FINANCIAL SERVICES

FINANCIAL BELLWETHER

Compiled by Yamini Sequeira

THE BANKING SAFETY NET

Ronald C. Perera lauds the resilience of banks amid evolving trends

Sri Lanka’s banking sector and monetary policy has been the subject of change in recent times. And as the Chairman of Bank of Ceylon Ronald C. Perera observes, “the government is streamlining the new Exchange Regulation Act and introducing tax reforms for the sector.”

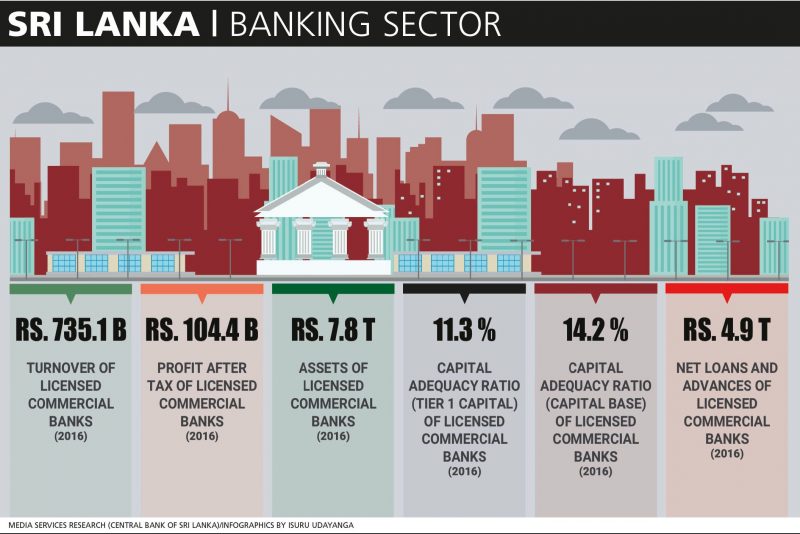

Perera predicts that with the implementation of Basel III, the banking sector “is likely to experience slower credit growth in time to come” while noting that “most banks in Sri Lanka maintained solid capital adequacy ratios of around 10 percent even before Basel III.”

“The new liquidity and funding requirements however, will restrict a bank’s ability to realise profits by increasing spreads from maturity mismatches. Therefore, banks will have to shift strategy accordingly. Raising additional capital for lending growth can be challenging in the absence of limited options to raise additional Tier I capital in Sri Lanka,” he adds.

According to Perera, “the equity market’s small size also poses a challenge – the combined market capitalisation of listed companies is nearly 25 percent of GDP.”

On the subject of whether banks are opening their lending books as much as they should, he explains: “Banks are expanding their lending books within the safety limits of maintaining non-performing loans (NPLs) at the lowest [ratio]. And they’re maintaining healthy liquidity levels and profitability, which is reflected in their return on assets (ROA) and return on equity (ROE).”

DISRUPTIVE TRENDS Technology is causing disruption across industries and the banking sector is one of the first to feel the sweeping changes brought about by technology.

And Perera asserts that “technology has empowered the banking sector to improve the customer experience – i.e. by capturing the nature of customer credit behaviour and providing tailor-made financial solutions to fulfil their needs through big data analytics. With recent social media breakthroughs, banks have reached the customer as never before by communicating more effectively and at a low cost.”

“Advanced technologies have created more reliable, secure and trustworthy banking systems, which builds customer confidence. Technology complements banking functions such as storing, lending, moving, trading and reconciling, and helps streamline a number of other processes and procedures to operate seamlessly,” he stresses.

GLOBAL BENCHMARKS Certainly, technology has enabled the local banking sector to be on a par with international banks by accessing settlement systems, and updating and understanding new standards and regulations that are practised globally. It has also strengthened the nation’s payment and settlement infrastructure.

Moreover, the banking sector has developed an efficient and stable payment and settlement system that is capable of catering to growing needs. For example, economies around the world are embracing cashless payment modes such as mobile wallets.

“As a result, customer care will take a different twist in the coming years with the banking sector moving forward with a digital infused transformation. In the future, customer touch points will be merely an application on the phone or on a laptop,” Perera predicts, and he informs that his bank is already catering to generation X whose requirements are more sophisticated and convenience driven.

He elaborates: “Furthermore, integrity is extremely important as the social grapevine is being driven by digitally integrated social media that can spread negative news with a ripple effect… Almost all licensed banks are providing digitally enabled banking solutions for their customers.”

CHALLENGING TIMES Commenting on challenges facing the banking community, Perera states that “capital adequacy and non-performing assets are the main issues facing the sector. The Basel III accord comes into force on 1 January 2019 with mandatory percentages that banks must maintain as capital.”

He continues: “This is easy for private banks, which can raise capital by floating right issues. However, the state owned banks – which have no shareholders except for the treasury – will have to depend on government assistance to raise capital. State banks also have to reschedule loans in case of natural disasters and so on but still bear this burden. As a result, we have to manage the interests of our stakeholder and the public.”

Looking ahead, Perera feels that the restoration of GSP+ will benefit apparel industry clients who were unable to repay their loans, noting that “the tea industry was also doing badly but is picking up and certain loans are being rescheduled. When a customer defaults, the state banks offer plenty of grace periods.”

MAJOR STRENGTHS On the strengths of the banking sector, Perera declares: “The sector is well-established with a solid base and an upward trend. The footprint of the banking sector covers the entire country – and the state banks dominate. Banking literacy is relatively high in Sri Lanka and the sector is being infused with the latest technology on a par with global standards.”

More importantly, he affirms that the sector is “adopting global economic and banking trends swiftly. We have a strong regulatory background with the Central Bank of Sri Lanka, the Banking Act, and established practices and policies. The greatest strength is the pool of highly educated human resources with specialisation in banking.”

SECTOR CONSOLIDATION Perera cites over-saturation, limited capital availability for expanding businesses and lending books, the limited presence of local banks in the international banking arena, the inability of banks to match mobile banking solutions provided by telecom companies and banks with relatively small balance sheets as being the main weaknesses of the sector.

In his opinion, the Sri Lankan market is saturated with over 5,700 Licensed Commercial Bank (LCB) outlets spread across the island. “With the new Basel III requirements, it will be wise for some financial institutions to merge and consolidate into much more robust institutions. Capital requirements may trigger mergers and acquisitions in the banking sector,” he muses.

And Perera believes there’s a need to consolidate the sector by increasing the scale of banking operations so as to provide more benefits to customers by reducing operational costs.

“Most banks are consolidated in urban cities to cater to the middle income segment. They only look at salaried employees, a few SMEs and mostly corporate clients. It’s high time to consolidate the banking sector by increasing its scale, and move into rural and semi-rural areas to accelerate the nation’s economic growth,” he concludes.

The interviewee is the Chairman of Bank of Ceylon