EXTERNAL SECTOR

PRESSURE MOUNTS ON THE TRADE DEFICIT

Shiran Fernando highlights the key drivers of external sector performance in the first quarter

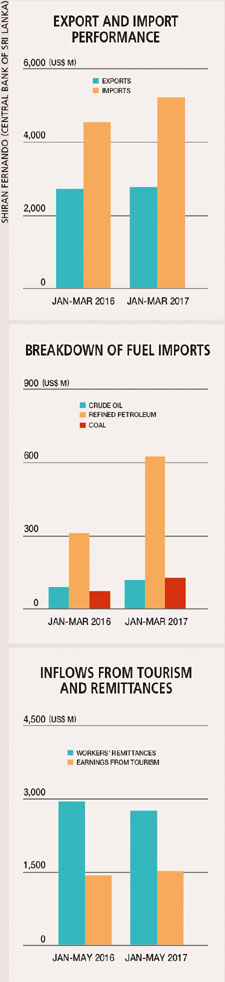

Trade data for the first quarter of this year reflects mixed fortunes in terms of growth rates and performance. Exports were up albeit only by 1.3 percent compared to the corresponding period of 2016 while imports rose sharply by 15 percent. This led to a notable widening of the trade deficit.

The imbalances have seen the trade deficit balloon by 35 percent year-on-year (y-o-y) in the January-March period.

Last year, import expenditure was higher but by only 2.5 percent y-o-y and driven mainly by investment goods. This category of imports (which comprises building materials, and machinery and equipment) spiked by 14 percent y-o-y in 2016 with the resumption of infrastructure projects such as the Port City.

But the increase in fuel imports was a major factor in the first quarter as growth in investment goods imports eased considerably.

DROUGHT IMPACT The drought conditions meant that power generation from hydro-related sources fell drastically. This meant that thermal and coal power needed to play a greater role to compensate for the hydro shortfall.

As a result, fuel imports shot up by more than 80 percent y-o-y in the first quarter of this year, which is the equivalent of a US$ 400 million spike in value. This is significant given that fuel imports fell by 219 million dollars last year.

IMPORT DRIVERS Another key driver during this period was the import of food and beverages. This was due to items such as dairy products, fruits and rice – with the latter increasing due to steps taken by the government to import rice to prevent a shortfall in the supply of the commodity that was hampered due to drought conditions.

EXPORT GROWTH On a more positive note, export earnings topped US$ 1 billion in March. This was the first time it had surpassed the milestone of one billion dollars in two years. The growth was led by agricultural exports, contrary to what was observed last year when this basket contracted by 6.3 percent y-o-y.

Among the export items that contributed to growth in the first quarter were tea, spices and seafood. Despite a fall in export volumes of tea, an increase in value realised higher earnings. In the meantime, seafood exports have been buoyed by the lifting of the ban by the European Union.

To sustain this level of exports, earnings from the likes of apparel and rubber products will need to be higher in the remainder of 2017.

TRADE DEFICIT If one considers some of the effects of the drought as being one-off, then the level of imports should ease in the second half of this year and cushion the expansion of the trade deficit.

As has been the case in the past, the trade deficit will need to be bridged by remittance inflows, tourism earnings and financial flows. This will help prevent a steep fall in the balance of payments (BOP).

CURRENT TREND The growth in remittances and tourism inflows is of concern at present. According to provisional data, tourism inflows for the first five months of 2017 were up by only 4.8 percent y-o-y. Last year, earnings from tourism rose by 18 percent y-o-y.

According to the Central Bank of Sri Lanka, the slowdown in the first three months was due in part to the changes that occurred with the resurfacing of the Bandaranaike International Airport. Given that this work has been completed, tourist arrivals are expected to increase in the second half of the year.

QATAR FACTOR Of more concern is the decline in workers’ remittance inflows, which were down by 5.8 percent y-o-y in the January-May period.

This concern is amplified by the diplomatic crisis in Qatar. Currently, there’s an estimated 150,000 Sri Lankans working in the Gulf nation, and remittance flows from Qatar and the region could be affected if the crisis continues.

This year, Bangladesh has seen its currency weaken against the US Dollar on the back of a drop in remittance inflows. This is relevant to Sri Lanka given its reliance on such inflows and in particular when there’s a demand for dollars due to imports.

Prior to the Gulf crisis, the World Bank released a report (in April) in which it expected remittances to the South Asian region to increase by two percent y-o-y this year from a decline of 6.4 percent y-o-y in 2016.

FINANCIAL FLOWS Despite the widening trade deficit in the first quarter of 2017, the BOP deficit fell to US$ 176 million compared to 720 million dollars in the corresponding period of last year. This is in part due to improved financial flows – namely long-term loans.

Such financial flows and the improvement in foreign direct investments (FDIs) will help ease any potential BOP deficit pressure.