INFRASTRUCTURE INVESTMENT

CLOSING THE FUNDING GAP

Samantha Amerasinghe explains the role of infrastructure in boosting growth

Infrastructure will be the key to economic recovery in the post-pandemic era. It is a pivotal time for the sector globally as governments call for more spending on infrastructure (i.e. from bridges to power grids) to help kick-start economies that have been subdued due to the pandemic.

The low interest rate environment should help as it means financing is cheap but infrastructure remains greatly unfunded everywhere. Asia still faces a large infrastructure funding gap.

The low interest rate environment should help as it means financing is cheap but infrastructure remains greatly unfunded everywhere. Asia still faces a large infrastructure funding gap.

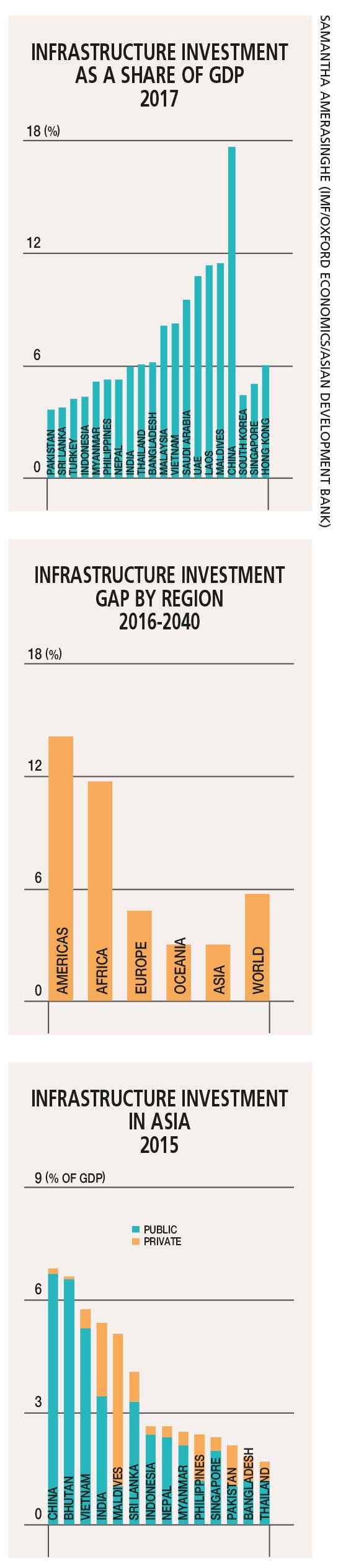

Nevertheless, it’s not only Asia that faces this dilemma. Even highly developed economies such as Europe and the US in particular – where private investment in infrastructure remains well below optimal levels – need to address this challenge. China is the exception.

We analyse the crucial role that the public sector will need to play in not only continuing to fund infrastructure but also in attracting risk averse private sector investors.

There is little argument – at least in Asia – on infrastructure investment’s role in boosting productivity and growth. Infrastructure’s role has become even more pronounced as governments grapple with the economic fallout from COVID-19.

Maintaining robust infrastructure investment is needed to get workers back to work, offset the collapse of domestic and export demand, and attract investments from global companies seeking to reorient supply chains away from China due to the Sino-US trade conflict.

Although the main drivers of Asian infrastructure investment – i.e. urbanisation, a growing middle class and the desire to link more closely with foreign markets – have not changed, COVID-19 will likely accelerate infrastructure building to support digitalisation and enhance renewable energy, which has increased its share of power generation since the pandemic began.

The ‘developing Asia’ region (excluding advanced nations such as Japan) will need to invest US$ 1.5 trillion a year on infrastructure (power, transport and communications) between now and 2030 (a total of 22.6 trillion dollars), according to the Asian Development Bank (ADB). This greatly exceeds the US$ 880 billion actually spent annually on infrastructure in 25 leading Asian countries.

Asia’s infrastructure deficit mirrors the world. McKinsey points out that the world presently invests 2.5 trillion dollars a year on infrastructure but needs to raise this to at least US$ 3.3 trillion annually between now and 2030 to support economic growth and development.

Despite policy makers ‘banging the drum’ for private investment in infrastructure over the past couple of decades, the public sector continues to fund the bulk of it. Asia – particularly China – is a case in point where state dominated finance has made the largest investments in electricity to railways in record time.

While private investment plays a significant role in transport infrastructure in some Asian countries such as India and energy infrastructure in Japan, emerging economies in the region – which face the greatest infrastructure needs in the coming years – seem unlikely to meet their objectives without overwhelming reliance on public finance.

While private investment plays a significant role in transport infrastructure in some Asian countries such as India and energy infrastructure in Japan, emerging economies in the region – which face the greatest infrastructure needs in the coming years – seem unlikely to meet their objectives without overwhelming reliance on public finance.

China has benefitted from its central planning system, which has strongly supported state investment (around 90% of total infrastructure spending) in recent decades. As a result, the country has seen unprecedented growth in its rail, roads, ports, airports, energy and communications infrastructure, enabling it to become a global supply chain hub.

In China, infrastructure investment has been around nine percent of GDP since the global financial crisis (8% in Asia). This is around twice the proportion in advanced economies. The public sector has accounted for the bulk (80% of total investment including multilateral development banks and bilateral aid) while private investment comprised some 20 percent.

According to the Brookings Institute, China has been a major funder of developing country infrastructure through its Belt and Road Initiative (BRI), lending US$ 40 billion annually. Despite the region being better able to fund infrastructure than elsewhere, Asia continues to face a major funding gap.

The solution is not so simple. The COVID-19 recession has made the need for greater private investment in infrastructure more important but more complicated – particularly as Asian emerging markets incur more debt to prop up safety nets, suffer falling tax revenues and face competing investment priorities especially to strengthen healthcare systems.

Many useful ideas have been put forward but are unlikely to make more than a marginal contribution. One idea is that Asia should develop its capital markets more quickly.

Another – as the Asian Development Bank Institute (ADBI) has suggested – is that to make infrastructure investment more attractive to private investors, perhaps part of the additional tax revenues generated by the buzz of economic activity along new ‘industrial corridors’ should be diverted to special funds designed to help fund new infrastructure projects.

The reality is that private institutional investors (they’re largely risk averse) are far from eager to opt for long-term investments in infrastructure because of the large perceived gap between risk and reward.

Although increasing public sector debt seems ill-advised when global debt has reached all-time high levels (in China, total debt exceeds 300% of GDP), it is widely accepted that infrastructure investment supports growth, in turn boosting tax revenue and governments’ debt servicing ability.

Dedicated ‘infrastructure bonds’ issued by governments that can act as guarantors might be the panacea to attract risk averse private investors. Clearly, there is more the public sector can and will need to do for the foreseeable future.

Leave a comment