ECONOMIC REVIEW

A REBOUND ON THE CARDS

Shiran Fernando analyses Sri Lanka’s economic performance during what was a challenging year

The Central Bank of Sri Lanka annual report, which is published in April each year, provides an overview of how the economy performed in the previous 12 months. With the release of the report, several numbers covering the entire year are released, enabling analysis and comparison for annual economic and social performance.

This month, we analyse a number of key numbers that have been released and what they may mean for the economy in 2021 and beyond.

This month, we analyse a number of key numbers that have been released and what they may mean for the economy in 2021 and beyond.

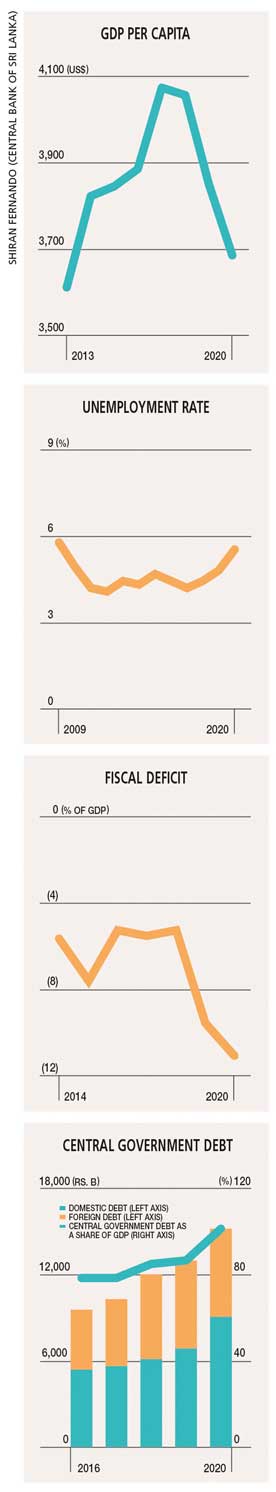

PER CAPITA GDP With the impact of the pandemic, the economy contracted by 3.6 percent last year. This resulted in its size reducing from a US$ 84 billion economy to 80.7 billion dollars.

As such, per capita GDP fell to US$ 3,682 in 2020 from 3,852 dollars in the previous year. This means that per capita GDP in dollar terms is at its lowest level since 2013.

The contraction of the economy will reverse in 2021 as it rebounds from the pandemic. A pick up in per capita GDP will gradually take place but this is dependent on the movement of the rupee against the dollar, which has been volatile so far this year.

UNEMPLOYMENT RATE With the impact on income, there was an increase in the unemployment rate to 5.5 percent last year, which is the highest since 2009.

This was driven by the fall in the labour force participation rate, which declined from 52.3 percent in 2019 to 50.6 percent last year. In this breakdown, both male and female labour participation decreased with the latter falling to 32.1 percent from 34.5 percent.

This was driven by the fall in the labour force participation rate, which declined from 52.3 percent in 2019 to 50.6 percent last year. In this breakdown, both male and female labour participation decreased with the latter falling to 32.1 percent from 34.5 percent.

The drop in the participation rate and increase in the unemployed population was due to temporary jobs losses or those looking for new jobs being unsuccessful. The concern was the rise in unemployment rates in females, youth and educationally qualified people, highlighting inequalities due to the impact of the pandemic.

As expected, there was a sharp drop in departures for foreign employment. In 2018 and 2019, about 211,211 and 203,087 respectively left for overseas employment. This number fell to 53,713 last year.

EXTERNAL SECTOR The contraction in imports – from 19.9 billion dollars to US$ 16.1 billion last year – outpaced the fall in exports, resulting in an overall decline in the trade balance.

With the improvement in remittances as well, this cushioned the overall current account deficit to US$ 1.1 billion in 2020 from a deficit of 1.8 billion dollars in the preceding year.

However, outflows due to repayments and limited foreign direct investments (FDI), and debt inflows, saw the balance of payments deficit expand to US$ 2.3 billion from a positive of 377 million dollars in 2019.

In 2021, exports expanded by about 11 percent in the first quarter compared to the previous year. And imports in the first two months kept pace with 2020 with a decline of 5.5 percent.

To maintain the reduction in the trade deficit, export growth momentum will need to continue while import growth must be contained. The balance of payments pressure could ease with higher FDI and inflows to the capital account by way of bilateral or multilateral financing.

FISCAL PERFORMANCE The budget deficit expanded to 11.1 percent as a share of GDP last year from 9.6 percent in 2019 thanks to a sharp fall in government revenue.

The latter fell below 10 percent with tax revenue declining to 8.1 percent of GDP from 11.6 percent. This was due to the reduction in economic activity in the wake of the pandemic, tax revisions in late 2019 and import restriction measures, which curtailed the government’s ability to raise trade related revenue.

Despite the worsening budget deficit position, the government debt mix of foreign to local improved, according to the Central Bank’s annual report. From a mix of 48:52 of foreign-local debt in 2019, it improved to 40:60 by the end of last year. This was due to the higher debt financing through local financing.

Overall, central government debt as a share of GDP rose to 101 percent in 2020 – up from 86.8 percent in the previous year – driven by domestic debt.

In the medium term, the government expects the budget deficit to reduce to four percent of GDP by 2025 with the deficit forecast at 9.4 percent of GDP this year. The targets rely on a higher growth trajectory for the economy in the next few years, which would help boost GDP (the denominator) as well as improve economic activity, resulting in higher tax collections.

Improvements in both growth and the debt trajectory will help boost the economy’s credit rating profile, which in turn will help ease refinancing concerns over the next few years.

THE OUTLOOK Last year was difficult for most economies. It was one of little progress but huge setbacks. Against that backdrop, Sri Lanka performed better than expected.

It is important to maintain the momentum in economic growth and development as the economy weathers the next phase of the pandemic.