LMD 100 Q&A

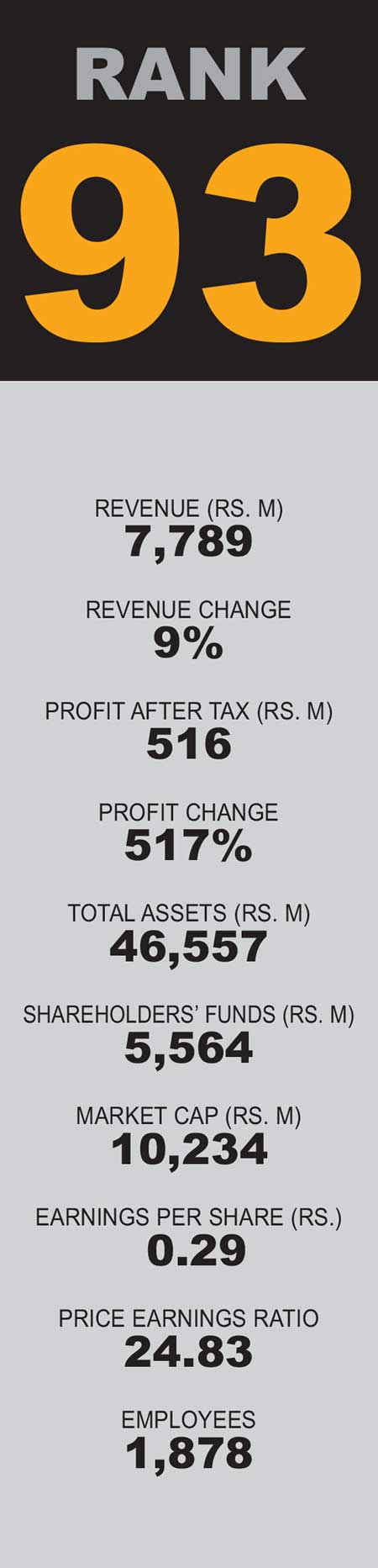

HNB FINANCE

Q: What are your key achievements in 2022?

A: The main achievement for HNB Finance (HNBF) in 2022 was the acquisition of Prime Finance – a high performing, ‘A’ rated finance company and subsidiary of the Prime Group, which is the market leader in Sri Lanka’s housing industry.

HNBF acquired a new product range by our acquisition of Prime Finance. We were able to venture into previously untapped markets such as micro-leasing and strengthen our presence in the housing loan market though mortgage-backed loans.

In 2022, HNBF achieved a significant improvement in non-performing advances with credit quality improving substantially. We offer a diversified portfolio that includes microfinance, auto and micro-leasing, gold loans, and property and business loans.

Q: What is the role of corporates in Sri Lanka’s economic revival, given the multiple crises we have faced recently?

A: Corporates have an important role to play in an environment of prevailing economic uncertainty. They can ensure job security of employees and protect the entire value chain consisting of suppliers and customers to the greatest extent possible.

Corporates can also influence policy makers to formulate policies to safeguard the industry while promoting the national economy.

Moreover, businesses can add value to existing products targeting exports while finding international markets to earn foreign exchange.

Q: What are your organisation’s priorities for the medium term?

A: A key ongoing focus is to accelerate digitalisation to achieve our vision. This will help achieve financial inclusion to support the base of the pyramid and lower income earning customers, and improve their lives and livelihoods.

Now, HNB Finance has a solid technology foundation to take the company into the future, supporting further innovation to expand service offerings and reach more customers across Sri Lanka. Our new infrastructure enables us to sustain ongoing business growth while delivering our services more efficiently and cost-effectively.

We will leverage on our resources to consolidate our business performance and financial stability.

Q: Should sustainability and business performance go hand in hand?

A: I strongly believe that sustainability should be a prime goal for businesses. As a responsible financial institution, we at HNBF have made sustainability a main pillar in our strategic business plan and many initiatives are being planned.

As Sri Lanka’s leading integrated financial services provider, HNBF has been ranked among Sri Lanka’s 100 most valuable consumer brands by Brand Finance for the second consecutive year, reflecting the strong trust placed in us by the public and our stability.

HNB Finance was also ranked among the Top 10 Best Workplaces in Banking, Financial Services and Insurance in Sri Lanka in 2021.

Q: What is your take on the country’s risk profile?

A: Sri Lanka was downgraded by rating agencies in 2022 and therefore, negotiations with the IMF are of paramount importance in establishing collaboration with the World Bank and Asian Development Bank to secure further financial assistance.

Managing Director/CEO

There are no shortcuts to revive the current economic deterioration in the economy. The high interest regime that prevails currently is not sustainable for the financial sector and any further downgrades of our sovereign rating will severely impact it.

Q: How do you view the value of the rupee – and where do you see it heading in 2023?

A: The current cross currency rates against the rupee are at very high levels. This will depreciate further unless and until we receive some foreign direct investment (FDI) receipts, employee remittances, and foreign exchange earnings through tourism and exports.

Q: How can Sri Lanka improve its ease of doing business and competitiveness on the international stage?

A: Existing red tape in the way of establishing businesses should be cut down as quickly as possible. The nation needs stable governmental policies that are standardised and long-term in nature to attract investors, who can also be wooed with incentives.

Public infrastructure needs to be developed as well. Further, legal and compliance processes should be simplified as far as possible. Basically, all systems should be modified through digitalisation and process improvements to improve investor confidence.

There are no shortcuts to revive the current economic deterioration in the economy – the high interest regime that prevails currently is not sustainable

Telephone 2176262 | Email info@hnbfinance.lk | Website www.hnbfinance.lk