INFLATION OUTLOOK

THE INFLATION PENDULUM

Shiran Fernando is hopeful inflation will be contained

Amid the many economic stresses the economy faced last year, high inflation in Sri Lanka has had a telling impact on the public. In a global environment where inflation rose to its highest levels in over four decades in developed economies such as the US and UK, a rise in countries like Sri Lanka was expected.

However, internal economic woes and vulnerabilities have resulted in sharp rises in a short period of time.

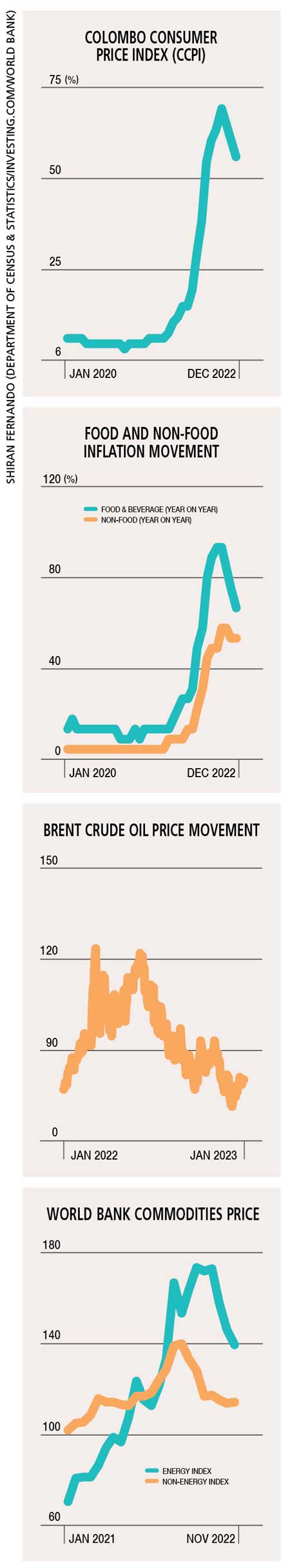

INITIAL CAUSES In September 2021, inflation – as measured by the Colombo Consumer Price Index (CCPI) – stood at only 5.7 percent year on year (YoY).

Since October 2021 however, food inflation began increasing on a monthly basis, pushing YoY growth to double digit levels and ending 2021 at 22.1 percent. This resulted in overall year on year inflation rising 12.1 percent by the end of that year.

Production output losses due to the fertiliser policy misstep impacted the Maha season in 2021/22 and food prices continued to rise in calendar year 2022, peaking at 95 percent (YoY) in September 2022.

Prices fell only in October 2022 (on a monthly basis) and year on year food inflation rose to 64 percent by December 2022.

Non-food inflation began increasing early last year with the YoY increment reaching double digits in February. Higher fuel, gas, electricity, water and transport costs resulted in the non-food index peaking at 58 percent by September.

Since then, YoY inflation growth has slowed, resulting in it falling to 53 percent by December 2022. The sharp devaluation of the Sri Lankan Rupee against the US Dollar and other currencies has also been a reason for the price of certain imported goods to rise as well.

CONSEQUENCES While inflation has been contained to some extent, the consequences have been dire.

There were severe shortages of essential commodities in 2022; and while supplies improved during the latter part of the year, the price hikes have reduced demand for these goods and services.

Due to the economic crisis, the FAO’s household survey from June to December 2022 reveals that four in every 10 households have had to contend with a reduction in their income.

A further 50 percent of households are relying on coping mechanisms such as using their savings and pawning jewellery or gold to buy food and other goods, according to the Food and Agriculture Organization.

The support of multilateral and donor agencies has helped limit – to some degree – the shortages that would have been experienced during the ongoing Maha season with the provision of seeds, fertiliser and pesticides.

However, more will need to be done to ensure food security and that malnutrition doesn’t accelerate further.

PROSPECTS The Governor of the Central Bank of Sri Lanka has announced that one of the main priorities this year will be to ease inflation and thereby help stabilise the economy.

A deceleration of inflation will also assist in driving down interest rates, which have risen from between six and seven percent in late 2021 to above 30 percent.

In April 2022, the Central Bank increased policy rates sharply due to rising inflation, as well as the need to slow down credit growth, which was fuelling imports.

Prospects this year will be influenced by both global and domestic factors: the main risks are geopolitical – in particular, the war in Ukraine. Any further escalation in hostilities could apply upward pressure on certain food commodities and oil.

Given that 20-25 percent of Sri Lanka’s import expenditure is on oil for transport and electricity generation, this upward pressure could be countered by the expectation of a global economic slowdown in 2023, which is likely to reduce the demand for commodities.

Higher inflation expectations are also easing at present, much faster than previously expected.

The local factors mainly revolve around outputs from the Maha and Yala seasons. If the outputs are much more than expected, it could reduce import dependencies for certain crops and essential commodities too.

If food inflation decelerates and reverts to a 10-20 percent YoY range, it will be a key driver for headline inflation to fall below 25 percent during the year.

It’s possible that non-food inflation will rise during certain periods – in particular, if another electricity hike is imposed in the first half of this year. The pricing formula for fuel and other commodities will ensure that Sri Lanka follows the global market, and is price reflective. This could swing non-food inflation expectations in the year.

The other risk locally is the currency weakening further, particularly if the IMF programme is delayed and we have import pressures similar to what Sri Lanka faced in the first half of 2022.

Overall, the key for inflation expectations is confidence in the economy. If 2023 is the year in which the economy turns around, we will most certainly see inflation reverting to acceptable levels.

Leave a comment