FINANCIAL SUSTAINABILITY

SUSTAINABLE GREENS

Protecting ESG through astute financials – Kiran Dhanapala

Financial Institutions (FIs) are changing under increasing regulatory and commercial pressures, and investing in sustainable development. The Business & Sustainable Development Commission expects the UN’s 17 Sustainable Development Goals (SDGs) to generate at least US$ 12 trillion in market opportunities by 2030.

What’s more, the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) estimates that the additional investments required by developing countries in the region will be around US$ 1.5 trillion annually.

What’s more, the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) estimates that the additional investments required by developing countries in the region will be around US$ 1.5 trillion annually.

Sustainable finance refers to policies, regulations and practices by regulators, supervisors, industry associations and FIs, to reduce and manage Environmental, Social and Governance (ESG) risks and opportunities from financial sector activities; and encourage the flow of capital to assets, projects, sectors and businesses that have environmental and social benefits.

Climate risk management has emerged as a particularly pressing priority in the spectrum of environmental and social risks. Responding to climate change (CC) also offers investment opportunities with climate finance, which is a key part of green finance under the umbrella of sustainable finance.

For FIs, this means applying a multi-pronged approach – viz. assessing and screening portfolio transactions for ESG risks; promoting capital flows to activities, businesses and sectors that have environmental and social (E&S) benefits; and taking care of their organisational E&S footprint.

This can include the cost of technologies, and adaptation to cleaner and more beneficial ways of doing things by existing businesses. Or avoiding polluting activities – e.g. the European Investment Bank has announced it will end its fossil fuel financing by 2021, spearheading the end of investments in oil, gas and coal by private banks.

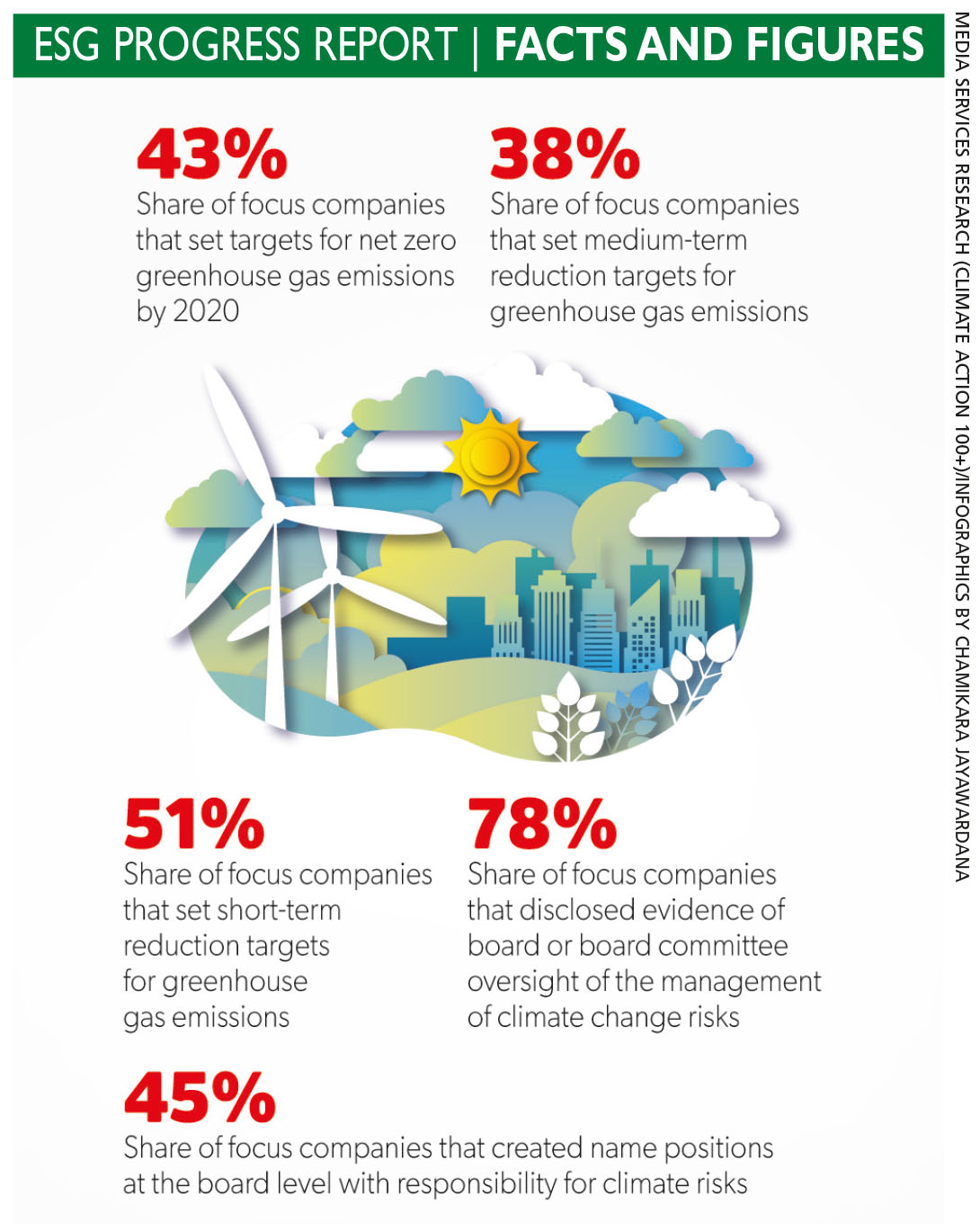

Led by BlackRock, one of the largest asset management companies, others are also changing course. BlackRock joined Climate Action 100+ to pressurise the largest polluting companies and its CEO has been signalling change by noting that CC is driving the transformation of finance.

He highlighted specific actions such as the use of voting powers to push for corporate sustainability issues; disclosure of CC related risks and opportunities; and innovative and sustainability aligned product offerings and investments including exiting high risks such as thermal coal producers.

These commitments will encourage other asset management firms to follow by adding more ESG investment products to their offerings. Growth in sustainable equity funds peaked in 2020 after increasing by 28 percent, the highest annual growth in a decade.

The reporting guidelines issued by the Task Force on Climate-related Financial Disclosures (TCFD) have not been taken up by most companies as yet, despite some progress being made. In the near future, the reallocation of capital will depend on this since the business case for ESG –especially CC – has been strengthened.

Sustainable finance trends have increased coalition building in the financial sector. This includes the Partnership for Carbon Accounting Financials, which was created recently by mainly European and US banks including Morgan Stanley, to measure and disclose the impact their lending decisions have on CC. Its mission is to develop a global carbon accounting standard and encourage FIs to use it.

The recently created Center for Climate-Aligned Finance aims to help FIs transition to a net zero carbon future and sees itself as a gold standard for financial sector climate action.

Another is the Energy Transitions Commission (ETC), which is a coalition of global energy producers, energy intensive industries, FIs and environmental advocates that believe clean electrification must be the primary route to decarbonisation, and that the world can achieve net zero greenhouse gas emissions by mid-century.

What can FIs do to support the transition to a low carbon world?

They could channel investment not only to green activities but also energy intensive industries that are making their transition and adopt a no financing policy towards fossil fuels. Or cut off at least 50 percent in financed CO2 emissions from 2010 levels by 2030, and then reduced effectively to zero by 2050.

FIs should also stop financing companies that are involved in the degradation of forests and other ecosystems.

The Central Bank of Sri Lanka (CBSL is the regulator) has also become active in promoting sustainable finance along with IFC and the Sustainable Banking Network. Supervision of FIs against ESG criteria is only a matter of time.

Meanwhile, the banking sector has been the first to organise itself under the Sri Lanka Bankers’ Association’s (SLBA) Sustainable Banking Initiative and has been a key contributor to sustainable finance. Other sub-sectors too will need to develop their own plans around CBSL’s road map as this trend snowballs globally.

Leave a comment