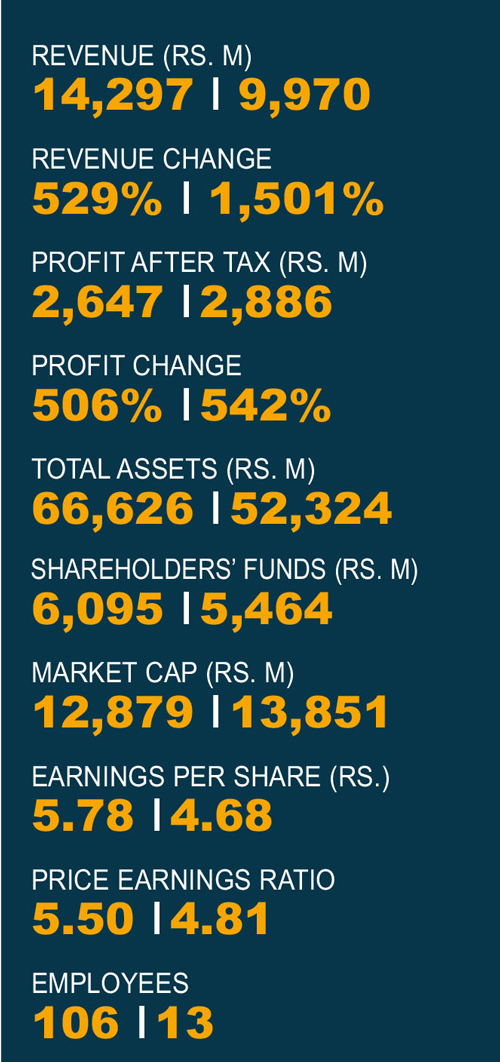

FIRST CAPITAL HOLDINGS

FIRST CAPITAL TREASURIES

LMD 100 Q&A

Q: As a financial services provider, how did you achieve the highest ever financial performance in 2022/2023?

Sachith Perera (SP): The fact that interest rates went up significantly – to over 30 percent, due to fears of domestic debt restructuring (DDR) and high policy rates by the Central Bank – provided an opportunity; but the question was when they were going to turn.

Then, if there was a DDR, what was the likely outcome? We worked out the impact on any risk taker and the risk-reward mechanics by running multiple scenarios.

Having assessed potential outcomes of a DDR and rewards waiting to be reaped, the question was whether to sit out the risk – or take it and go for potential rewards.

Our strategy was to take the risk and reap the rewards, which led to a historical performance last year.

Q: What is your assessment of Sri Lanka’s resilience and recovery?

SP: Arguably, measures the Central Bank took in April 2022 were either too hard or appropriate, or even too little. But they took decisions to slow down the economy and tighten credit.

That helped to stem inflation. Then the IMF programme brought fiscal discipline. Monetary and other economic policies were harmonised.

I can see a drastic improvement in economic sentiment. We still have some challenges. External debt restructuring is causing a delay in the IMF’s second tranche.

Although some US$ 330 million dollars is not critical at this stage, it’s a confidence booster vis-à-vis foreign investment. While those challenges are causing a cautionary approach to the economy, I can see signs of real economic activity improving significantly.

The financial services industry and market should improve once external debt matters are resolved. The other challenge we face is the global slowdown that is expected with high interest rates in key economies.

All those markets to which we export products are slowing down. But because we have a diversified economy, we should be able to weather current economic conditions and start growing next year.

Q: What is the vision of the company you’re heading?

Dilshan Wirasekera (DW): Our strategy for expansion stems from our vision to improve the lives of all Sri Lankans through financial solutions to help the general public who are deprived of higher offerings in financial services.

They know only fixed deposits or savings accounts compared to capital market offerings that encompass government securities, corporate debt instruments, equity, derivatives, and unit trust or mutual funds.

The yields investors get out of conventional banking products are below those of capital market products. If you take government securities, investors earn 15 percent while banks pay below 10 percent at present.

Capital market products offer much better spreads where investors get a higher return and issuers face lower borrowing costs, directing capital in the economy more efficiently.

Globally, savers and investors have moved away from conventional banking to capital market products. We predict that Sri Lanka will move to these too and are trying to make that shift happen.

Q: How is your company unique?

DW: We are a fully fledged investment banking institution, one of 10 primary dealers appointed by the Central Bank, the oldest licensee and largest primary dealer in the non-bank segment.

We command 15 to 20 percent of the government securities market, making us one of the largest funders to the government.

Managing assets worth over Rs. 70 billion, our unit trust business is the third largest fund manager with business expanding to private wealth management as well. We provide corporate finance advisory services encompassing debt and equity.

Our stockbroking arm provides research backed insights for equity market investments. Our in-house award-winning expert research team specialises in fixed income and equities.

We have been recognised as the ‘Most Valuable Consumer Brand in the Investment Banking Sector’ by Brand Finance.

One of the few companies that have this full offering, we have been in existence for 40 years and are a publicly listed company.

All our businesses are regulated. Rated ‘A’ by Lanka Rating Agency, we are part of the Janashakthi Group.

All of these make us special, unique and place us above the rest of the competition out there.

Telephone: 2639899 | Email: info@firstcapital.lk | Website: www.firstcapital.lk