FISCAL REVIEW

UPS AND DOWNS IN 2023

Shiran Fernando reflects on the pluses and minuses of Sri Lanka’s fiscal performance so far this year

State revenue improved this year based on data reported by the Ministry of Finance in its annual Mid-Year Fiscal Position Report. Although revenue increased however, expenditure rose too – and it’s necessary to understand fiscal performance in the context of what it will mean for the remainder of the year and implications for the economy.

State revenue improved this year based on data reported by the Ministry of Finance in its annual Mid-Year Fiscal Position Report. Although revenue increased however, expenditure rose too – and it’s necessary to understand fiscal performance in the context of what it will mean for the remainder of the year and implications for the economy.

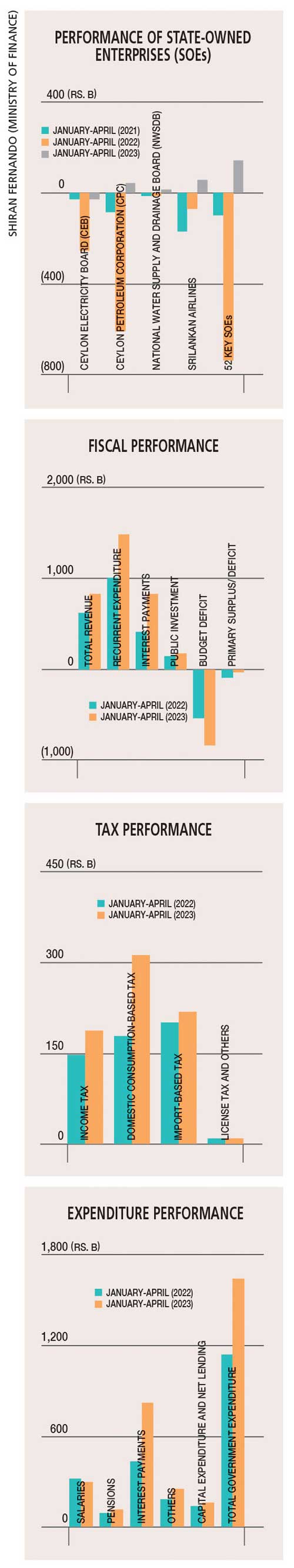

REVENUE Total government revenue in the first four months of this year increased by 30 percent to Rs. 820 billion, from 631 billion rupees in the same period in 2022. But only 24 percent of the estimated annual revenue was collected in the first four months of the year.

Tax revenue, which constitutes the lion’s share of government income, rose 24 percent due to higher collections from VAT, income tax, excise and the newly introduced Social Security Contribution Levy.

Income tax rose by 28 percent in the first four months of 2023 with higher collections from corporate, PAYE (Pay As You Earn) and interest income.

VAT, which is the single largest tax revenue generator, also rose by 64 percent in this period due to the rate doubling to 15 percent and the threshold being reduced. Excise duty spiked by only 11 percent due to an increase in petroleum and tobacco products.

EXPENDITURE Government expenditure rose by 42 percent on the back of higher interest payments – with the domestic interest rate being around 30 percent in this period. Interest payments increased by 92 percent at the same time.

EXPENDITURE Government expenditure rose by 42 percent on the back of higher interest payments – with the domestic interest rate being around 30 percent in this period. Interest payments increased by 92 percent at the same time.

Although salaries and pension expenditure are under control, welfare payments rose substantially because of the higher allowance for Samurdhi payouts among others due to the economic crisis. Public investments also increased in this period.

As a result of expenditure outpacing revenue growth, the budget deficit widened to the tune of Rs. 824 billion. The key figure in focus for debt sustainability is the primary deficit, which is the budget deficit minus interest payments.

If this figure is calculated for the first four months of 2023, the result is a marginal deficit of five billion rupees – compared to the deficit of Rs. 97 billion last year. This is a notable improvement as the goal is to reach a primary deficit of 2.3 percent of GDP in 2025 from 3.7 percent in 2022.

ECONOMIC GROWTH The growth we have seen in revenue so far is due to the higher rates and lower thresholds, which has widened the net.

Economic activity has been subdued as seen in the sharp GDP contraction in the first quarter of this year however, and the movement of high frequency indicators such as the Purchasing Managers’ Index indicates that the second quarter will also see a contraction.

If the government is to reach its ambitious target of Rs. 3,200 billion in revenue, there will need to be increased economic activity.

The opening up of import restrictions for certain items will see higher trade taxes being collected. Interest payments will also decline in the second half of 2023 with Treasury bill rates falling below 20 percent. This will support fiscal deficit consolidation.

In addition, there will be the need for a razor-sharp focus on widening the tax net through better collections from the cash and informal economies.

SOE PERFORMANCE According to the Ministry of Finance, the performance of state owned enterprises (SOEs) improved in the first four months of this year. The 52 key SOEs identified by the ministry recorded a profit of Rs. 144 billion in the first four months of 2023, compared to the loss of 859 billion rupees last year.

SOEs such as the Ceylon Petroleum Corporation (CPC) turned over a profit of Rs. 43 billion compared to the loss of 615 billion rupees in 2022 and Rs. 81 billion in the previous year. Cost reflective pricing and other reforms to introduce competition and productivity have led to profitability.

The other key loss making SOE is the Ceylon Electricity Board (CEB), which managed to reduce its losses to 30 billion rupees from last year’s loss of Rs. 262 billion and 34 billion rupees in 2021.

Once more, the cost reflective tariff helped increase revenue in August 2022 and February this year. However, more reforms are needed to maintain this momentum.

The National Water Supply and Drainage Board (NWSDB) also reported a marginal profit due to the higher tariff. SriLankan Airlines managed to record a profit of Rs. 60 billion in the first three months of 2023 – this is notable compared to the steep losses it incurred in previous years.

FISCAL REFORM The foundation for fiscal reform has been laid with the changes in taxation and a focus on SOE reforms.

Sri Lanka’s weakness in the past has been its tendency to deviate from fiscal discipline and consolidation. Success in reaching debt sustainability lies in sticking to a prudent fiscal path, which will need to be complemented with growth oriented reforms.

Leave a comment