200 million for reform efforts. How do you plan to continue supporting Sri Lanka in addressing its economic challenges and what specific initiatives do you foresee stemming from this grant?

A: The approval of this policy based loan by the World Bank’s board in early September is something that Sri Lankans should be truly proud of.

It recognises the incredibly hard work undertaken by the country’s economic authorities over the past 24 months. They have implemented meaningful and often challenging reforms, to stabilise and restore credibility to the economy.

For example, the enactment of a new Public Debt Management Act has set a robust framework for managing Sri Lanka’s debt. Meaningful strides have been taken in tax administration, financial sector policy and restructuring the debt of the two largest state-owned banks – the Bank of Ceylon (BOC) and People’s Bank.

These banks have also undergone critical reforms to enhance transparency and governance in their management. These are some of the comprehensive measures supported by our programme. And they’re significant reforms!

But as you intimate, the journey is far from over. More is needed in the medium term –addressing issues related to state-owned enterprises (SOEs), continuing to work on tax administration and compliance, and reducing leakage and losses are imperative. Keeping an eye on the financial sector with its existing vulnerabilities will be very important. These are areas where we will likely focus our support going forward.

However, nothing is more important for Sri Lanka than sustained job creating growth. Enhancing competitiveness, liberalising trade regimes, investing in service delivery and improving trade facilitation are essential steps.

And increasing female labour force participation is crucial. Currently, women in Sri Lanka are less than half as likely to participate in the labour force compared to men (32% – compared to 71% for men). We estimate that Sri Lanka has an untapped export potential of 10 billion dollars annually.

By integrating into global and regional value chains, the country could create an additional 142,500 jobs to fuel economic growth and prosperity. These efforts are not just about economic metrics; they’re about building a resilient, inclusive and prosperous future for all Sri Lankans.

Q: Given the prevailing global economic climate, what are your projections for Sri Lanka’s GDP growth over the next few years?

A: In the near term, we are projecting a robust 4.4 percent GDP growth in 2024, thanks to the impressive stabilisation efforts driven by important reforms and smart policy decisions. This reflects a strong rebound in both tourism and industry, alongside improved supply conditions.

It’s the medium-term growth path that the authorities really need to keep an eye on: the departure of skilled workers, relatively limited external financing compared to pre-crisis levels and of course, the pressing need to advance the next phase of structural reforms are all important factors.

Critical areas of focus include SOE reform and addressing pivotal tax issues – both in broadening the tax base, and tackling the tricky problems of tax administration and compliance. These reforms will be key for Sri Lanka to achieve a meaningful medium-term growth path that delivers for its citizens.

There are also big risks out there, some of them exogenous to the country – something like an extended La Niña event affecting agricultural production or a downturn in the global economy.

So the quality of policy and economic decision making will be crucial in navigating an uncertain world.

Q: The World Bank has expressed its commitment to supporting Sri Lanka’s new administration. What specific strategies or initiatives do you plan to implement in collaboration with the government to address issues faced by the vulnerable citizenry?

A: I can’t wait to start deeply engaging with Sri Lanka’s new authorities.

My first priority is to listen to them to understand their priorities and plans. By the time this interview is published, we will have had the opportunity to sit down with President Anura Kumara Dissanayake and his economic team in Colombo. I am confident that we will have fruitful discussions at the annual meetings of the World Bank and IMF in Washington D.C.

Prior to the election, I had the chance to meet members of the president’s economic team. I’ll say with all sincerity that I was deeply moved by their commitment to maintaining prudent economic policy and critically, taking concrete action to support those most affected by the crisis.

Their commitment to addressing the scourge of corruption – which has been something of an Achilles’ heel for Sri Lanka – was truly, frankly speaking, inspiring. I previously mentioned the opportunity to develop a modern well targeted safety net programme to support the vulnerable. This is crucial!

As Sri Lanka moves forward with trade openness and reforms to make the economy more flexible and export oriented, it will be critical to build a safety net that mitigates some of the near term costs of these policies.

Effective safety nets go beyond providing financial support; they help upskill people so they can contribute to higher value added industries in the manufacturing and service sectors. If this is done properly, such programmes can be highly effective.

Q: Given the challenges posed by the recent economic crisis and structural benchmarks tied to the IMF backed programme, how does the World Bank envision its role in facilitating Sri Lanka’s economic recovery?

A: The most important thing for Sri Lanka to avoid slipping back into a situation of debt distress is to achieve robust economic growth.

A 4.4 percent GDP growth is good – but not really good enough to ensure that the country has sufficient buffers to weather a serious or sustained shock.

So the primacy of the reforms – to build a more flexible and responsive economy that is open to the world and takes advantage of the competitive advantages of the island – is where we think we can be most helpful.

While we do provide some funding, our greatest value to policy makers in Sri Lanka lies in offering policy advice and being a trusted partner in helping them make smart data driven decisions.

Our role in facilitating the nascent recovery involves making strategic investments in critical sectors and providing the kind of policy guidance that fosters sustainable growth.

One of the most exciting things about our engagement in Sri Lanka is the innovative approach we are taking. Sri Lanka is one of the first countries where the World Bank Group, including the IFC (i.e. the International Finance Corporation, which is the arm of the World Bank Group that works with the private sector), has established a single office under the management of a Joint Country Representative.

We are fortunate to have an exceptional Joint Country Representative in Colombo, Gevorg Sargsyan. We’re truly excited about this innovation because we feel that it facilitates the incorporation of private sector driven development into everything we do.

Even after only a few months, it’s already bearing fruit in our support for public-private partnerships (PPPs) in renewable energy generation.

Q: In August, the World Bank Group launched its High-Level Advisory Council on Jobs to identify actionable policies and programmes aimed at addressing the employment crisis in the Global South. In view of the brain drain that is affecting Sri Lanka, are there any emerging lessons as to how it can address the looming shortage of skills and talent?

A: As World Bank Group President Ajay Banga aptly said when launching the High-Level Advisory Council, “a job is the most meaningful yardstick of success for any individual.”

This is an important reminder that beyond economic metrics such as GDP growth, there are real people who benefit from economic progress or, as we’ve seen in Sri Lanka over the past years, directly feel the impact of economic turbulence and stagnation.

And right now, the challenge in Sri Lanka is really about getting growth going even faster to create more, better jobs. This challenge is particularly acute at this moment in Sri Lanka’s history as it is in the midst of a demographic and spatial transition, from a predominantly rural and agriculture based economy to one that is modern, urbanised and service driven.

We’ve seen a very clear change in demand for the skill sets of workers in Sri Lanka and the data shows that the country simply can’t produce enough skilled workers – or keep them from moving overseas.

Of the 450,000 people who complete Grade 11 in a typical academic year, only 20 percent move on to higher education and only around a third of the rest enrol in vocational training. So basically, half of secondary school graduates are not continuing with any formal training or education. The skills challenge is central to the job creation agenda in Sri Lanka.

The World Bank’s new advisory council, which includes luminaries such as former president of Chile Michelle Bachelet and the President of the Republic of Singapore Tharman Shanmugaratnam – two countries that have shown what sustained, broad-based job creation looks like – can significantly help our efforts in Sri Lanka. Their expertise can help us focus on the necessary policy actions and investments needed right now.

Indeed, the jobs challenge in Sri Lanka is multifaceted. Beyond the need for openness and trade, sharp reforms in governance and transparency, addressing skills gaps and removing barriers to female labour force participation are equally important.

By focussing on these areas, Sri Lanka can create a robust job market that supports its economic transition and benefits all its citizens.

Q: And in what ways can the World Bank provide tailored support to the new administration in Sri Lanka to help achieve its development goals?

A: As I mentioned earlier, the most important thing for an institution such as ours – a member owned development cooperative – is to listen to Sri Lankans.

The people of Sri Lanka understand their country’s critical development challenges far better than we do. Our role is to help them achieve their aspirations!

Given the current context, macroeconomic policy issues will undoubtedly be a significant part of what the new government seeks from us. However, I also expect that we will continue to address some of the most pressing challenges of our times.

This includes tapping into the emerging world of climate finance to support Sri Lanka’s green energy transition, using innovative financial tools such as de-risking instruments and PPPs to attract more private investment, and making investments in resilience and climate change adaptation to reduce risks and prepare for inevitable events.

We also aim to address the critical issue of skills development to build a labour force capable of unlocking the potential of the manufacturing and service sectors, and building 21st century infrastructure for service delivery and competitiveness.

And since we are a truly global institution, our relationship with Sri Lanka is not only about money and investment. It is also about the knowledge and convening power we bring by curating information, and connecting policy makers and civil society from our 183 member states. These are exciting times for our relationship with Sri Lanka!

Leave a comment