INSURANCE SECTOR

PREMIUM PROTECTION

Compiled by Yamini Sequeira

WANTED: COHESIVE GROWTH

Jude Gomes believes the delivery of insurance solutions will be transformed

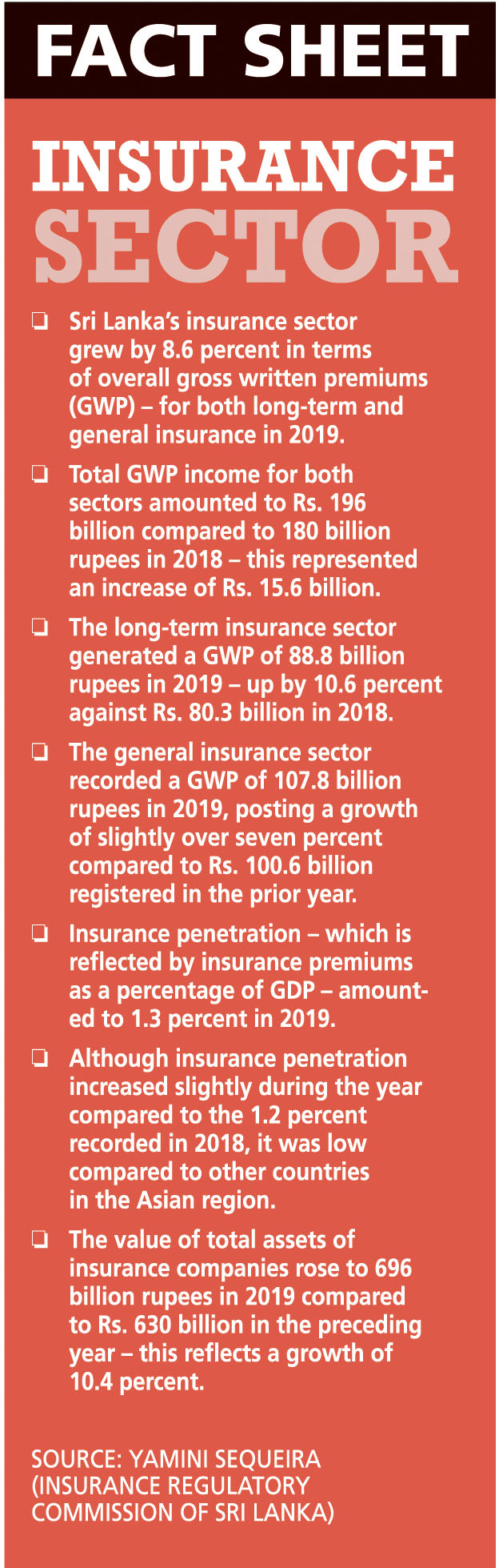

A relatively low level of insurance penetration compared to regional markets, expected rising income levels and an ageing population bode well for the growth prospects of Sri Lanka’s insurance sector in the medium to long term.

In the past year, the sector fared reasonably well amid the growing need for protection.

Casting a look back on the tumultuous year gone by, Jude Gomes states: “It goes without saying that 2020 was a challenging year for many industries with limitations on doing business as usual. Last year was one for responding to and recovering from the crisis, the headwinds of which will impact us as we navigate 2021.”

Casting a look back on the tumultuous year gone by, Jude Gomes states: “It goes without saying that 2020 was a challenging year for many industries with limitations on doing business as usual. Last year was one for responding to and recovering from the crisis, the headwinds of which will impact us as we navigate 2021.”

“With the vaccine taking effect later in the year in Sri Lanka, we can expect a significant drag on economic growth,” he adds. Given the dynamics of the market, he feels that a focus on diversified channels, innovative product suites and leveraging advances made in digital adaptation will help capture growth potential.

SCALING BARRIERS Commenting on the opportunities he sees in the market for general and life insurance, Gomes says: “Emerging markets are forecast to recover to pre-pandemic levels in 2021, according to Deloitte’s insurance outlook (from December).”

“In the Sri Lankan context, we have witnessed a greater appreciation for protection in life insurance following COVID-19,” he remarks, adding: “We also see the impact of the economic environment benefitting this sector by commoditising life insurance and making it comparable to competitive banking products.”

Gomes continues: “Insurance products that couple protection and investment are sought after as they have the potential to realise better returns, and thereby signal potential in the short to medium term.”

Aspects of economic growth, sociocultural factors and financial literacy have been barriers to sector expansion, as he explains: “Consider the impacts of economic growth – insurance is considered to be the last item on priority lists. This explains why insurance penetration is high in markets with high economic growth and vice versa.”

“Where Sri Lanka is concerned, the aged have the comfort of care and protection from loved ones rather than protection afforded through financial instruments. However, penetration is greater now as there seems to be more awareness and a need to maintain independence in later life,” Gomes elaborates.

In his view, financial literacy is low compared to developed markets where insurance penetration is high. This is an important factor for improving insurance consciousness and awareness across society.

STRATEGIC MOVES Gomes believes that there are three key strategies to driving the insurance sector.

He remarks: “In Sri Lanka, insurance is highly dependent on a push strategy that relies largely on advisers. While we acknowledge the advances made in digitalisation, we understand that this market is going to be manpower dominated for the foreseeable future. Therefore, cohesive strategies should be in place to attract and retain the right talent.”

And Gomes firmly believes that omni-channels represent the future of insurance. Another key strategy is to create efficiencies around operations and delivery platforms, making the entire buying cycle convenient, effortless, fast and transparent.

“The current complexities associated with insurance products lead to a longer buying process, and issues associated with trust and product understanding,” Gomes says, while maintaining that “insurers also need to address the last mile issue, and make the claims process seamless and swift. They need to invest in superior platforms to reach and service customers throughout their life cycle.”

On the whole, he believes the market for health insurance in Sri Lanka has great potential: “The private sector is expanding its presence in the healthcare market to reduce the burden of medical funding and healthcare infrastructure as seen in Sri Lanka’s public sector.”

He adds: “On the other hand, we have a high rate of noncommunicable diseases (NCDs), which is fuelled by tobacco use, unhealthy diets, the harmful use of alcohol and physical inactivity.”

Gomes is of the opinion that these interrelated factors augur well for the insurance sector. Sri Lankan corporates have begun to focus on employee wellbeing, even more so in the current context as a part of retention efforts. As a result, insurance players have an opportunity to cater to employee health requirements too.

Gomes is of the opinion that these interrelated factors augur well for the insurance sector. Sri Lankan corporates have begun to focus on employee wellbeing, even more so in the current context as a part of retention efforts. As a result, insurance players have an opportunity to cater to employee health requirements too.

By and large, the market has a dearth of technical expertise. The role requires analytical capabilities and communication skills, both of which are in high demand but low in supply.

THE NEW NORMAL Meanwhile, lockdown and physical distancing protocols have disrupted the physical interaction of insurance distribution. This initially affected new business in the early stages of the crisis. Much of the renewal collections came through physical channels as digital payments were not too popular before the pandemic.

Gomes cautions that the economic slowdown and market volatility may impact premium growth prospects in the foreseeable future, and competition may intensify for market share in a shrinking customer segment.

A survey of 8,000 respondents across eight markets in the Asian region unveils a positive perception of the sector driven by a realisation of the importance of life and health insurance, the response of insurers to the crisis, and increased awareness of personal needs and protection gaps.

This may hold true in the Sri Lankan context as well.

Assessing the fallout of COVID-19 on the economy, Gomes cautions: “The stimulus measures, and actions to curb the trade deficit and capital outflows, are expected to combat the immediate deflationary shock; but they will need to be managed effectively in the medium to long term.”

“Sluggish credit growth is expected with enterprises that have stalled as a result of the economic impact on the services and industry sectors, which account for over 90 percent of Sri Lanka’s GDP,” he notes.

“Sluggish credit growth is expected with enterprises that have stalled as a result of the economic impact on the services and industry sectors, which account for over 90 percent of Sri Lanka’s GDP,” he notes.

And Gomes says that “effective economic recovery is vital to swiftly close the gap caused by the pandemic, and stabilise incomes and standards of living.”

Job losses and pressure on per capita income caused by weak economic growth could inhibit insurance penetration, and impede sustainable growth. With the mass market expected to shrink, insurance players will compete for a small segment that can afford life insurance – and this could drive prices up in a low demand environment in the short to medium term.