LMD 100 SECOND BOARD | 2022/23

SECONDARY LISTING TRIUMPH

Sri Lanka’s secondary listing of leading listed companies is a testament to corporate resilience in tough times

At the end of October 2023, the Colombo Stock Exchange (CSE) consisted of 290 companies – categorised as 20 Global Industry Classification Standard (GICS) industry groups – with a combined market capitalisation of Rs. 4,296 billion.

The annual edition of the LMD 100 (i.e. the ‘First Board’) showcases the top 100 companies based on their reported revenue. And the LMD 100’s ‘Second Board’ features the next ranked 50 companies on the same basis.

In financial year 2022/23, Swisstek (Ceylon) helmed the LMD 100 Second Board with an annual turnover of Rs. 8.9 billion. However, it dropped 15 places from its previous No. 86 ranking on the First Board in the preceding year. Its post-tax loss of Rs. 703 million compares unfavourably with the profit after tax (PAT) of 900 million rupees recorded in financial year 2021/22.

Securing the second position is HDFC Bank of Sri Lanka, which held the 100th spot on the First Board in financial year 2021/22. HDFC enjoyed a substantial increase in revenue to Rs. 8.8 billion, marking a 27 percent surge from the previous year’s seven billion rupees.

Watawala Plantations has made a notable climb from fifth position in the LMD 100 Second Board in 2021/22 to secure third place in the latest edition of the annual rankings. The company recorded a substantial 35 percent increase in its top line, rising from Rs. 6.4 billion in 2022/23 to 8.7 billion rupees.

In fourth position is Lankem Developments, which catapulted up the LMD 100 Second Board rankings from 26th place in the preceding year. In financial year 2022/23, the company reported an impressive 89 percent increase in revenue, yielding a net profit of Rs. 8.5 billion compared to 4.5 billion rupees in the previous review period.

Completing the top five on the LMD 100 Second Board is Agarapathana Plantations, a newcomer with an impressive 91 percent increase in turnover. The company’s top line rose from Rs. 4.4 billion in 2021/22 to 8.5 billion rupees in the latest financial year.

In sixth position is Kotmale Holdings, making a significant ascent on the Second Board from its 29th ranking in financial year 2021/22. Kotmale recorded a noteworthy 95 percent increase in revenue, surging from Rs. 4.3 billion to 8.4 billion rupees.

Asian Hotels and Properties’ ascent on the LMD 100 Second Board is noteworthy too; it moves up from No. 33 to seventh place in financial year 2022/23. This marked a 106 percent spike in its top line although the bottom line only improved slightly by recording a loss after tax of Rs. 333 million compared to the 508 million rupees in the previous financial year.

Aitken Spence Plantation Managements secures eighth place with its revenue exceeding Rs. 8.3 billion – a notable increase from the five billion rupees reported in the preceding financial year. It recorded a 64 percent spike in revenue.

Elpitiya Plantations has also made significant progress in the rankings to No. 9 by moving up eight spots. In financial year 2021/22, the organisation held 17th place on the LMD 100 Second Board. Its advancement in the 2022/23 pecking order is attributable to a robust revenue of Rs. 8.3 billion and a PAT exceeding 1,831 million rupees.

Rounding off the top 10 in the secondary listing of LMD 100 entities is Three Acres Farms, which climbs nine places on the Second Board. The company reported a revenue of Rs. 8.3 billion, marking a 71 percent increase from its previous financial year’s tally of 4.8 billion rupees.

The cumulative income of the latest LMD 100 Second Board surpassed Rs. 331 billion, which reflects a substantial 35 percent increase compared to the previous year’s 245 billion rupees.

In the financial year 2022/23, cumulative post-tax profits exhibited robust growth of 38 percent, surging from over Rs. 29 billion to 42 billion rupees.

Total assets also appreciated substantially, increasing by 15 percent from Rs. 587 billion to 674 billion rupees. And shareholders’ funds rose by 12 percent, to exceed Rs. 255 billion in the period under review.

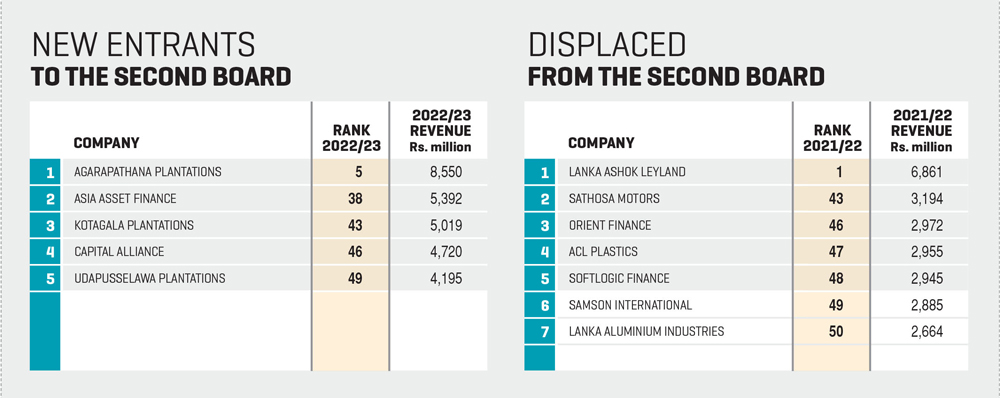

The 2022/23 LMD 100 Second Board welcomes five new entrants – namely Agarapathana Plantations, Asia Asset Finance, Kotagala Plantations, Capital Alliance and Udapusselawa Plantations.

Meanwhile, seven entities have been displaced from the LMD 100 Second Board in 2022/23 – viz. Lanka Ashok Leyland, Sathosa Motors, Orient Finance, ACL Plastics, Softlogic Finance, Samson International and Lanka Aluminium Industries.

The LMD 100 Second Board for financial year 2022/23 displays a predominant presence of the food, beverage and tobacco sector comprising 24 entities. Diversified financials count for five representatives while the insurance sector is represented by five. The consumer durables and apparel sectors account for four, and materials, capital foods and healthcare equipment and services for two each. Banks, consumer services, retailing, utilities, and household and personal products each have one representative on the Second Board.

Notably, the healthcare equipment and services, as well as the consumer services sectors, each have a single entrant on the Second Board of the 2022/23 LMD 100.

FOOTNOTE Public companies incorporated under the Companies Act No. 7 of 2007 or any other statutory corporation – incorporated or established under the laws of Sri Lanka or any other state (subject to exchange control approval) – are eligible to seek a listing on the CSE to raise debt or equity. Companies desiring to be admitted to the official list of the exchange and secure a listing of their securities will be required to comply with the relevant provisions of the above act and the Securities & Exchange Commission Act No. 36 of 1987 (as amended) and Listing Rules of the Exchange.