FINTREX FINANCE

FINTREX FINANCE PROMOTES ECONOMIC DEVELOPMENT THROUGH SME FINANCING

In a bid to promote economic development amongst the SME sector in Sri Lanka, Fintrex Finance has launched an island wide effort to actively capture and leverage financing opportunities for small and medium enterprises. Whilst SMEs constitute a large part of Sri Lanka’s enterprises and is a cornerstone of the nation’s economy, Fintrex Finance will penetrate this often neglected market segment with renewed effort.

As a relatively new but fast growing finance company, Fintrex Finance will use its dedicated island wide network and especially trained staff to advice, ascertain and actively pursue SMEs, where according to the organization’s policy, 30 percent of the SME portfolio must include women and sustainable/green financing.

With over 40 years of experience in the SME sector, veteran banker Mr. A. L. Somaratne, senior consultant at Fintrex Finance is responsible for training and developing the SME staff of Fintrex. His hands-on training approach ensures dedicated staff can properly evaluate and assist in financial formalities to enable quick and easy documentation and fund management. “I have studied this sector thoroughly during my four-decade career in banking and finance and foresee a huge requirement in this segment. It is also in line with the Fintrex strategy and positioning in SME lending,” he said. “This is a much neglected sector and with the proper guidance and support will contribute immensely towards the economic development of this nation.”

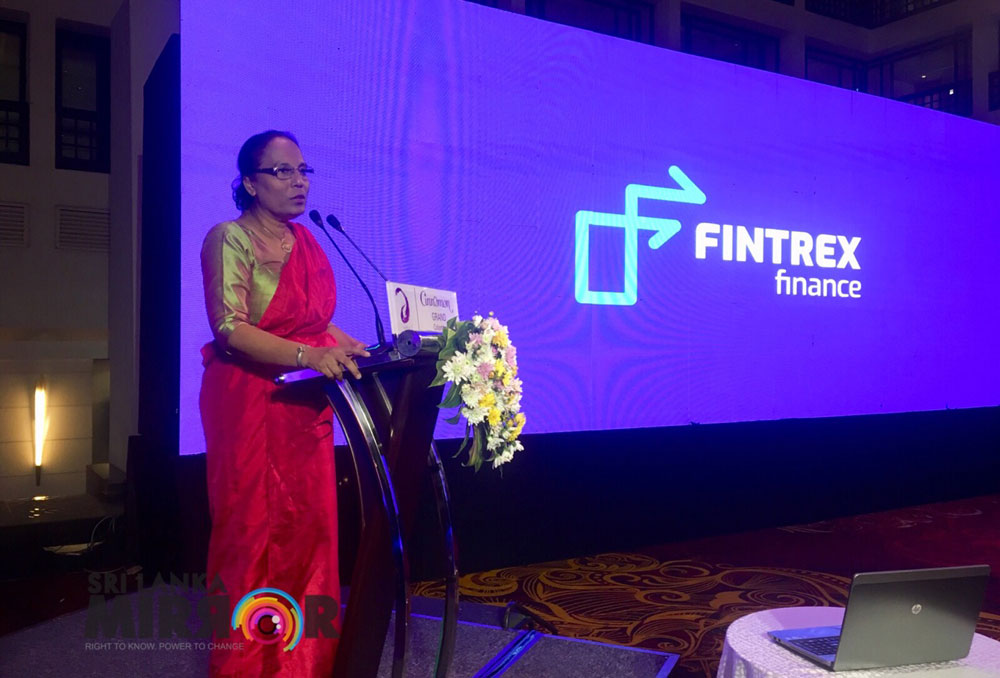

“Fintrex Finance strongly believes in the serving the SME sector,” said Mrs. Tamara Dharmakirti-Herath, CEO of Fintrex Finance. “We have a very capable team that will assess your situation and offer you the best possible financing option to suit your cash flows and help you grow your business.” She added that actively diversifying into the SME sector fulfils the company’s social obligation as well as increases its profitability.

The portfolio of Fintrex Finance covers short and long term loans and revolving loans. “These loans will help you to buy stocks and raw materials, meet recurring expenditure and invest in capital goods,” added Mr. Somaratne. He added that ideally Fintrex Finance will pursue smaller loans which will be handled by teams located in strategic areas. Once the need has been identified, the evaluation process between the enterprise and Fintrex Finance will take eight simple “steps” before the loan can be approved.

For more information, contact 0117 200 100